On Monday, the dollar started with a negative bias as the failed Doha meeting on oil production cuts triggered a risk-off trade in Asia. However, the impact on European and US markets was moderate and equities and oil rebounded.

The dollar traded mixed and struggled to prevent further losses against the euro. EUR/USD hovered in the 1.13 area to close the day at 1.1313 (from 1.1284 on Friday). USD/JPY reversed earlier losses as oil and equities rebounded intraday. The pair finished the session at 108.82 (from 108.76)

Overnight, Asian equity markets reverse part of the post-Doha decline with Japan and commodity-sensitive countries outperforming, while China underperforms. The Bank of Korea left its policy rate unchanged at a record low 1.5%, but reduced its 2016 growth forecast to 2.8%. The Korean won trades at its strongest level since early November. USD/JPY rebounds north of 109. The Aussie (0.7775 area) and the kiwi dollar (0.6995 area) both trade at the highest level since June last year. EUR/USD trades with a marginally positive bias changing hands in the 1.1325 area. Overnight, Fed Rosengren sounded less dovish than is usually the case. However the limited rise in US yields had no significant impact on EUR/USD trading.

Today, the eco calendar contains the German ZEW indicator and US housing starts and permits, while the ECB Q2 Bank Lending Survey is published. The US earnings season might get some attention with Goldman Sachs and Johnson & Johnson reporting before market and Intel and Yahoo after market. The German ZEW indicator is expected to have risen slightly in April for the second month in a row (from 4.3 to 8). We see room for an upward surprise. In the US, housing starts and permits are expected mixed. Housing starts are expected to have declined. Permits on the contrary are expected to have increased. For both data series we put the risk for an upward surprise. Both the ZEW and the US housing data often have only a modest, intraday impact on FX. Their impact goes via global risk/equity sentiment. So, a constructive outcome might be slightly supportive for the dollar, especially for USD/JPY. The impact on EUR/USD might be limited. In a day-to-day perspective, the rebound in oil and equities prevented USD/JPY yesterday to fall to new lows and this may continue today. Last week’s (cautious) rebound of the dollar against the euro stalled. For now, we don’t see a trigger for a clear directional move. The ECB meeting on Thursday is the next important point of reference.

The dollar lost ground after the March ECB and FOMC meetings. EUR/USD set a new 2016 high at 1.1465, but the key 1.1495 resistance remained intact. Last week’s price action suggests that the topside of EUR/USD is better protected.

We see no trigger for a clear directional move in EUR/USD short-term. Medium term, the dollar needs really good eco news to regain substantial ground. The soft Fed approach and risk aversion pushed USD/JPY below the 110.99/114.87 range. The pair reached a new correction low below 108, which was almost retested yesterday. Japan apparently didn’t get much support at the G20 to weaken the yen via interventions. So, Japanese authorities apparently lack tools to prevent further yen strength if sentiment would turn again risk off. We don’t row against the yen positive tide for now.

Sterling rebound continues

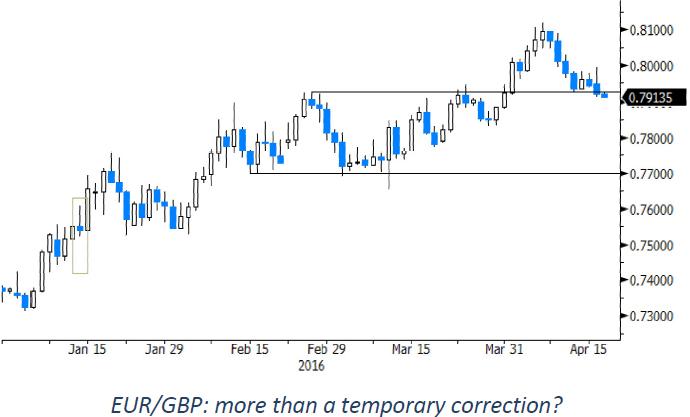

On Monday, sterling started under slight pressure on the failed Doha meeting. However, oil rebounded and the decline of European/UK equities was modest, putting a floor under sterling. Later in US dealings, sterling gained ground as global risk sentiment improved. EUR/GBP declined to close the session at 0.7923 (from 0.7944). Cable closed the session at 1.4278 (from 1.4202). An interview of UK’s Fin Min Osborne where he elaborated on the negative economic consequences of a Brexit scenario has little impact.

Today, there are no important UK data, but BoE’s Carney will speak before a committee of Parliament. He will face a lot of questions on the impact of the EU referendum. However, we don’t expect him to give new guidance on monetary policy. At the margin, the hearing might be slightly negative for sterling. Markets will also look forward to the labour market report tomorrow. The technical picture of EUR/GBP improved, as the pair broke above the 0.7929/31 and 0.8066. The sterling decline has been fast, raising the chances for a (temporary) pause, which occurred last week. The day-to-day momentum for sterling improved of late. Even so, we assume that sterling sentiment will remain fragile as long as the referendum is a neck-and-neck race.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.