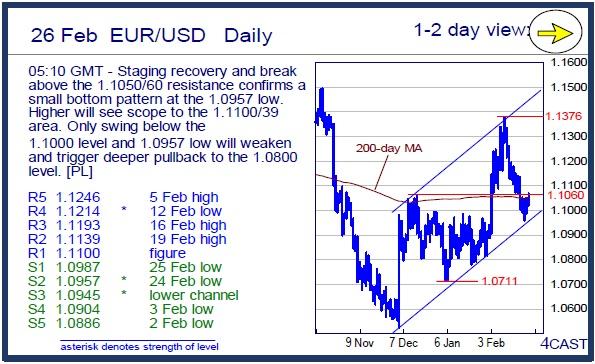

EUR/USD Daily

Staging recovery and break above the 1.1050/60 resistance confirms a small bottom pattern at the 1.0957 low. Higher will see scope to the 1.1100/39 area. Only swing below the 1.1000 level and 1.0957 low will weaken and trigger deeper pullback to the 1.0800 level. [PL]

EUR/CHF Daily

Tracing out a small bottom pattern following bounce from the 1.0865 low. Neckline resistance is at 1.0942/48 area and clearance will trigger stronger recovery back to the 1.1000 level. Support now at the 1.0900 level ahead of the 1.0865 low where break is needed to trigger deeper pullback. [PL]

USD/CHF Daily

Pressure returning to the downside after bounce was checked at the .9953 resistance. The .9853 mid-wk low now at risk and break will see return to the .9800 level then the 200-day MA at .9762. Resistance at .9918 and .9953 now protecting the 1.0004 high. [PL]

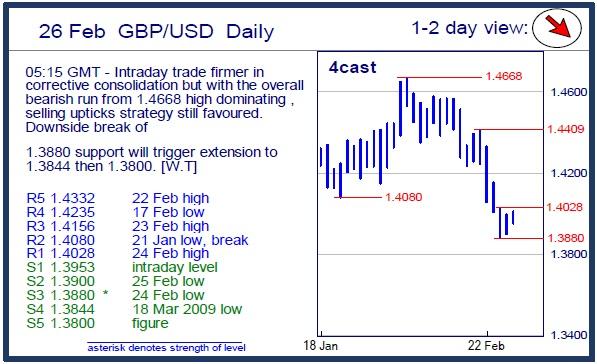

GBP/USD Daily

Intraday trade firmer in corrective consolidation but with the overall bearish run from 1.4668 high dominating , selling upticks strategy still favoured. Downside break of 1.3880 support will trigger extension to 1.3844 then 1.3800. [W.T]

USD/JPY Daily

Settling back from the 113.22 high but further strength not ruled out. Nearby see strong resistance at the 113.38/60 area and break needed to clear the way back to the 114.00 level. Downside see support now at 112.60 and the 112.00 level. [PL]

EUR/GBP Daily

Settling back from the .7929 high to consolidate the up-leg .7708 low and dips see support now at .7845 then the .7800 level. Higher low sought to further pressure the upside later to target .7955 then the .8000 level. Beyond this will see scope to .8050, the 10-mth base measuring objective. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD drops to near 1.0650 ahead of Fed policy

EUR/USD continues its decline for the second consecutive day, hovering around 1.0650 during Asian trading hours on Wednesday. With European markets largely closed for Labour Day, investors are expecting the Federal Reserve's latest policy decision.

GBP/USD holds below 1.2500 ahead of Fed rate decision

The GBP/USD pair holds below 1.2490 during the early Wednesday. The downtick of the major pair is supported by the stronger US Dollar amid the cautious mood ahead of the US Federal Reserve's interest rate decision later on Wednesday.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Bitcoin price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area. It comes as markets continue to digest the performance of Hong exchange-traded funds after their first day of issuance.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.