Yesterday, equities and oil slumped, bringing risk‐off sentiment again to the forefront. European eco data were weak, while IMF chief Lagarde was downbeat about the outlook for global growth. The yen was the main beneficiary, while also the Swiss franc and gold advanced. USD/JPY extended Monday’s losses and tumbled from 111.35 to an intraday low of 109.95 even as there were rumours about BOJ policy easing in April. At the close, USD/JPY was quoted 110.34, down from 111.34 at the previous close. EUR/USD spiked lower on a weak open of European equities and a secondly time after a better‐than expected the US ISM. However, twice the euro erased the losses. The pair ended the session nearly unchanged at 1.1384 (1.1392 previously).

Overnight, sentiment on risk improved slightly. Asian indices traded little changed to marginally higher. Sentiment is supported by a rebound of oil. Brent oil trades around $38.60 p/b. The Aussie dollar rebounds slightly from yesterday’s commodity driven decline (currently around AUD/USD 0.7555). The yen stabilizes as the equity sell‐off slows. However, at 110.35 USD/JPY is still holding near yesterday’s correction low. The dollar trades marginally stronger against the euro at EUR/USD 1.1370. However, the pair shows no clear trend and holds in the tight consolidation pattern than is in place since mid‐last week.

After this morning’s German production data, the eco calendar is empty, both in the US and euro zone. After the European close, Fed’s Mester is scheduled to speak. She has a more hawkish profile and likely indicated that she sees three hikes this year (in the dot plot). We will see whether she has become a bit more dovish since. The FOMC Minutes might be interesting, as they give a view on the debate that took place at the March FOMC meeting. However, following the publication of the eco and rate projections, the Yellen press conference and a raft of Fed speakers, the markets most likely won’t react too much to its release. In day‐to‐day perspective, currency markets will keep an eye at oil. A stabilisation in oil (and subsequently in equities) might also slow the decline of the dollar, in the first place against the yen. However, the jury is still out.

After the dovish March ECB and FOMC meetings, the dollar was sold. Subsequently, the EUR/USD 1.1376 resistance was broken after soft comments from Yellen. EUR/USD set an new reaction top/2016 high at 1.1438. The 1.1495 resistance is the key line in the sand medium term, but is left intact for now. We see no trigger for a clear directional move in EUR/USD short‐term (the eco calendar is thin this week). Medium term, the dollar probably needs really good news to regain substantial ground. The soft Fed approach and the risk‐off sentiment pushed USD/JPY below the 110.99/114.87 range. The pair tested the 110 barrier yesterday. It looks difficult for USD/JPY to regain ground in a sustainable way as long as sentiment on risk remains negative/fragile. We look out whether official talk on more BOJ easing or some kind of verbal interventions from the BOJ can slow/stop the rebound of the yen.

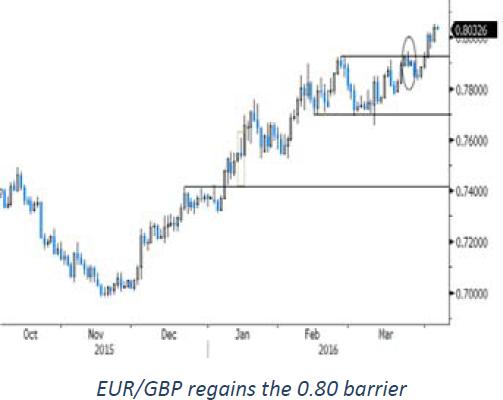

EUR/GBP nearing key 0.8066 resistance

Yesterday, sterling couldn’t build on Monday’s tepid gains even as the UK services PMI improved more than expected to 53.7 from 52.7. The pair hovered sideways in a tight 0.7980 to 0.80 range till the start of the US session. During the US session, sterling was again heavily sold. A negative sentiment on risk, a low oil price and linger uncertainty on Brexit continued to weigh. EUR/GBP set a new correction top near the 0.8050/60 resistance area and closed the session at 0.8039 (from 0.7985 on Monday evening). Cable also ignored the PMI release and dropped from 1.4264 to 1.4161 in the close.

Overnight, BRC shop prices were reported at ‐1.7%Y/Y in March from ‐2.0% Y/Y in February. However, the report didn’t affected sterling. Later today, the UK calendar is empty except for the UK new car registrations.

Yesterday, sterling was again hit hard by the global risk‐off trade. Sentiment improved slightly in Asia this morning. However, this is not enough to change sterling sentiment for the better in a sustainable way. Brexit will remain an important factor of uncertainty for sterling. That said, the recent sterling decline has been fast, which heightens the chances for a pause. The technical picture of EUR/GBP improved further as the pair broke above the 0.7929/31 resistance. EUR/GBP marched higher since December (0.70) without significant corrections. It closes in on the 0.8050/66 resistance area (H2 2014 highs) and erased the steep early 2015 losses. We don’t try to catch a falling knife and remain cautious on sterling longs.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.