The table below includes updated supply/demand levels on the major currency pairs. The table is updated on a daily basis after the NY close. The levels will help trading decisions for intraday, swing and positions traders.

**RBR = Rally-base-rally

**RBD = Rally-base-drop

**DBD= Drop-base-drop

**DBR= Drop-base-rally

** Refer to footnote for further information on supply/demand analysis

Supply Demand Charts and Analysis

Below readers can graphically identify supply and demand areas registered in our daily supply/demand table above. A brief comment on the outlook has also been added.

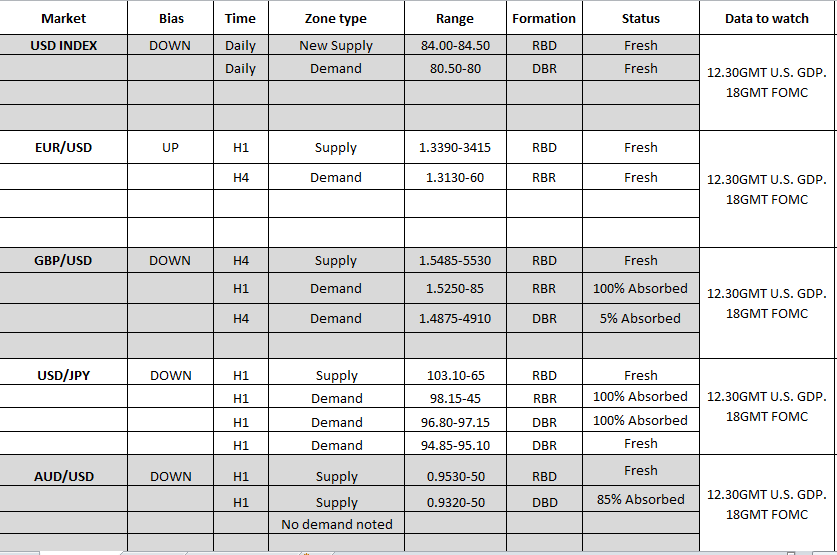

1 - USD INDEX (watch LIVE chart)

Risk is still skewed to the downside, with the next target found at 80.50-80.80, where solid bids are expected to resurface. On the upside, there is room to appreciate too until imbalance in favur of sellers is found.

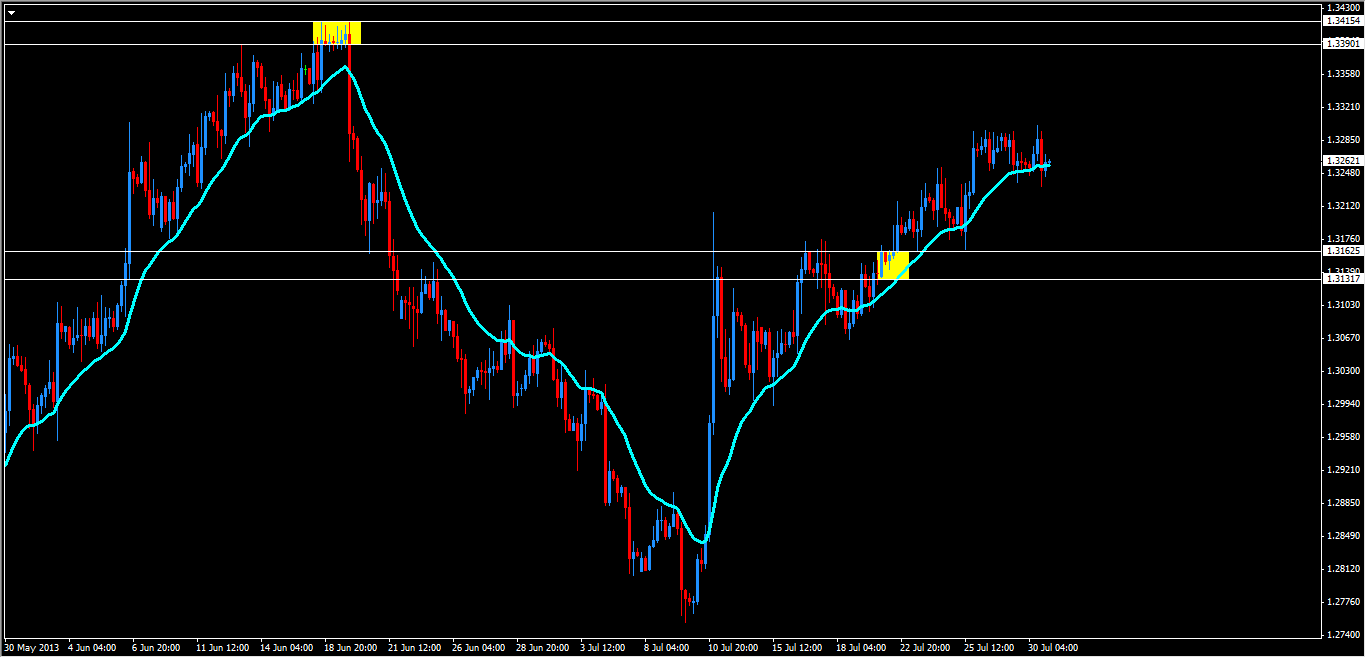

2 - EURO

The pair finds itself in equilibrium between supply and demand. Since the trend remains up, the risk is for a test of 1.3390-1.3415 before sellers regain control. Watch for strong volatility today, with wild swings either side subject to FOMC, US GDP outcomes.

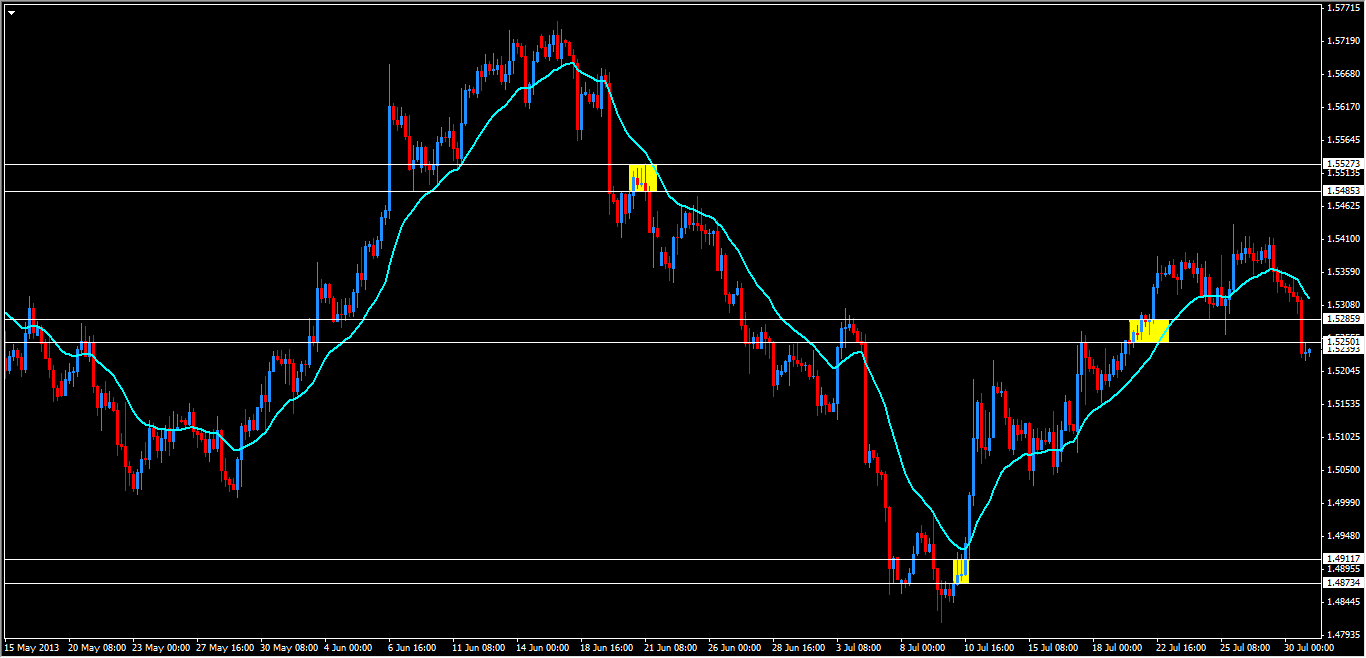

3 - BRITISH POUND

Pair collapsed through proven demand, despite warning it had been partly absorbed on July 25, allowing now much further room to fall.

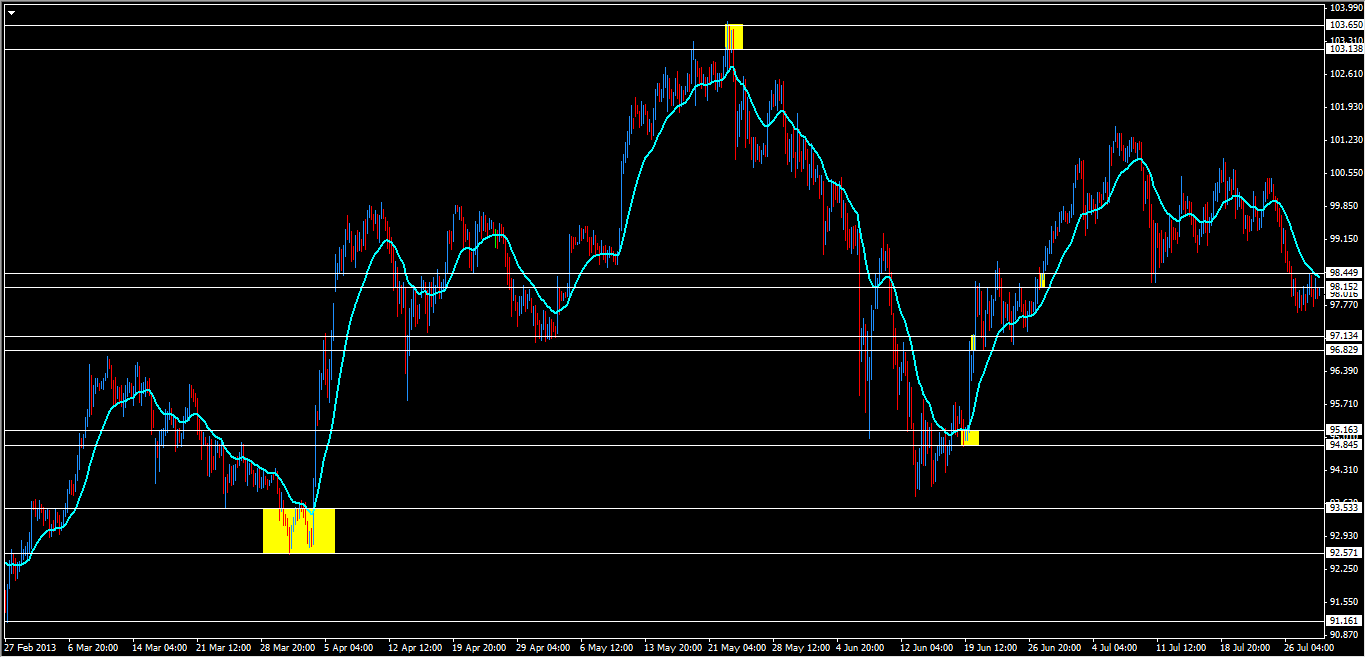

4 - JAPANESE YEN

The pair looks set to test to weaken further after absorbing area of demand at 98.00+.

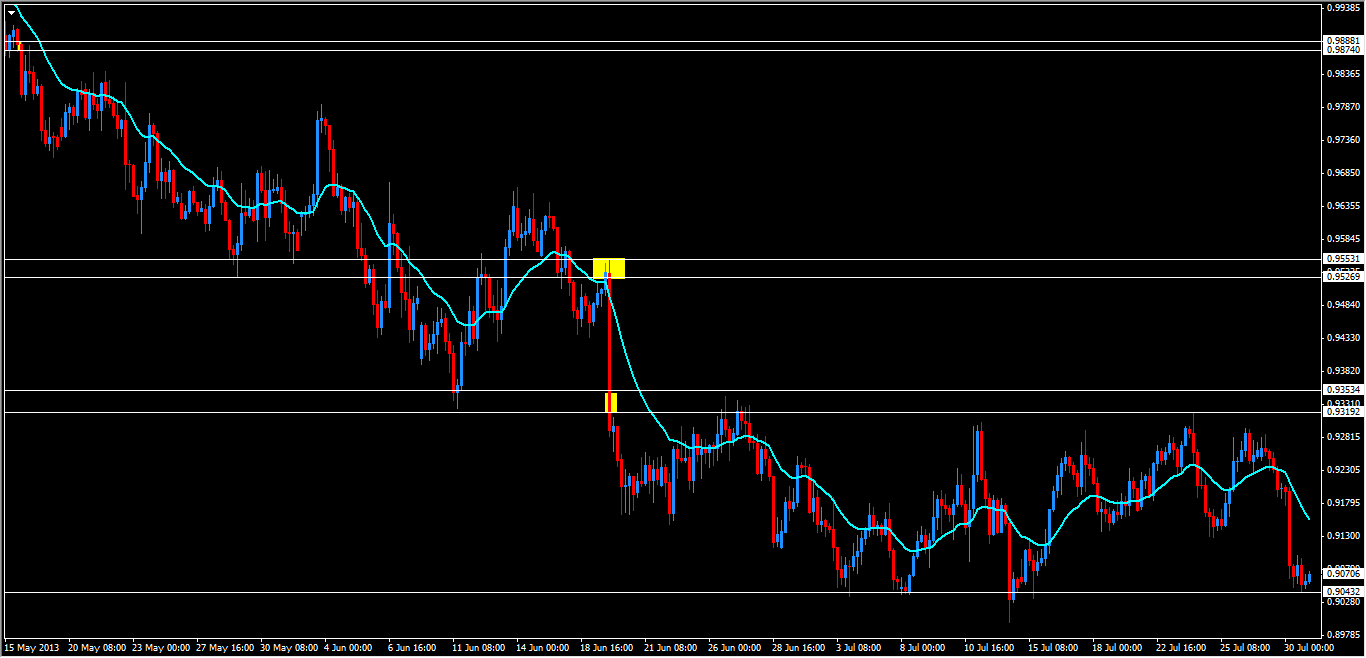

5 - AUSTRALIAN DOLLAR

Risk increases for an eventual break lower from the present range. Until that happens, any bounce approaching 0.93 is seen as selling opportunity.

Good luck everyone!

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD drops to near 1.0650 ahead of Fed policy

EUR/USD continues its decline for the second consecutive day, hovering around 1.0650 during Asian trading hours on Wednesday. With European markets largely closed for Labour Day, investors are expecting the Federal Reserve's latest policy decision.

GBP/USD holds below 1.2500 ahead of Fed rate decision

The GBP/USD pair holds below 1.2490 during the early Wednesday. The downtick of the major pair is supported by the stronger US Dollar amid the cautious mood ahead of the US Federal Reserve's interest rate decision later on Wednesday.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.