Statements released after US Federal Reserve meetings are thoroughly scrutinized for the slightest change in wording and for good reasons. The statements are formulaic, nearly identical to preceding statements with only the slightest change in wordings. Fed obscurity has always been a ‘known secret’. Under the administration of Fed Chair Mr. Alan Greenspan, analyst jokingly referred to the released statements as ‘quatrains’. Chair Greenspan once quipped “...I guess I should warn you, if I turn out to be particularly clear, you've probably misunderstood what I've said...” The point is that the US Fed has a tradition for being particularly subtle, especially when it comes to indicating the direction of monetary policy. This is the main reason analyst pay particular attention to speeches and interviews when Fed members might let their guard down a bit. On 10 April 2016, CNN’s Fareed Zakaria interviewed Chair Yellen and four former Fed Chairs: Paul Volker, Ben Bernanke and Alan Greenspan .

The questions were directly put. In response to the economic health, Chair Yellen noted: “... the U.S. economy has made tremendous progress in recovering from the damage from the financial crisis. Slowly but surely, the labor market is healing... ...we're coming close to our assigned congressional goal of maximum employment...”

Again, this leaves room for interpretation. It has been 8 years since the depth of the crises, yet Chair Yellen still not quite fully satisfied with the employment situation; this in spite of a 5% unemployment rate.

On the December 2015 policy action, Chair Yellen responded: “... I certainly don't regard it as a mistake. We set out two criteria to boost the funds rate that led to the December decision. One was we wanted to see substantial progress in the labor market, and we felt that had been satisfied...” Although it is far from contradicting the previous comment over employment, it doesn’t seem to sync up, exactly.

Chair Yellen was emphatic about the December action being a measured step noting that, “... [the FOMC] wanted to feel reasonably confident that inflation would move up over the medium term back to two percent. And we all felt, I think, that those conditions were satisfied in December and justified taking a step... ...We indicated that we thought the path of rate increases would be gradual, and that remains our best guess and expectation...”

In the most recent Fed press conference following the Open Market Committee meeting of 16 March , Chair Yellen noted that “...concerns about global economic prospects have led to increased financial market volatility and somewhat tighter financial conditions in the United States... ...economic growth abroad appears to be running at a somewhat softer pace than previously expected... ...These unanticipated developments, however, have not resulted in material changes to the Committee’s baseline outlook...”

To sum up, the Chair of the US Fed seems to have a very slight tightening bias, if not neutral. In fact in the press conference following the meeting, questions did arise over the very public debate between voting Fed board members, as well as the Fed’s inaction at the previous June, July and September meetings. Chair Yellen responded by noting that “...let me start with the question of the Fed’s credibility... ...the paths that the participants project for the federal funds rate and how it will evolve are not a preset plan or commitment or promise of the Committee... ...you should fully expect that forecasts for the appropriate path of policy on the part of all participants will evolve over time as shocks, positive or negative, hit the economy that alter those forecasts...”

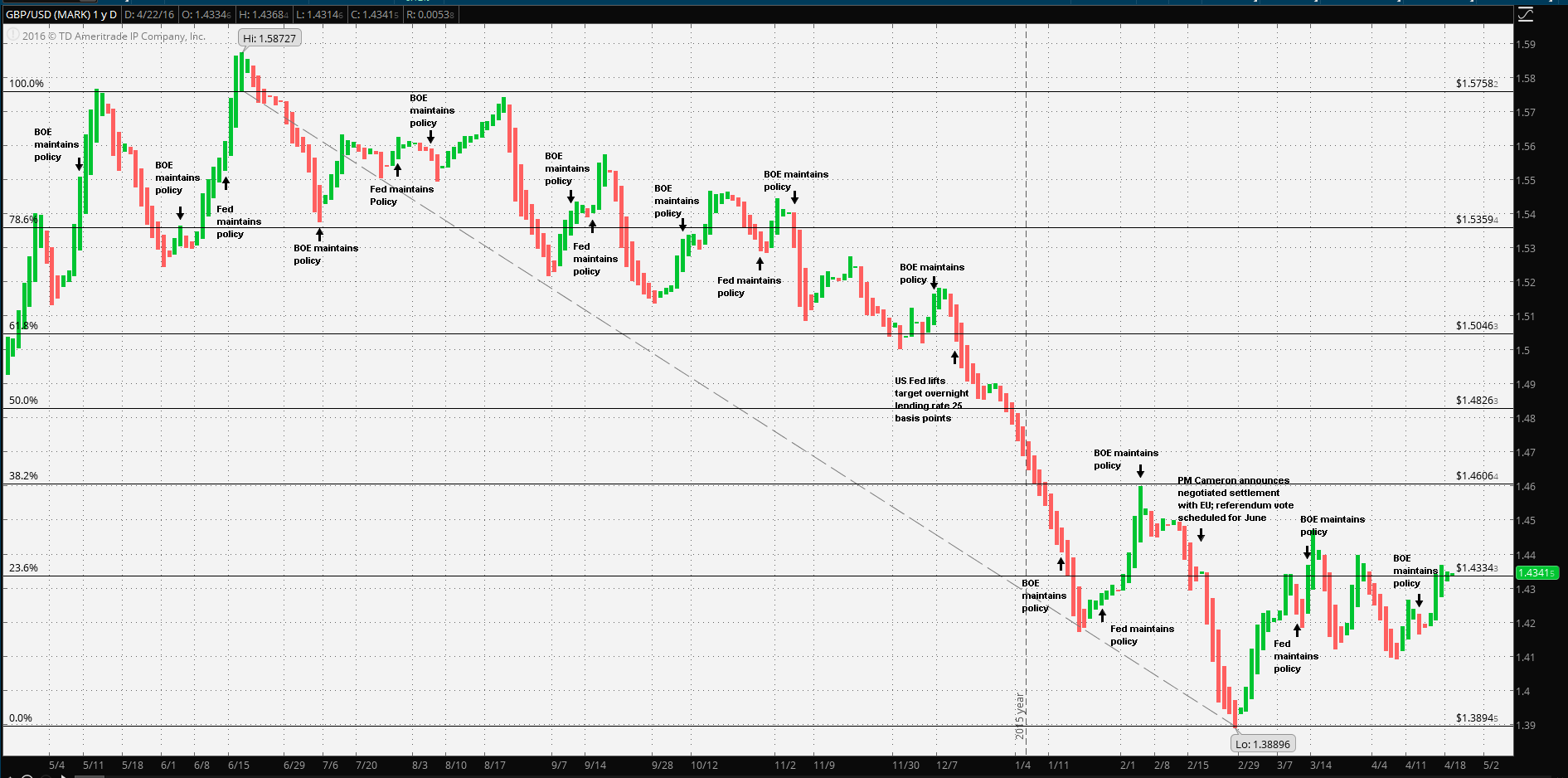

If any interpretation might be gleaned is that the US Fed is now assessing the global economic impact on the US economy, possibly affecting their rate decisions. In fact, one of those ‘shocks’ might just originate with one of the closest US allies, the United Kingdom and in particular the potential of a Brexit. The next Fed Open Market Committee meeting will be held one week before the UK referendum vote. Hence, if US economic data demonstrates accelerating economic growth, will they still delay if polls are not conclusive? Complicating the issue are upcoming US elections. Both the Democratic and Republican parties have their candidate nominating conventions in July. So far, the campaigns have been contentious, to say the least. Traditionally, the Fed refrains from policy changes at such times in order to avoid the appearance of influencing the elections. Hence, this might eliminate June, certainly July as well as October and clearly the election month itself, November.

The nearest opportunity will be at the 26-27 April meeting. However, the risks are high. US economic data is not yet convincingly strong. If the get it wrong, they would be forced to act during those party nominating conventions. Hence the safest (most politically neutral) opportunity would be at the September 20-21 FOMC meeting.

Thus to the point: with a Brexit secession still uncertain by recent polling with a large number of voters undecided, it’s likely that Sterling will weaken in a flight to safety trade, while the US dollar is likely to strengthen, as capital from the UK as well as Europe and Asia-Pacific seeks a safe haven in the US Dollar.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.