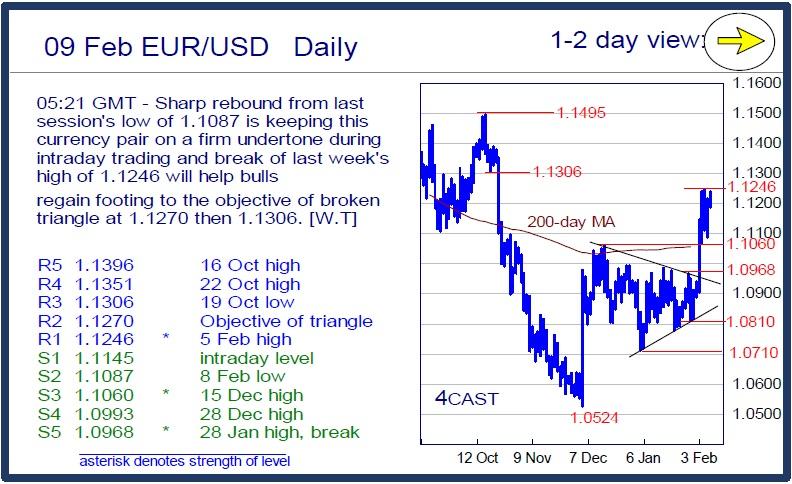

EUR/USD Daily

Sharp rebound from last session's low of 1.1087 is keeping this currency pair on a firm undertone during intraday trading and break of last week's high of 1.1246 will help bulls regain footing to the objective of broken triangle at 1.1270 then 1.1306. [W.T]

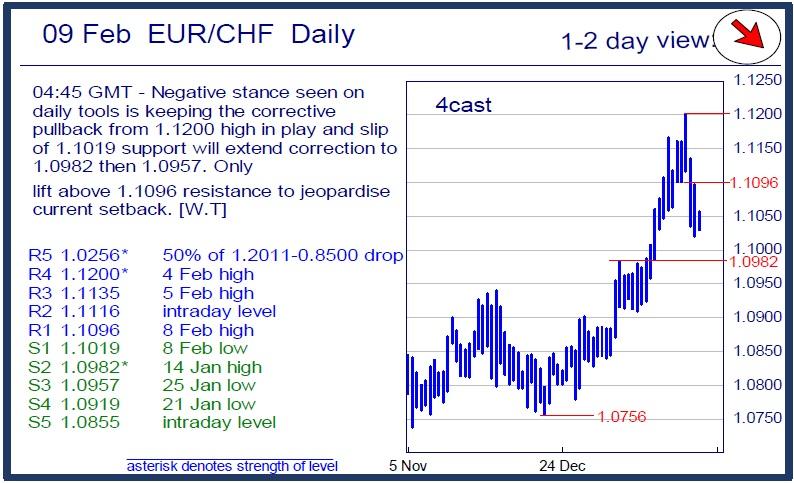

EUR/CHF Daily

Negative stance seen on daily tools is keeping the corrective pullback from 1.1200 high in play and slip of 1.1019 support will extend correction to 1.0982 then 1.0957. Only lift above 1.1096 resistance to jeopardise current setback. [W.T]

USD/CHF Daily

Intraday trade extending the downmove from 1.0257 high and eyeing the strong support at 0.9786 and with daily technical tools intruding into oversold territories, would expect the latter to put up a strong fight to current downmove and probably trigger a strong rebound from the latter. [W.T]

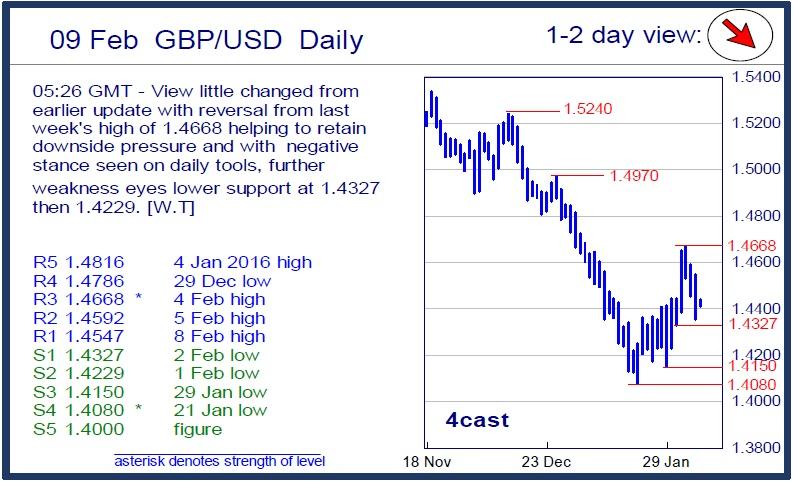

GBP/USD Daily

View little changed from earlier update with reversal from last week's high of 1.4668 helping to retain downside pressure and with negative stance seen on daily tools, further weakness eyes lower support at 1.4327 then 1.4229. [W.T]

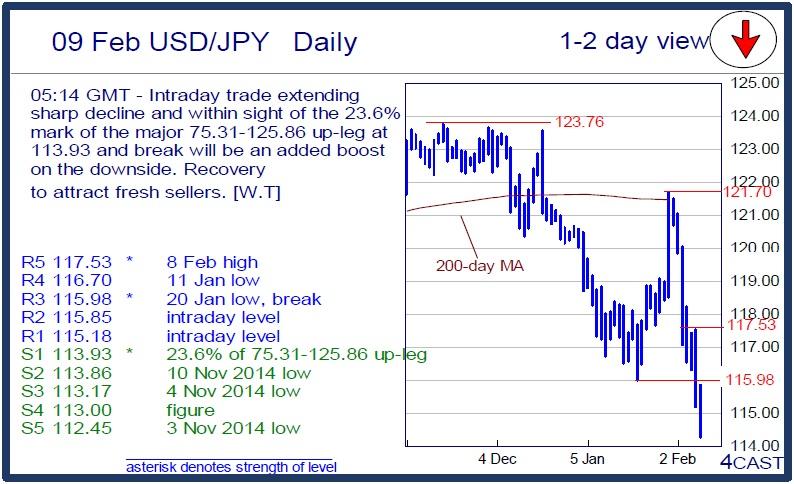

USD/JPY Daily

Intraday trade extending sharp decline and within sight of the 23.6% mark of the major 75.31-125.86 up-leg at 113.93 and break will be an added boost on the downside. Recovery to attract fresh sellers. [W.T]

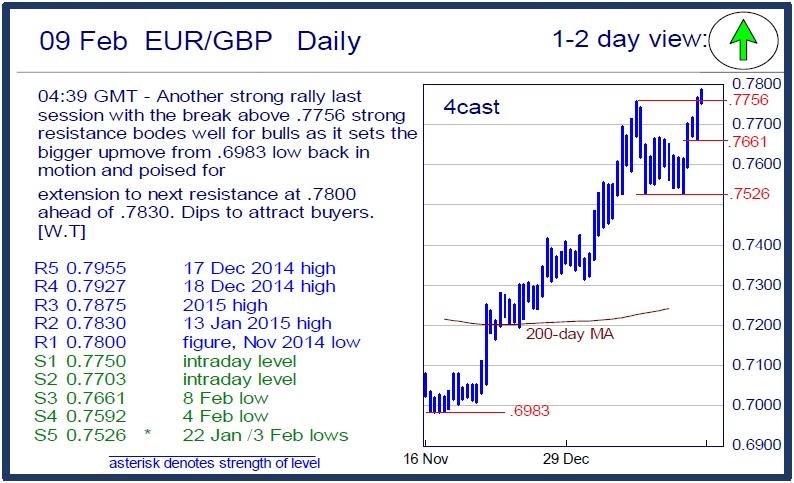

EUR/GBP Daily

Another strong rally last session with the break above .7756 strong resistance bodes well for bulls as it sets the bigger upmove from .6983 low back in motion and poised for extension to next resistance at .7800 ahead of .7830. Dips to attract buyers. [W.T]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD holds steady above 1.0650, awaits US data and Fed verdict

EUR/USD is trading sideways above 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD keeps losses below 1.2500 ahead of US data, Fed

GBP/USD holds lower ground below 1.2500 early Wednesday. The stronger US Dollar supports the downtick of the pair amid the cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

ADP Employment Change Preview: US private sector expected to add 179K new jobs in April

The ADP report is expected to show the US private sector added 179K jobs in April. A tight labour market and sticky inflation support the Fed’s tight stance. The US Dollar seems to have entered a consolidative phase.