Indeed, in the press release, the BOJ made clear that it was maintaining monetary policy. However, by the time of the September meeting, the US Fed as well as the BOE were having second thoughts about ‘lift-off’. In a Bloomberg Polliii all but two of 35 analysts expected any policy change. Further, many analyst were becoming anxious over China’s economy. Shoji Hirakawa, chief equity strategist at Okasan Securities noted that “...The fact that investment is slowing down is especially worrying, and it’s negative if you see it as proof that China’s policies have been unsuccessful so far...” The September BOJ statement released was optimistic; the BOJ clearly intended to hold the lineiv: “...Quantitative and qualitative monetary easing (QQE) has been exerting its intended effects, and the Bank will continue with QQE, aiming to achieve the price stability target of 2 percent, as long as it is necessary for maintaining that target in a stable manner...”

However, those very same analyst concerns about China must certainly have raised ‘red flags’ for both the Fed and BOE. Neither changed policy noting ‘global economic’ concerns.

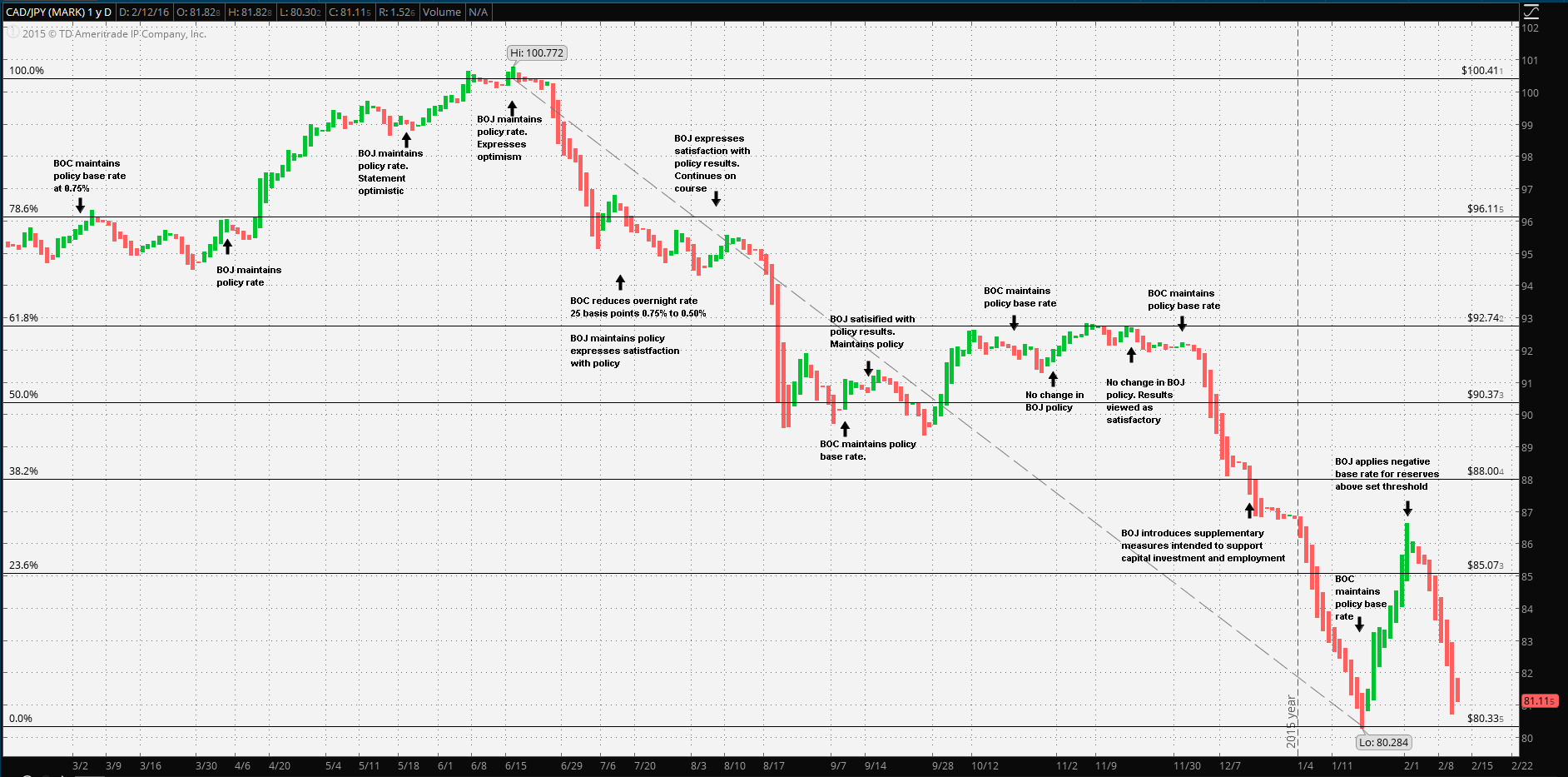

The tune continued to change as markets entered deeper into Q4 with declining commodity prices and increasing volatility in China’s asset markets. However, Prime Minister Shinzo Abe’s top economic advisor remained convinced of the success of the current policy. Koichi Hamada noted thatv “...The BOJ’s new core CPI measure that excludes fresh food and also energy is a better indicator to discern the trend of prices now... ...As long as the new core measure is rising, the BOJ has no need to expand its monetary policy...” At both the October 30 and 18 December meeting, the BOJ stayed on track with the current policy. Curiously, it added supplementary measures to facilitate capital investment and new hiringvi. The above narrative clearly demonstrates a fair degree of complacency among the BOJ advisors. However the patience and persistence of Bank of Japan had clearly reached its limit in January. Consider that the BOJ went negative after months of optimistic expectations. This should serve as a clear indication that the BOJ has changed tack.

Although half a world away and the manager of an export economy, the Bank of Canada had been proactive, easing for several years starting in 2008 at 4.25, steadily reducing to 0.25% in 2010. The BOC then began to taper, but it might have been too soon. In August of 2010 the overnight rated had reached 1.00%. In 2015 the BOC pulled back by half, bringing the overnight rate down to 0.50% when it currently remains. In the September statementvii, Governor Stephan Poloz made particular note that “...Economic activity continues to be underpinned by solid household spending and a firm recovery in the United States, with particular strength in the sectors of the U.S. economy that are important for Canadian exports... ...Movements in the Canadian dollar are helping to absorb some of the impact of lower commodity prices and are facilitating the adjustments taking place in Canada’s economy...”

It seems that, not unlike other advanced export economies, the BOC has resigned itself to the fact that there would be no short term rebound for commodity prices. Instead, the BOC would keep the Loonie weak, facilitating exports to its US NAFTA partner. This ‘fall back plan’ was reiterated at the October meetingviii: “...In the United States, the economy is expected to continue growing at a solid pace with particular strength in private domestic demand, which is important for Canadian exports...”

Lastly, a few weeks after asset markets unraveled, the BOC was out front stating that “...Prices for oil and other commodities have declined further and this represents a setback for the Canadian economy... ...GDP growth likely stalled in the fourth quarter of 2015, pulled down by temporary softness in the U.S. economy, weaker business investment and several other temporary factors...”

The point is that further BOC rate reduction will have little if any effect on Canada’s natural resource sector, hence a ‘moot point’ for the BOC. On the other hand, a weak Loonie versus the US Dollar is extraordinarily beneficial to the rest of the Canadian economy considering that US demand for non-natural resource exports is reasonably strong.

Hence, it’s reasonable to expect that the BOC will maintain the overnight rate; there’s no need to change it. If the Fed maintains, it remains weak; if the Fed increases, it weakens further. As for the BOJ, well, it was only a matter of days before the Yen regained what it lost, (and then some), after the BOJ policy shift. It’s more than likely that the CAD/JPY cross will reverse and potentially sharply should the BOJ act unexpectedly. As to when, it’s difficult to say, however, it’s worth noting that CAD/JPY is approaching its 52 weal low, as demonstrated in the above chart.

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.

”

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

AUD/USD trades with mild positive bias near 0.6700, RBA Meeting Minutes eyed

The AUD/USD trades with a mild positive bias near 0.6695 during the early Asian session on Monday. The weaker US Dollar provides some support to the pair. The markets remain unconvinced that the Fed will pivot earlier than previously expected.

EUR/USD gains ground above 1.0850, focus on Fedspeak

The EUR/USD pair trades on a stronger note around 1.0875 on Monday during the early Asian trading hours. The uptick in the major pair is bolstered by the softer Greenback. The Federal Reserve’s Bostic, Barr, Waller, Jefferson, and Mester are scheduled to speak on Monday.

Gold gains ground above $2,400, eyes on Fedspeak

Gold price gathers strength around $2,415 during the early Asian session on Monday. The softer US inflation data in April provides some support to the yellow metal. Meanwhile, the USD Index edges lower to 104.50, losing 0.03% on the day.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.