After placing great pressure on the resistance level at 0.77 over the last week, the Australian dollar fell heavily earlier this week before surging higher again only to run into heavy resistance again. This level remains firm and continues to repel any buying pressure. Over the best part of the last couple of weeks, the Australian dollar has relied heavily on support at the 0.76 level after falling away sharply to down below the key 0.77 level over the course of the week prior, and it is relying on this level again presently. Throughout last week it has felt significant resistance from the key 0.77 level which has been severely tested during this period. The AUD/USD has surged strongly higher and made repeated attempts to push through, however the resistance at 0.77 has stood tall and fended off the buyers at this stage. Its next obvious support level is down at 0.7550 and it will hoping to be propped up by it. Its recent decline was from the key 0.7850 level after surging higher to a new two month high above 0.79 earlier a few weeks ago.

For a couple of weeks it moved back and forth from below 0.76 and up to the key resistance level at 0.7850 and higher, before the recent fall. Back in early March the Australian dollar made a statement and broke down strongly through the key 0.77 level which then provided significant resistance for the following few days. It was also able to enjoy some short term support around 0.7550 which propped it up and allowed it to rally strongly back up to above 0.79. Throughout February the Australian dollar made repeated attempts to move up strongly to the resistance level at 0.7850 however it was rejected every time and sent back easing lower, which is why this level remains significant presently. Just prior to that towards the end of February the Australian dollar moved through the resistance at 0.7850 to reach a new four week high around 0.7900. In the second half of January, the Australian dollar fell very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200.

Back in mid-January it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650.

The International Monetary Fund (IMF) has highlighted the damaging effect the iron ore slump is having on Australia, as the Treasurer seeks a discussion with the Chinese finance minister on the matter. In its latest world outlook, the IMF forecasts Australia’s economy will grow by 2.8 per cent this year, which is slightly down on its previous prediction in October of 2.9 per cent. The slump in iron ore is largely to blame, dragging metals prices down 15 per cent since September last year and the IMF warns the pain is not over yet. “Average annual metal prices are expected to decline 17 per cent in 2015 … and then fall slightly in 2016,” the report says. It does not expect metals prices to stabilise until 2017. Lower interest rates and a weaker currency are helping to sustain growth, but the IMF says the Reserve Bank has more work to do. The report raises concerns that inflation in Australia could continue to fall, which would have serious consequences for wages and consumer spending.

(Daily chart / 4 hourly chart below)

AUD/USD April 15 at 23:45 GMT 0.7678 H: 0.7700 L: 0.7571

AUD/USD Technical

During the early hours of the Asian trading session on Thursday, the AUD/USD is easing back slightly after recently running into the resistance at 0.77 again. Current range: trading right below 0.7700.

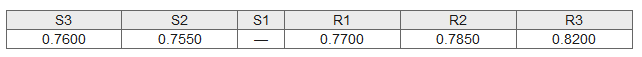

Further levels in both directions:

- Below: 0.7600 and 0.7550.

- Above: 0.7700, 0.7850 and 0.8200.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.