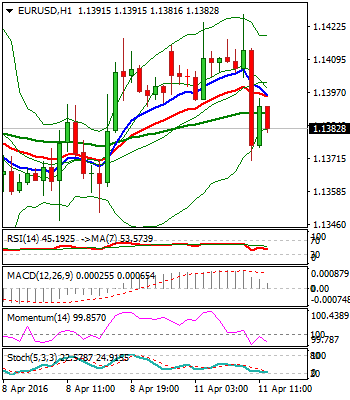

EURUSD

The Euro remains within 1.1325/1.1452 congestion, which extends in the seventh consecutive day. Strong indecision was confirmed by weekly long-legged Doji candle, as the pair remains unable to break above fresh 2016 peak, which was posted on brief attempt above near-term congestion tops.

Daily MA’s turned into full bullish setup and favor fresh upside attempts, which require sustained break higher, to open next significant barrier at 1.1494 (15 Oct 2015 peak).

Rising daily 10 SMA / Tenkan-sen offer initial support at 1.1370, also session low, head of 1.1337 (Fibo 38.2% of 1.1151/1.1452 upleg) and congestion floor at 1.1325, above which, dips should be contained.

Otherwise, violation of 1.1325/00 support zone, would trigger stronger correction of 1.1151/1.1452 upleg, which was signaled by repeated upside rejections during last week.

Res: 1.1436; 1.1452; 1.1465; 1.1494

Sup: 1.1370; 1.1337; 1.1325; 1.1300

GBPUSD

Cable eventually penetrated daily cloud base at 1.4145, which capped the action during past few days. Upside action was signaled by Friday’s bullish Outside Day, with fresh bullish acceleration extending near strong resistance zone at 1.4225/40, which consists of daily 20 SMA and Tenkan-sen line. Sustained break here would open next pivotal barrier at 1.4258 (daily Kijun-sen line), followed by 1.4284 (Fibo 61.8% of 1.4457/1.4004 downleg).

Daily Slow Stochastic reversed from oversold territory and shows enough room upside for extended correction, with violation of 1.4258/84 barriers, needed to sideline downside threats, in favor of stronger correction.

Res: 1.4230; 1.4258; 1.4285; 1.4350

Sup: 1.4145; 1.4090; 1.4050; 1.4038

USDJPY

The pair hit fresh low at 107.61 today, following n/t recovery rejection at 109.08 last Friday. Strong downside pressure was shaped in long bearish weekly candle. Which suggests bearish resumption towards psychological 107.00 support and 106.70 (Fibo 76.4% of 100.81/125.84 (May 2004 / May 2015 rally).

Meantime, corrective rallies should be ideally capped by hourly cloud base at 108.50, before fresh push lower.

Pivotal barrier lies at 109.08 (Friday’s high / hourly cloud top) and only sustained break here would sideline immediate bears, for possible extension towards key near-term barriers at 110.00 (psychological resistance) and 110.50/65 (daily 10SMA / former consolidation range floor).

Res: 108.30; 109.08; 109.35; 110.00

Sup: 108.00; 107.61; 107.00; 106.70

AUDUSD

Aussie trades in near-term sideways mode, holding within hourly Ichimoku cloud, as near-term action from late Friday until current, is entrenched within 0.7577/0.7526 range.

This could be seen as a part of larger consolidation under fresh high at 0.772, which so far based at 0.7475.

Overall bullish stance is fading, as the pair broke below daily 10 & 20 SMA’s, with south-turning daily indicators, keeping in play scenario of deeper correction of 0.6826/0.7721 upleg, on loss of 0.7475 handle, which may trigger 100-pips bearish extension towards 0.7379 (Fibo 38.2% of 0.6826/0.7721).

Broken daily 20SMA caps today’s action at 0.7575, followed by 10SMA at 0.7596, while only break above lower platform at 0.7630 zone will neutralize existing downside threats.

Res: 0.7575; 0.7596; 0.7675; 0.7721

Sup: 0.7526; 0.7490; 0.7475; 0.7412

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD drops to near 1.0650 ahead of Fed policy

EUR/USD continues its decline for the second consecutive day, hovering around 1.0650 during Asian trading hours on Wednesday. With European markets largely closed for Labour Day, investors are expecting the Federal Reserve's latest policy decision.

GBP/USD holds below 1.2500 ahead of Fed rate decision

The GBP/USD pair holds below 1.2490 during the early Wednesday. The downtick of the major pair is supported by the stronger US Dollar amid the cautious mood ahead of the US Federal Reserve's interest rate decision later on Wednesday.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.