Outlook:

Today could be a biggie for data—we get the revision to Q2 GDP, probably an improvement from 1.5% to 2.1%, with many analysts saying it really more like 2.5%. We also get consumer confidence, probably an improvement, too. We get merchandise trade, probably a worsening deficit that will be a drag on Q4 GDP. And Case-Shiller will update house prices, even though they are already several months old by now.

What we are looking for in the data in the broadest way is a noticeable improvement in the US. It doesn’t have to be accompanied by a worsening of conditions elsewhere.

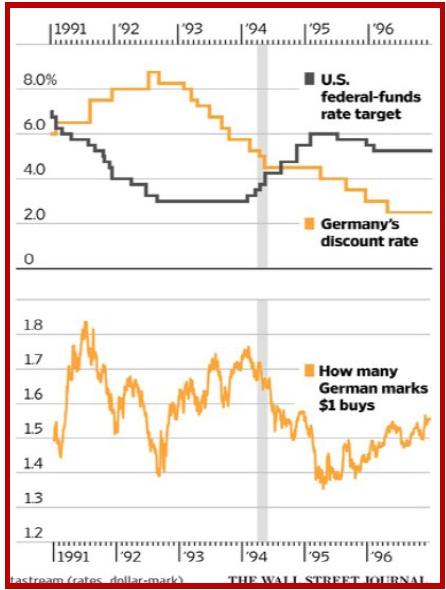

The conventional wisdom is that divergent-policies will inevitably lead to euro parity with the dollar. Many analysts have noted it will be the first time since May 1994 that we had divergence, and that time, the dollar failed to rise. The WSJ has a dandy chart, copied below, to illustrate. We scratched around for an explanation of why the DM rose instead of falling, or the dollar fell instead of rising. Several Readers made the key point that in 1994, German unification was still new (October 1990) so demand for DM was still high. Besides, the US was emerging from the recession that started in 1990 and it was a “jobless recovery.” Relative growth and growth prospects count. Another comparison is the hiking cycle that began in June 2004. Again the dollar fell, and this time we had the euro.

The point the WSJ is trying to make is that yield differentials rule, but not always or not fully, and can be overridden by other factors, like the safe-haven flow to the euro when the Chinese stock market threw a fit last summer. We say there are too many moving parts in the world economy to draw comparisons between events even a few years apart, let alone 20 years. We had pretty good global information flow in 1994, but ETF’s had just been launched the year before.

The global retail investor was still a new thing when we wrote a book for CNBC in 1999. In 1994, we didn’t have “frontier markets” and China was barely a blip on the radar screen of international finance—and China devalued in 1994, too, setting off what was to become a capital outflow, the famous “savings glut” and ten years later, Greenspan’s conundrum. Starting in June 2004, the Fed started raising rates and raised them 17 times, from 1% to 5¼%. But long term rates, specifically the 10-year, fell instead of rising proportionately. Speaking to Congress in 2005, Greenspan called it a conundrum and academics have spent the next 10 years trying to explain it. The Fed makes a compelling argument that at least half of the drop in 10-year yields comes from the increase in foreign holdings of Treasuries (from 20% in 1994 to 57% in 2007).

In a nutshell, looking back at historical events is lots of fun but not useful, except perhaps to remember that ten years ago, we were already blaming emerging Asia and China in particular for a disconnect between yields and currencies.

The resilience and robustness of the euro continues to amaze and impress. The euro is weathering storms that would fell a lesser currency, one without rock-hard confidence. Consider the problems—Russian sanctions, Grexit and Brexit, China slowdown, Volkswagen, Merkel taking refugees by the ton, terrorist attacks on Paris that certainly suggest Berlin is next. Plus France trying to cozy up to Russia right after Merkel took the reins of leadership in European-Russian relations. Meanwhile, Turkey is “negotiating” with the EC behind the scenes over everything from border control and treatment of the Kurds to EU membership and probably NATO membership, too.

We are not going to buy into the idea that the divergent-policy thesis is already priced in. It’s not. It won’t be fully understood until we get the ECB on Dec 3 and the Fed on Dec 16, and maybe not even then. Heaven only knows what the fallout will be, including the new geo-political positions. But the road to parity will be bumpy, to say the least.

Note to Readers: Thursday is a national holiday in the US. Banks are closed. We will not publish any reports.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 122.51 | LONG USD | WEAK | 10/23/15 | 120.45 | 1.71% |

| GBP/USD | 1.5122 | SHORT GBP | WEAK | 11/06/15 | 1.5137 | 0.10% |

| EUR/USD | 1.0651 | SHORT EUR | STRONG | 10/23/15 | 1.1115 | 4.17% |

| EUR/JPY | 130.48 | SHORT EURO | STRONG | 10/23/15 | 133.88 | 2.54% |

| EUR/GBP | 0.7043 | SHORT EURO | STRONG | 10/23/15 | 0.7220 | 2.45% |

| USD/CHF | 1.0168 | LONG USD | WEAK | 10/23/15 | 0.9735 | 4.45% |

| USD/CAD | 1.3362 | LONG USD | STRONG | 10/28/15 | 1.3235 | 0.96% |

| NZD/USD | 0.6513 | SHORT NZD | WEAK | 10/05/15 | 0.6641 | 1.93% |

| AUD/USD | 0.7215 | LONG AUD | WEAK | 11/23/15 | 0.7174 | 0.57% |

| AUD/JPY | 88.39 | LONG AUD | WEAK | 10/08/15 | 86.06 | 2.71% |

| USD/MXN | 16.5410 | LONG USD | WEAK | 11/06/15 | 16.6275 | -0.52% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.