Outlook:

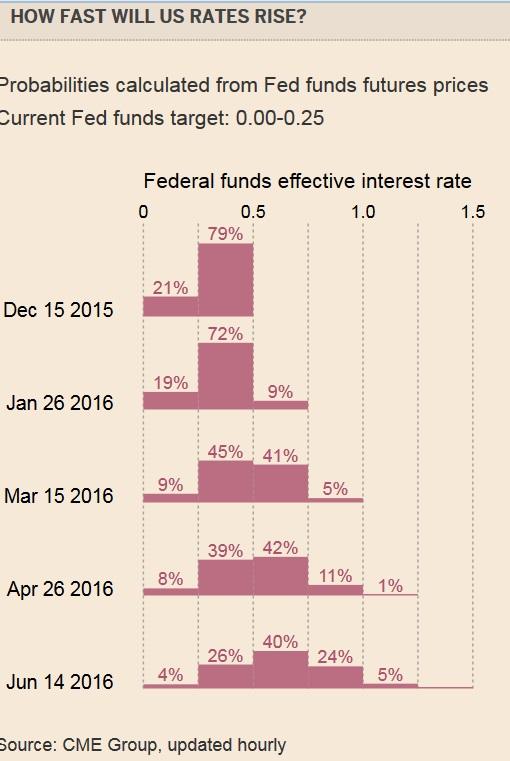

Now that Japanese and eurozone GDP revisions are in, we turn to US data but the plate is nearly bare—just JOLTS, always interesting but not a market-mover. That gives us time to consider the Fed’s rate hike and what it means. Most of the shouting is over but some traders are growing increasingly wary of all the hints that the trajectory of hikes is going to be “gradual”—make that “glacial.” An ultra-slow pace, as shown in the FT’s futures chart, implies waning support for the dollar. Given the historic anti-dollar bias, the dollar needs a constant diet of good news to maintain upward momentum.

Moreover, despite the ECB’s dovish stance and unfavorable differential, the euro could be getting a con-stant diet of favorable economic news. That could suggest Draghi won’t need the extra arrows in his quiver and the monthly amount never does get raised nor the deadline extended further. In a nutshell, we need to watch momentum, both economic and in FX. The divergent policy thesis is nice but does not suffice to support an ever-rising dollar unless the divergence grows wider. If instead the divergence grows narrower or looks like it should on economic grounds, the dollar is presumably subject to the same anti-dollar bias that has long held sway.

The fruit of holding reserve currency status and also having a rising yield favorability is capital inflow. But the FT’s Plender writes today that global conditions are pointing toward a lesser in-flow to the US. For one thing, the Gulf oil producers are going from fiscal surpluses to a giant deficit, estimated by the IMF to reach a combined $125 billion this year and $450 billion in 2015-2020.

“The fall in [energy] prices shifts wealth from energy producers to high-saving Asian countries, but also to large, low-saving advanced economies. That points to lower global saving and higher interest rates in bond markets. While sovereign wealth funds have significant holdings of illiquid assets such as proper-ty, infrastructure and private equity, it is the more liquid investments such as equities and government bonds that will feel the selling pressure if budgets remain under pressure for a sustained period.

The Fed itself estimated (in 2012) that the pace of foreign official buying of US Treasuries is directly correlated to emerging market current account surpluses. So, “… if foreign official inflows into US Treasuries were to decrease in a given month by $100bn, five-year Treasury rates would rise by about 40-60 basis points (100ths of a per cent) in the short run. But once foreign private investors react to this yield change the longer-run effect would be about 20 basis points. Whether the much discussed decline in market-making capacity in the system might lead to bigger rises in yields is moot.”

Plender goes on to say a side-effect of the reduced capital inflow and less pressure on the rising dollar might be to reduce protectionist sentiment in the US during an election year. What planet does this guy live on? American politicians have no idea whatever of capital inflows or the level of the dollar, let alone anything but a single view of the trade deficit—it’s a Bad Thing.

Plender goes off the rails another time by saying “In a world suffering from a shortage of safe assets a reduction in excess reserve accumulation is welcome.” What, exactly, is “excess reserve accumulation”? And then also he misses that when inflation does return, it will be better and more directly managed by the ECB than by the Fed, or so international fund managers have amply demonstrated they believe, driv-ing flows to euros rather than dollars.

This is not to say the dollar is going down the rabbit-hole again, at least not right away. But we sure do need a breakout move to the upside and until we get that, it will be hard to manage positions with all the big players evidently fiddling with their outlooks. Some are already saying parity by year-end is out of reach. We don’t buy it, yet.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 123.12 | LONG USD | STRONG | 10/23/15 | 120.45 | 2.22% |

| GBP/USD | 1.4999 | SHORT GBP | WEAK | 11/06/15 | 1.5137 | 0.91% |

| EUR/USD | 1.0858 | SHORT EURO | NEW*WEAK | 12/08/15 | 1.0858 | 0.00% |

| EUR/JPY | 133.69 | LONG EURO | NEW*STRONG | 12/04/15 | 133.59 | 0.07% |

| EUR/GBP | 0.7238 | SHORT EURO | WEAK | 10/23/15 | 0.7194 | -0.61% |

| USD/CHF | 0.9973 | LONG USD | NEW*WEAK | 12/08/15 | 0.9973 | 0.00% |

| USD/CAD | 1.3543 | LONG USD | STRONG | 10/28/15 | 1.3235 | 2.33% |

| NZD/USD | 0.6626 | LONG NZD | NEW*STRONG | 12/04/15 | 0.6641 | -0.23% |

| AUD/USD | 0.7214 | LONG AUD | WEAK | 11/23/15 | 0.7174 | 0.56% |

| AUD/JPY | 88.83 | LONG AUD | WEAK | 10/08/15 | 86.06 | 3.22% |

| USD/MXN | 16.9612 | LONG USD | NEW*WEAK | 12/07/15 | 16.7258 | 1.41% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.