EUR/USD Daily

Extending pullback from the 1.1376 high of last week and see the 1.1200 level now within reach. Break here will see room for stronger pullback to 1.1161 then the 1.1087/60 area. Higher low sought for renewed strength later with resistance now at the 1.1300/20 area then 1.1376 high. [PL]

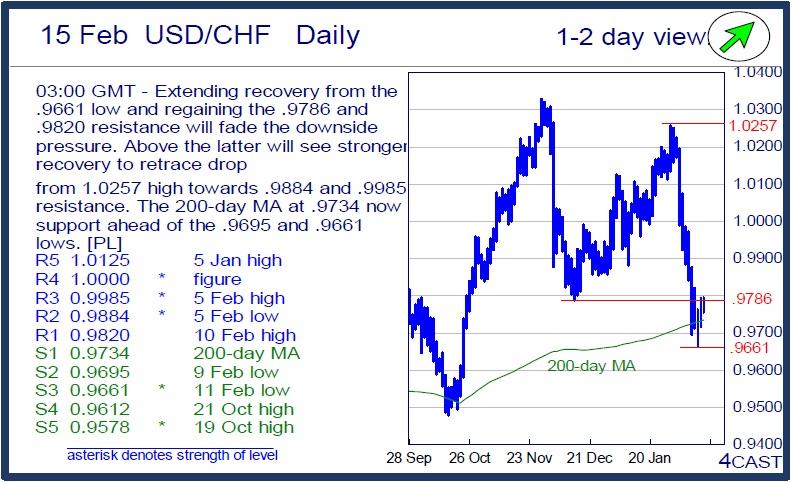

USD/CHF Daily

Extending recovery from the .9661 low and regaining the .9786 and .9820 resistance will fade the downside pressure. Above the latter will see stronger recovery to retrace drop from 1.0257 high towards .9884 and .9985 resistance. The 200-day MA at .9734 now support ahead of the .9695 and .9661 lows. [PL]

USD/JPY Daily

Break of the 113.20 and 113.60 resistance see mkt retracing the recent steep drop from the 121.69, Jan high. Above the 114.21 resistance will see room for stronger retracement to target the 115.08 and 115.85 resistance. Support now at the 113.00 level and 111.57 then 110.99 low. [PL]

EUR/CHF Daily

Higher in range from the 1.0950 low but the upside still limited and see lift over 1.1043 high needed to trigger stronger recovery to the 1.1100 level. Support is at the 1.0950/40 area and break will see room for deeper pullback to the 1.0900 level and 1.0870 support. [PL]

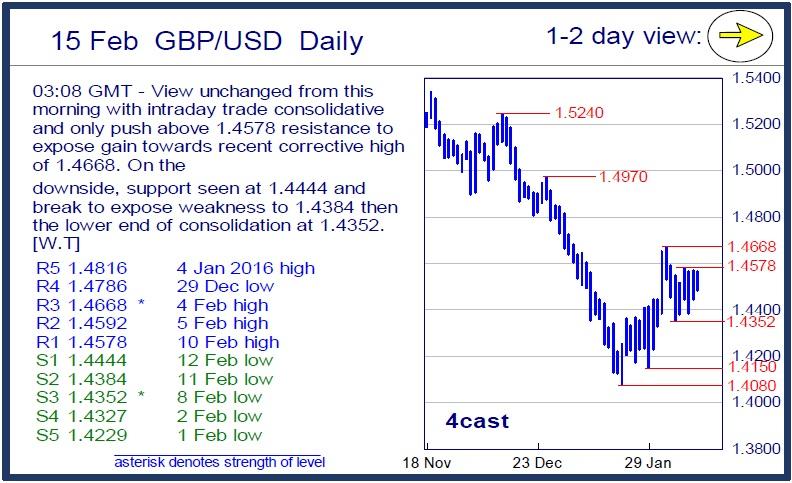

GBP/USD Daily

View unchanged from this morning with intraday trade consolidative and only push above 1.4578 resistance to expose gain towards recent corrective high of 1.4668. On the downside, support seen at 1.4444 and break to expose weakness to 1.4384 then the lower end of consolidation at 1.4352. [W.T]

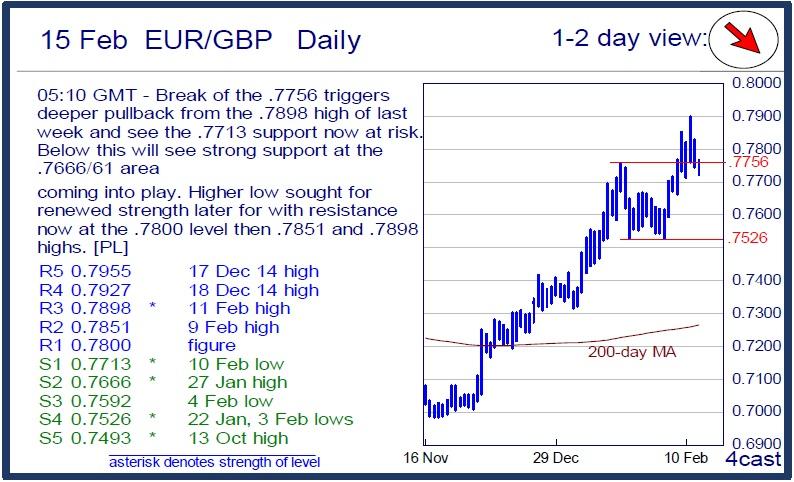

EUR/GBP Daily

Break of the .7756 triggers deeper pullback from the .7898 high of last week and see the .7713 support now at risk. Below this will see strong support at the .7666/61 area coming into play. Higher low sought for renewed strength later for with resistance now at the .7800 level then .7851 and .7898 highs. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD stays slightly above 1.0700 after mixed US data

EUR/USD lost its traction and turned negative on the day but managed to hold above 1.0700. Although the upbeat Employment Cost Index data boosted the USD earlier in the day, the weak consumer sentiment reading limits the currency's gains.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold extends daily slide toward $2,300 as US yields edge higher

Gold stays under bearish pressure and declines toward $2,300 on Tuesday. The benchmark 10-year US Treasury bond yield stays in positive territory above 4.6% after US Employment Cost Index data, weighing on XAU/USD.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.