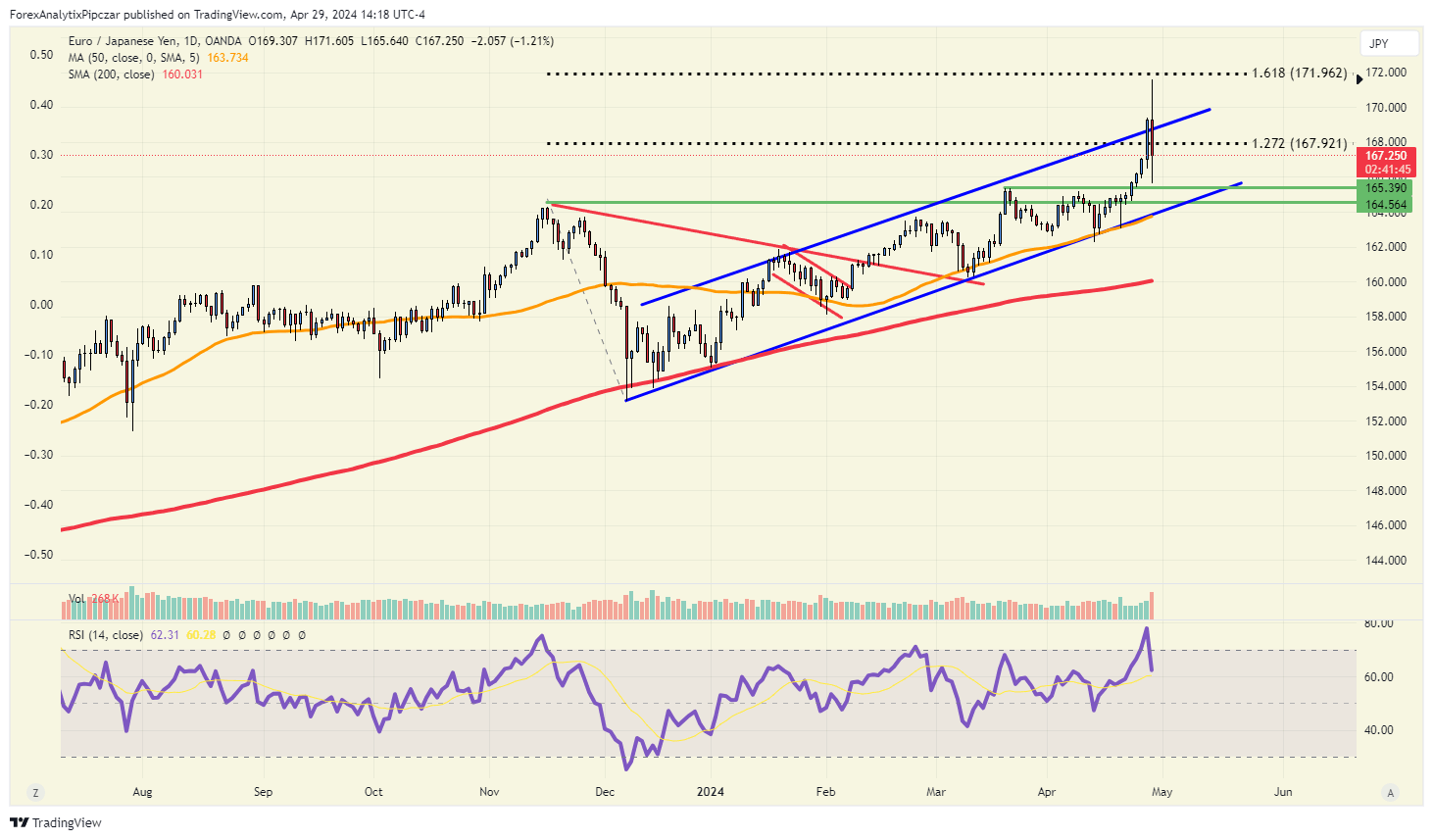

Chart of the day: EUR/JPY

Golden Fibonacci Extension tested!

The EURJPY and other XXXJPY pairs surged lower following the "speculated" BOJ/MOF intervention in European trade today. Although many pairs hit some key levels, the EURJPY was particularly interesting today. The EURJPY surged higher initially on Sunday, April 28th when market reopened over the weekend and the EURJPY came within pips of the 161% Golden Fibonacci extension of the November 2023 highs to December 2023 lows at near 171.96. Sellers stepped in at the 171.60 level, only to be swatted back to the 167.25 level at writing. The fact is that the daily candle is a bearish outside day which officially puts the bulls on warning. A break back below the 165.39 level would signal a near term reversal may be in play.

Author

Blake Morrow

Forex Analytix

Blake Morrow spent most of his professional career as the Chief Currency Strategist for Wizetrade group for 15 years, and then the Senior Currency Strategist for Ally Financial after the acquisition of Tradeking which owned the Wizetrade Group.