Due to this uncertainty, capital flight has increased in Greece. Greek savers are withdrawing money at an alarming rate as a potential exit from the Eurozone looms large. Below is a pie chart of who owns the large amount of Greek debt.

Aside from Greece’s on-going negotiations, the ECB will be implementing their new QE programme next month which should boost growth and stave-off deflation. This should lower the Euro and help firms boost profits thereby creating employment. However, structural reforms need to take place in order for QE to be effective.

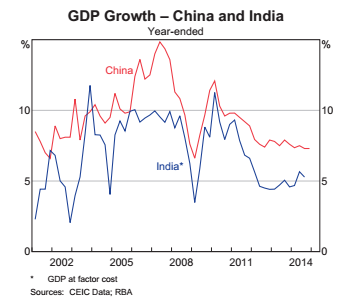

After 18-months of holding the rate constant at 2.5%, and with the recent a slowdown in consumer spending, the RBA cut interest rates to 2.25. In addition, due to China’s slowdown (shown in the graph) there has been a declining demand for commodities. The RBA have also reiterated that the Aussie Dollar remains very high and thus a rate cut should devalue the Aussie Dollar.

Unemployment still remains a concern for the RBA and currently sits at 12.5%. A rate cut should lift business investment and thus increase employment. In addition, a declining Aussie dollar and lower oil prices should help firms profit and help inflation.

The only concern the RBA have are house prices - with a lower cash rate there will be more buyers in the market. Thus there is a likely to be a mismatch between demand and supply resulting in higher property prices.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD looks depressed ahead of FOMC

EUR/USD followed the sour mood prevailing in the broader risk complex and plummeted to multi-session lows in the vicinity of 1.0670 in response to the data-driven rebound in the US Dollar prior to the Fed’s interest rate decision.

Gold pullbacks on rising US yields, buoyant US Dollar as inflation heats up

Gold prices drop below the $2,300 threshold on Tuesday as data from the United States show that employment costs are rising, thus putting upward pressure on inflation. XAU/USD trades at $2,296 amid rising US Treasury bond yields and a stronger US Dollar.

Bitcoin price tests $60K range as Coinbase advances toward instant, low-cost BTC transfers

BTC bulls need to hold here on the daily time frame, lest we see $52K range tested. Bitcoin (BTC) price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.