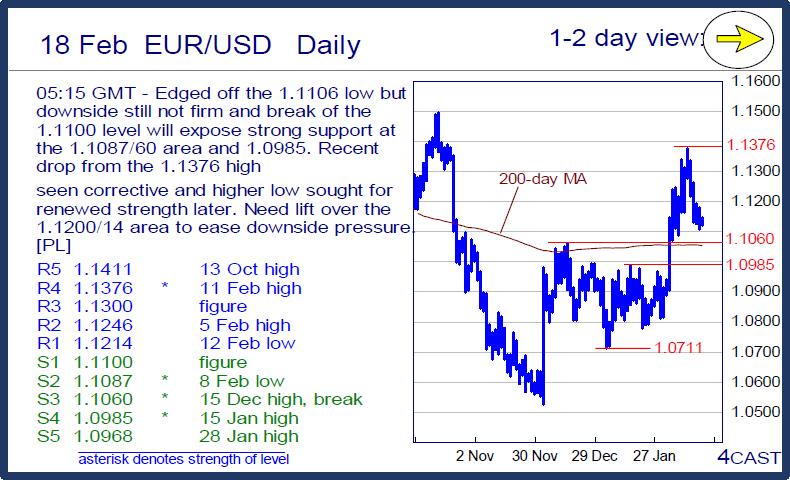

EUR/USD Daily

Edged off the 1.1106 low but downside still not firm and break of the 1.1100 level will expose strong support at the 1.1087/60 area and 1.0985. Recent drop from the 1.1376 high seen corrective and higher low sought for renewed strength later. Need lift over the 1.1200/14 area to ease downside pressure. [PL]

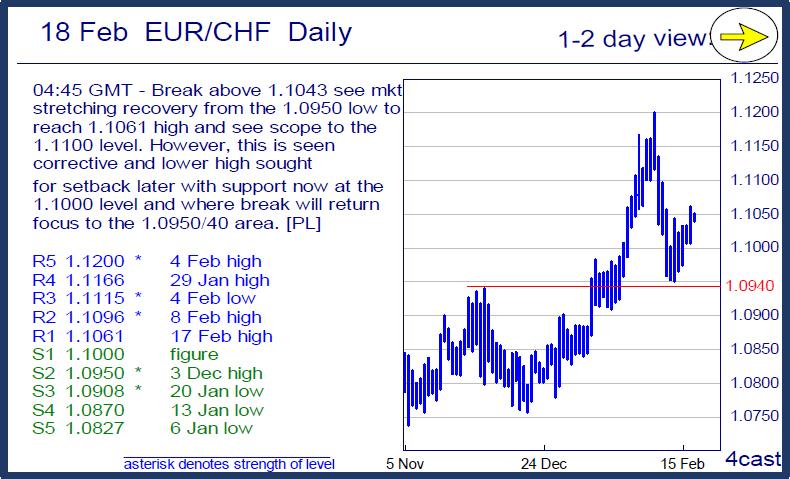

EUR/CHF Daily

Break above 1.1043 see mkt stretching recovery from the 1.0950 low to reach 1.1061 high and see scope to the 1.1100 level. However, this is seen corrective and lower high sought for setback later with support now at the 1.1000 level and where break will return focus to the 1.0950/40 area. [PL]

USD/CHF Daily

Settling back from the .9942 high but upside stays in focus and further recovery not ruled out. Higher will see further retracement of the drop from the 1.0257 high to target .9960 then .9985 resistance. Below the .9900 level see support now at .9847 then the .9791/62 recent highs. Break will return focus to the downside. [PL]

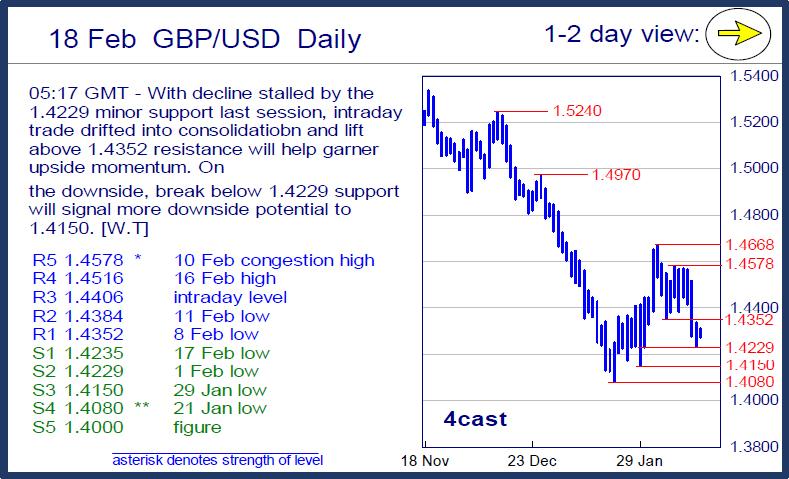

GBP/USD Daily

With decline stalled by the 1.4229 minor support last session, intraday trade drifted into consolidatiobn and lift above 1.4352 resistance will help garner upside momentum. On the downside, break below 1.4229 support will signal more downside potential to 1.4150. [W.T]

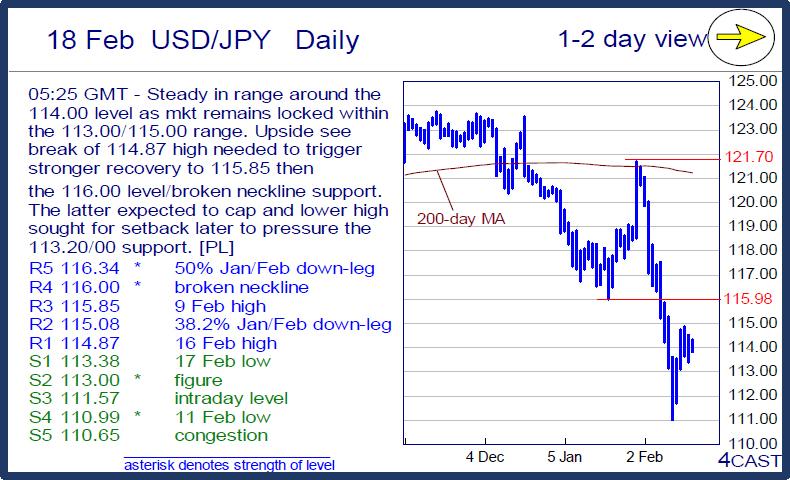

USD/JPY Daily

Steady in range around the 114.00 level as mkt remains locked within the 113.00/115.00 range. Upside see break of 114.87 high needed to trigger stronger recovery to 115.85 then the 116.00 level/broken neckline support. The latter expected to cap and lower high sought for setback later to pressure the 113.20/00 support. [PL]

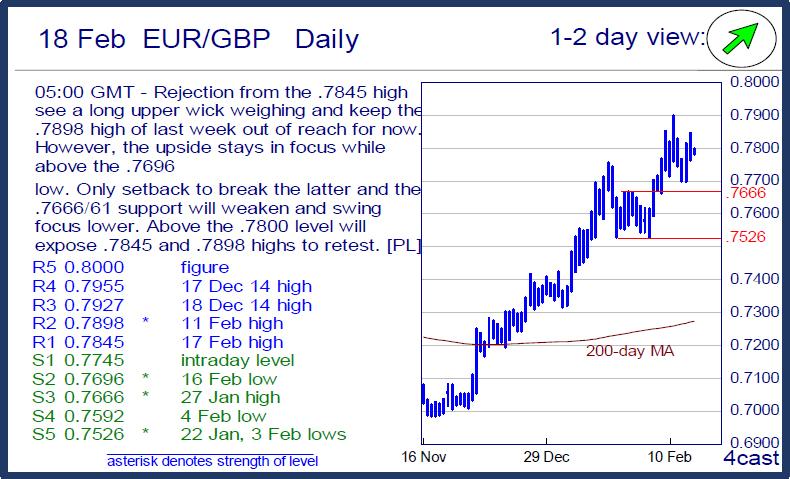

EUR/GBP Daily

Rejection from the .7845 high see a long upper wick weighing and keep the .7898 high of last week out of reach for now. However, the upside stays in focus while above the .7696 low. Only setback to break the latter and the .7666/61 support will weaken and swing focus lower. Above the .7800 level will expose .7845 and .7898 highs to retest. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD remains on the defensive near 1.0680 on Dollar strength

The solid performance of the Greenback keeps the price action in the risk-associated universe depressed so far on turnaround Tuesday, sending EUR/USD to multi-day lows in the 1.0680 region.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold maintains its bearish note and challenges $2,300

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.