Bulls came back to play after the price broke above congestion tops at 1.3080. Fresh strength through initial barriers at 1.3121/45, opens way towards 1.3205, 11/07 peak, setting scope for further retracement of 1.3414/1.2754 downleg. Break above 1.3205 is required to open 1.3258, next target, Fibonacci 76.4% retracement and 21/06 high, seen as next target. Positive tone on lower timeframes studies and daily close above 200DMA, supports the notion, while previous resistances at 1.3100/1.3080 offer immediate support, while key support and breakpoint lies at 1.3000 higher platform.

Res: 1.3173; 1.3205; 1.3258; 1.3300

Sup: 1.3125; 1.3100; 1.3080; 1.3050

GBPUSD

The price bounced from short-term consolidation floor and cracked the upper boundary at 1.5140 zone, signaling possible extension higher and retest of key short-term hurdle at 1.5220. However, lack of momentum for final push higher, with hourly studies being overall neutral, would question short-term bulls. Failure to regain 1.5200/20 barriers, would signal prolonged sideways trading. Initial support at 1.5100 holds for now, while more downside risk would be seen on violation of range floor at 1.5030 zone.

Res: 1.5142; 1.5167; 1.5192; 1.5220

Sup: 1.5100; 1.5075; 1.5056; 1.5043

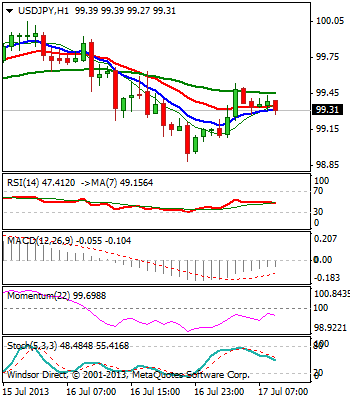

USDJPY

The pair remains under pressure, following Monday’s rejection at 100.47 and subsequent reversal that dented 99.00 support. Further extension of downmove from 100.47 would threaten 98.22, 11/07 low and psychological 98.00 support, reinforced by 100DMA, as short-term indicators hold in the negative territory and keep the downside favored. Corrective rallies are expected to stay under 100.47 high.

Res: 99.53; 100.00; 100.47; 100.62

Sup: 99.00; 98.88; 98.56; 98.22

AUDUSD

The pair returned to strength and extended short-term recovery rally from 0.8997 low, with eventual break above 0.9200 barrier, seeing scope for further gains and full retracement of 0.9304/0.8997 downleg. Positive short-term technicals support the notion, however, consolidative/corrective action on overbought hourly studies, may delay bulls, with dips to be ideally contained at 0.9160 zone, 38.2% retracement of 0.8997/0.9259 rally / 20/55DMA bullish crossover. Key upside barriers lay at 0.9304/43 and break here is required to spark stronger correction and sideline broader bars.

Res: 0.9237; 0.9259; 0.9304; 0.9343

Sup: 0.9200; 0.9160; 0.9120; 0.9085

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.