In the interim between the September 2015 meeting and the 10 December meeting, the price decline in strategic commodities accelerated, emerging markets continued to feel the impact and China’s equity markets experienced volatility well above the norm.

It’s also important to note that the Reserve Bank of Australia had been toeing the line, holding its benchmark OCR at 2.00%. At the 1 September 2015 meeting, the RBA noted “...The global economy is expanding at a moderate pace, with some further softening in conditions in China and east Asia of late, but stronger US growth. Key commodity prices are much lower than a year ago, in part reflecting increased supply, including from Australia. Australia's terms of trade are falling...” Importantly the RBA also made mention of the US Fed. “...The Federal Reserve is expected to start increasing its policy rate over the period ahead, but some other major central banks are continuing to ease policy...”

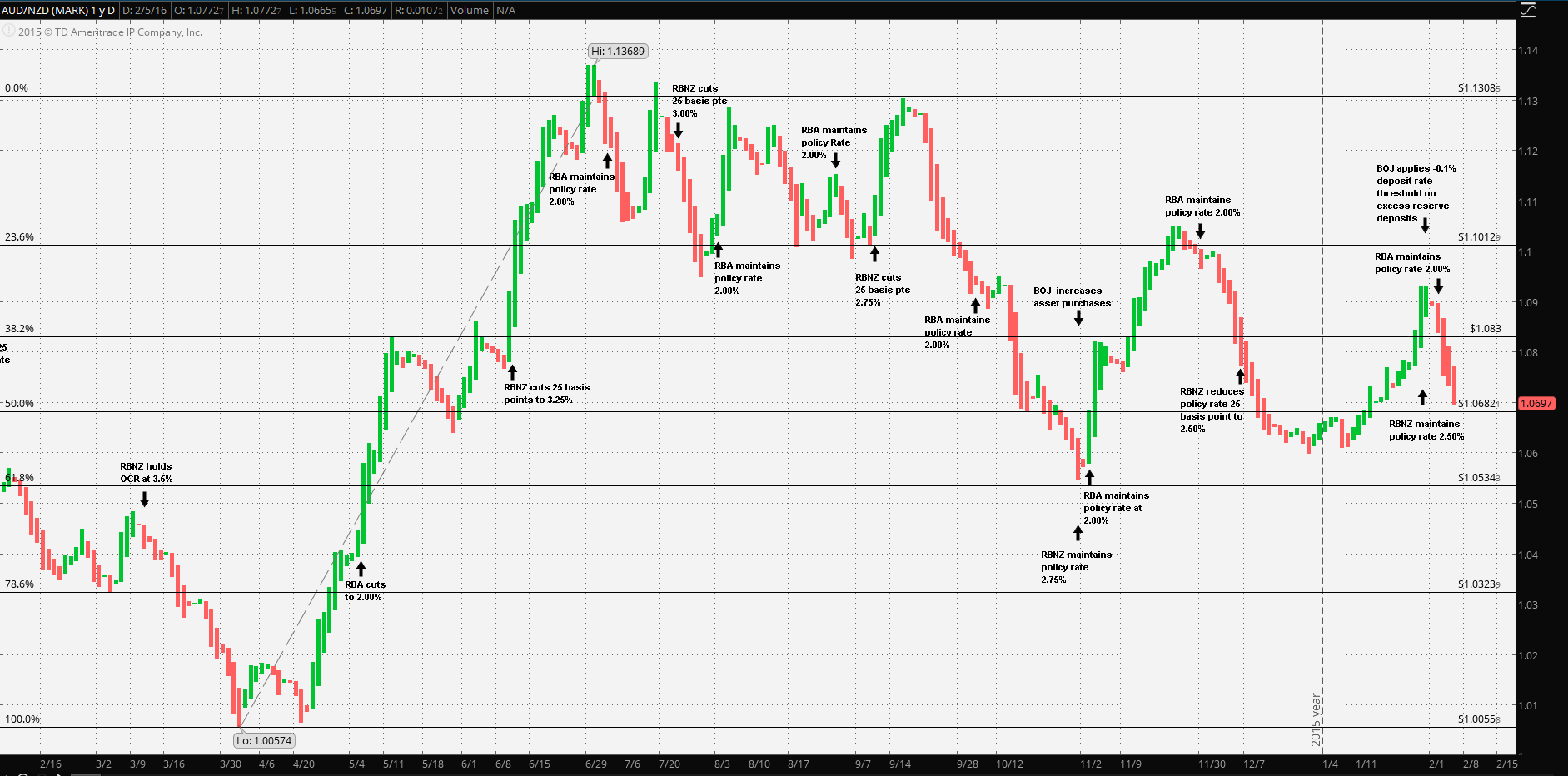

It should be noted that several commodity export currencies have weakened considerably against the US Dollar, the Aussie and Kiwi among them. Just days before the US Fed’s 16 December meeting at which the Fed Funds rate was increased by 25 basis points, the RBNZ took action and reduced the OCR by 25 basis points. The 10 December Statement noted that “... economic growth is below average and inflation is low, despite highly stimulatory monetary conditions... ...Markets are also focused on the expected tightening of policy in the United States and the prospect of an increasing divergence between monetary policies in the major economies... ...[growth] has softened over 2015, due mainly to lower terms of trade...”

At the 1 December meeting, two weeks before the Fed action, the Governor Stevens again noted “...Key commodity prices are much lower than a year ago, reflecting increased supply, including from Australia, as well as weaker demand. Australia's terms of trade are falling.... ...The Federal Reserve is expected to start increasing its policy rate over the period ahead, but some other major central banks are continuing to ease monetary policy...” The board considered the 2.00% OCR appropriate and no action resulted.

The next RBNZ meeting was held 28 January, one day before the Bank of Japan surprised markets by establishing a threshold on deposits above which a negative rate of -0.1% would be imposed. Although the BOJ’s stated purpose is to provide additional liquidity to the domestic economy, the side-affect defends the Yen against sudden, large flight to quality trades. Hence, capital outflows from other nations must seek other venues, else incur the cost of a negative rate on a portion of deposits.

Hence, there’s a four way dynamic at work on AUD/NZD: The higher OCR rates of the RBNZ and RBA, the BOJ’s negative interest rate policy (aimed at a portion of reserve deposits), the potential for excessive capital outflows from China and the US Fed strengthening the dollar.

The new BOJ rate would create a 260 basis point spread (for those BOJ deposits above the threshold). The next RBA meeting was held 2 February at which the board decided to maintain the OCR at 2.00%. Although this creates less of a spread, 210 basis points is difficult to ignore in a global low yield environment.

AUD/NZD traded in a range of NZ$ 1.1016 support to NZ$ 1.1308 resistance from about mid-June 2015 through late September 2015 essentially under the same circumstances. The pair broke through several support levels over the month of October 2015 as commodity prices and Chinese markets seemed to unravel, finding support at NZ$ 1.0534. The pair met resistance at NZ$ 1.1012. The same dynamic is still at work for the pair but has taken a step further. AUD/NZD has traded between NZ$ 1.0534 support to NZ$ 1.1012 resistance Fibonacci retracement marked from the 4 April 52 week low.

Hence, it’s not unreasonable to expect capital inflow to support AUD/NZD in this range with an advantage to the Kiwi in light of the larger OCR basis point spread.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.