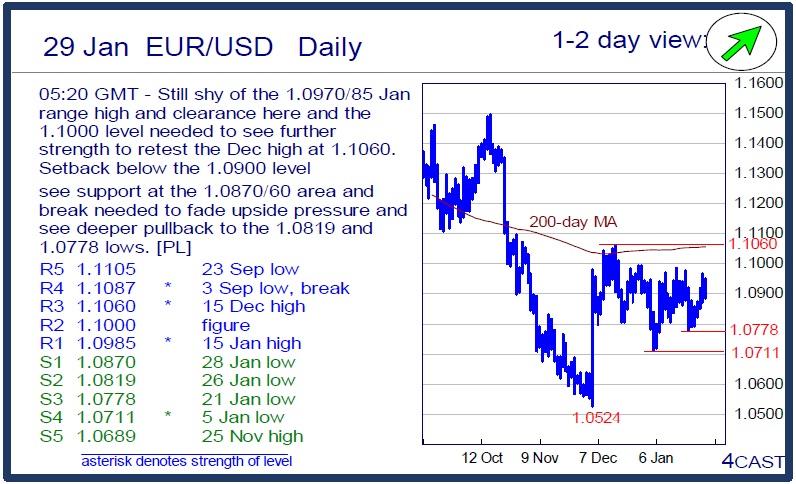

EUR/USD Daily

Still shy of the 1.0970/85 Jan range high and clearance here and the 1.1000 level needed to see further strength to retest the Dec high at 1.1060. Setback below the 1.0900 level see support at the 1.0870/60 area and break needed to fade upside pressure and see deeper pullback to the 1.0819 and 1.0778 lows. [PL

EUR/CHF Daily

Saw spike above the 1.1107 high to reach fresh high at 1.1134 before settling back below the 1.1100 level. Further strength will see scope to the 1.1145/60 area though the stretched intraday and daily tools caution corrective pullback with support now at 1.1050 and the 1.1000 level. Would take break of 1.0982 support to fade upside pressure. [PL]

USD/CHF Daily

Saw spike above the 1.0200 level to reach fresh high at 1.0224 but gains not sustain. Clear break will see scope to the 1.0300 level then 1.0328 high. Would take break of the 1.0118/11 lows to trigger a small top pattern and see stronger pullback within the 7-wk up channel to parity level then .9959/50 support and the lower channel. [PL]

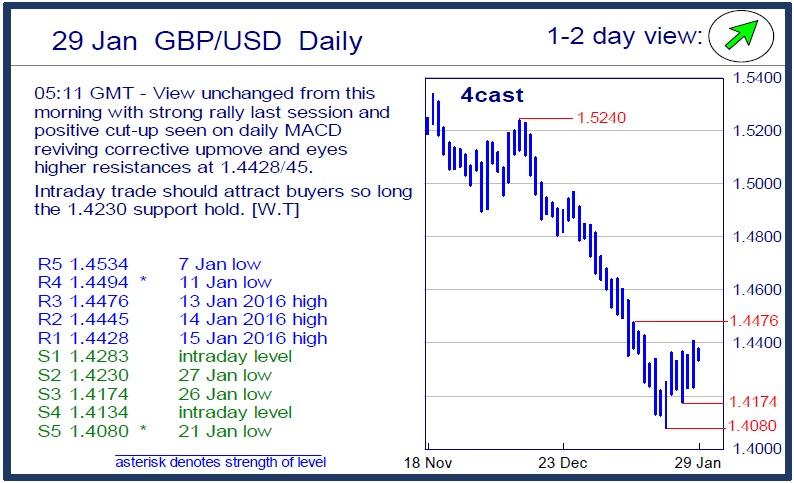

GBP/USD Daily

View unchanged from this morning with strong rally last session and positive cut-up seen on daily MACD reviving corrective upmove and eyes higher resistances at 1.4428/45. Intraday trade should attract buyers so long the 1.4230 support hold. [W.T]

USD/JPY Daily

Strong rally above the 120.00 saw spike to 121.42 high ahead of an equally sharp pullback. Volatile price action see the pair regaining the 120.00 level and hold above this will see scope to retest 121.42/48 high and the 200-day MA. Clearance will open up 122.00/20 area. [PL]

EUR/GBP Daily

Failure to clear the .7654/70 resistance see mkt settling back in consolidation and below the .7600 level expose the .7550/26 lows to retest. Below this see the .7500 key and where break is needed to swing focus lower to further retrace up-leg from .6983, Nov low. Break will see scope to .7460 then .7424/00 area. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.