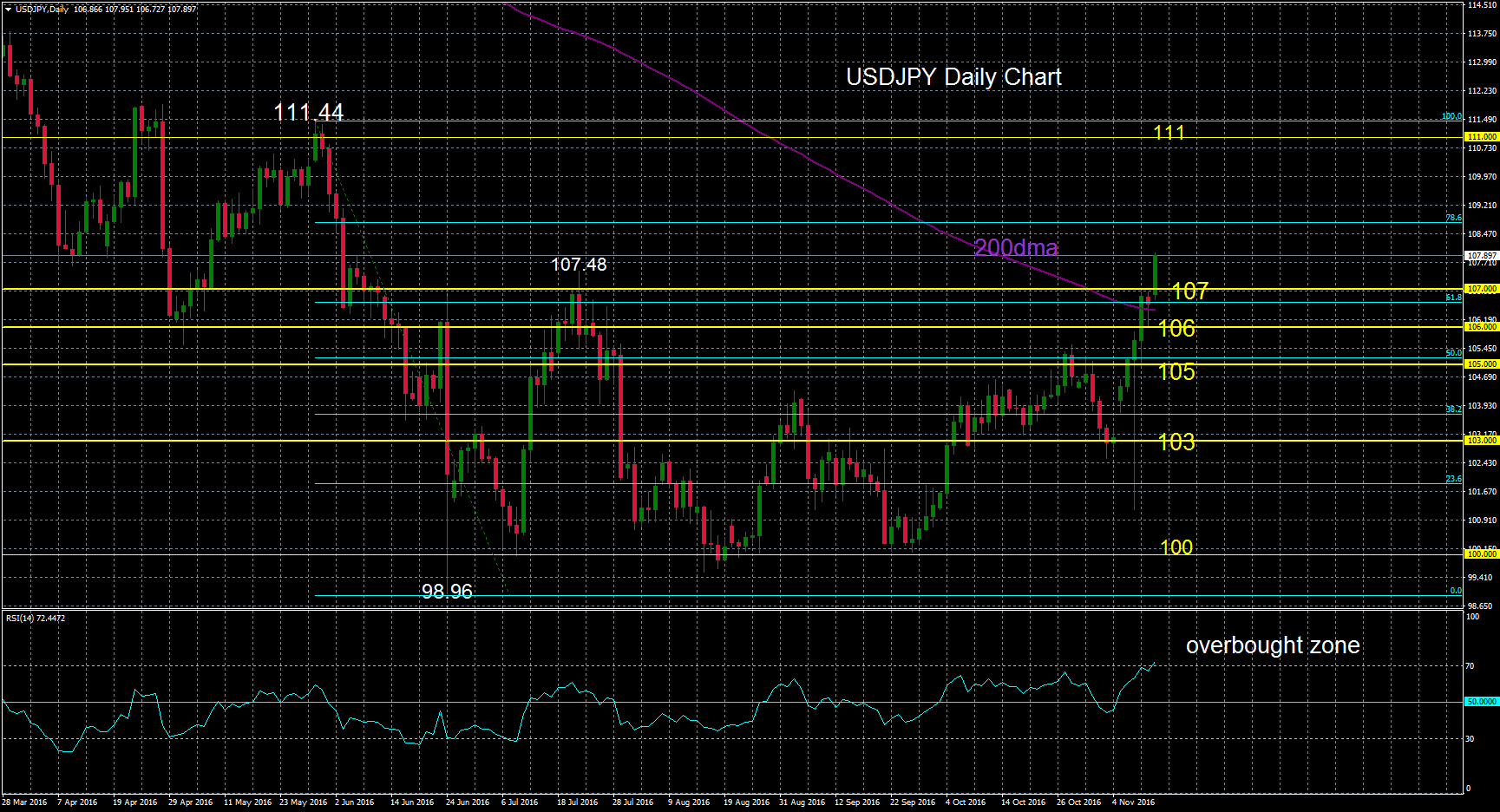

USD/JPY extended higher to hit a 5-month peak of 107.95 in early Monday trading. The break above the key psychological level of 107.00 and above the 200-day moving average today strengthens the bullish bias.

The next target to the upside is at 108.75. This level is defined as the 78.6% Fibonacci retracement level of the May to June fall from 111.44 to 98.96. Above this, the key 111.00 level comes into view and from this level prices would target the May 30 high of 111.44.

To the downside, there is immediate support at the 61.8 Fibonacci at 106.64. below this, the 200-day moving average is a strong support level around 106.44. Below this, Friday’s low of 106.02 is another support level.

If USDJPY remains above 105.00, which is close to the 50% Fibonacci level, the bullish structure will likely remain intact in the short term.

However, there should be some caution as the market is looking overextended now. The daily RSI has reached overbought levels at 70.

Interested in USDJPY technicals? Check out the key levels

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.