EUR/USD Daily

With Christmas around the corner, trade into Fareast's market remains thin with prices stuck in tight consolidation and slippage below 1.0870 support will trigger renewed weakness to 1.0848 then stronger 1.0796. Merry X'mas to All. [W.T]

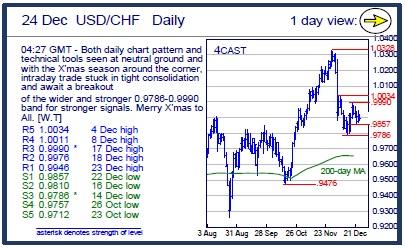

USD/CHF Daily

Both daily chart pattern and technical tools seen at neutral ground and with the X'mas season around the corner, intraday trade stuck in tight consolidation and await a breakout of the wider and stronger 0.9786-0.9990 band for stronger signals. Merry X'mas to All. [W.T]

USD/JPY Daily

Renewed weakness triggered during intraday trading with prices slipping below 120.73/58 supports and poised for extension to stronger level at 120.35 and bears seek clearance of the latter to garner stronger downside momentum. Merry X'mas to All. [W.T]

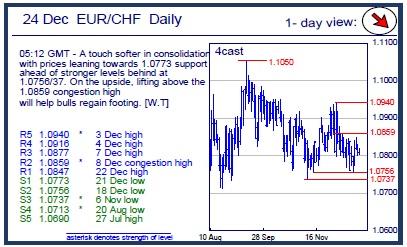

EUR/CHF Daily

A touch softer in consolidation with prices leaning towards 1.0773 support ahead of stronger levels behind at 1.0756/37. On the upside, lifting above the 1.0859 congestion high will help bulls regain footing. [W.T]

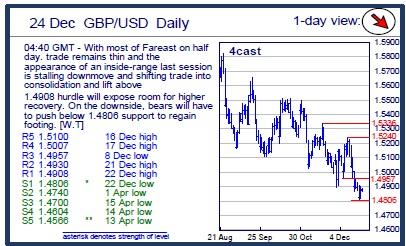

GBP/USD Daily

With most of Fareast on half day. trade remains thin and the appearance of an inside-range last session is stalling downmove and shifting trade into consolidation and lift above 1.4908 hurdle will expose room for higher recovery. On the downside, bears will have to push below 1.4806 support to regain footing. [W.T]

EUR/GBP Daily

Overbought daily tools hindered further upmove and triggered corrective pullback last session and need clearance of .7307 support to expose deeper setback to .7272 then .7240. Bulls will have to take out the strong resistance at .7416 to regain upmove. [W.T]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD remains on the defensive near 1.0680 on Dollar strength

The solid performance of the Greenback keeps the price action in the risk-associated universe depressed so far on turnaround Tuesday, sending EUR/USD to multi-day lows in the 1.0680 region.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold maintains its bearish note and challenges $2,300

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.