Hungarian Retail Sales surge raises some questions

No one saw this strong Hungarian retail performance coming. The March data surprised to the upside, without any early hint. So, we take it with a pinch of salt, but file it away as a possible ray of hope for recovery.

The development of Hungarian retail sales in March was a rather strong positive surprise. On a monthly basis, after a contraction of 0.6% in the previous month, sales volumes across all sectors rose by 2% in seasonally- and working-day adjusted terms. The dynamic one-month growth also led to a strong improvement in the year-on-year index, which rose by 4.2%, adjusting for the calendar effect. Such a spectacular pace of expansion was not at all expected by the analyst community, especially in light of the preliminary release of first quarter GDP, where retail trade was not highlighted as a strong performing sector.

Looking at the details, the most influential surprise came from food sales, which showed dynamic growth in March after February. It is quite rare for this subsector to post consecutive monthly growth rates close to 1%. However, this could be due to the Easter effect, although calendar-adjusted data should (in theory) take care of this. Non-food sales also showed a significant correction after the decline in February. On a monthly basis, we saw an increase of 0.9% in this segment. There was also strong growth in sales of books, newspapers and second-hand goods.

Breakdown of Retail Sales (% YoY, wda)

Source: HCSO, ING

We saw a correction in mail order and internet sales, which rose by almost 2% after a sharp fall in the previous month. Sales in stores selling higher-value goods (such as electronics, furniture, etc.) also increased somewhat, but the performance was rather below average. It would therefore appear that the coupon payments on retail government bonds (together with the accumulation of transfers in previous months) have already had some positive impact on retail sales in March. It remains to be seen, however, why this did not boost purchases of big ticket items to a greater extent. Last but not least, fuel sales were also somewhat puzzling, as fuel prices continued to rise by 2.1% month-on-month in March. In fact, sales rose by 0.5% on a monthly basis.

All in all, therefore, the March retail sales data in many ways added to the plethora of questions rather than answering some of them. In light of today's data, it will therefore be even more important to look at the detailed GDP data, which may provide some explanation. Fundamentally, of course, real wage growth and a trend improvement in household confidence could explain the expansion in retail sales, but this is unlikely to be seen as a sudden rebound after two months of poor performance. Moreover, developments on the revenue side of the budget did not necessarily foreshadow this surge either. While VAT receipts in the first quarter of 2023 reached 23% of full-year receipts, in 2024 this share (relative to expected full-year receipts) was 19%. However, to be fair, the year-on-year performance is clearly improving.

The year-to-date development of VAT receipts (HUF bn)

Source: Hungarian State Treasury, ING. Note: Data labels are referring to the year-on-year change

By historic standards, retail sales turnover volume is now at levels last seen in the summer of 2021, following the surge in March, so the overall picture is also improving, but a full recovery is still some way off.

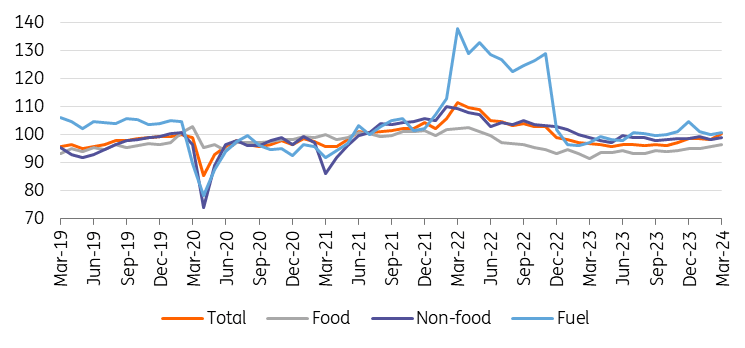

Retail Sales volume in detail (2021 = 100%)

Source: HCSO, ING

In the coming months, relatively low inflation and, as a result, strong real wage growth should support retail sales. Similarly, the inflation-linked coupon payments on retail government bonds may have an increasing impact on consumption. At the same time, households need to become less cautious and confidence needs to recover (remember that the latest consumer confidence reading surprised on the downside with a decline) before there can be talk of a sustained recovery. But there are undoubtedly already encouraging signs, even if many questions remain.

Read the original analysis: Hungarian Retail Sales surge raises some questions

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.