After threatening to break through the support level at 0.93, the Australian dollar has finally slid lower to below this level after mounting another rally in recent hours. Over the last month or so, it has generally been sliding lower from close to 0.95 down to its present trading levels around 0.93. A couple of weeks ago the Australian dollar surged higher to a one week high near 0.9375, before easing back and then falling sharply. It has done well of late to cling onto the 0.93 level after its sharp fall which saw it move from above 0.9400 down to a seven week low below 0.9240. A few weeks ago it was easing back below both the 0.9425 and 0.9400 levels with the former providing some resistance. The Australian dollar reached a three week high just shy of 0.9480 several weeks ago after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week.

Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95. After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further.

Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

RBA governor Glenn Stevens is "quite concerned" that Australia's unemployment rate has reached a 12-year high. Australia's jobless rate jumped to 6.4 per cent in July, official figures showed, surprising market analysts who have been awaiting the governor's thoughts on the shocking rise. In his semi-annual testimony to parliament on Wednesday, Mr Stevens said he was concerned about the rise but reminded people that the current jobless rate would historically be regarded as low. "I'm quite concerned at the thought that unemployment is higher," Mr Stevens said. "I'd still observe that even on the latest reading, it's not that many years ago that six-point-something was regarded as low. "I regard it as not quite low enough actually, but I think we need to keep a bit of historical perspective here on how high it is." Mr Stevens said the RBA's mandate was to achieve full employment as well as price stability. He said the RBA's two-to-three per cent inflation target framework was a good one for keeping both goals in mind.

(Daily chart / 4 hourly chart below)

AUD/USD August 20 at 23:50 GMT 0.9286 H: 0.9289 L: 0.9279

AUD/USD Technical

During the early hours of the Asian trading session on Thursday, the AUD/USD is trading in a small range just below 0.93 after surging higher in recent hours and then returning to below 0.93. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.95 again. Current range: trading right around 0.9285.

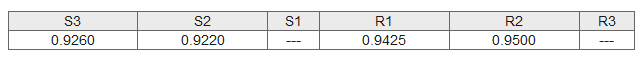

Further levels in both directions:

- Below: 0.9260, and 0.9220.

- Above: 0.9425 and 0.9500.

Recommended Content

Editors’ Picks

EUR/USD stays in tight channel above 1.0750

EUR/USD continues to fluctuate in a narrow band slightly above 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.