Outlook:

We get so much data and have so many openings for an important speaker that it’s hard to know what to watch. Sometimes when there is too much material, we get a surprise FX move on what seems a secondary factor. Which is more important, eurozone PMI’s—already reported so now in the revision phase from the flashes—or inflation? And where does Greece come into it? Some analysts say they expect Mr. Draghi to speak of Greece at the press conference on Wednesday, but we guess he will be silent unless something new has occurred. He has already positioned himself as not wanting to steal any thunder or “make” any news. Instead he may trumpet that deflation is behind us, even if it’s only a tepid 0.2%, as forecast. Better than zero and certainly better than a negative.

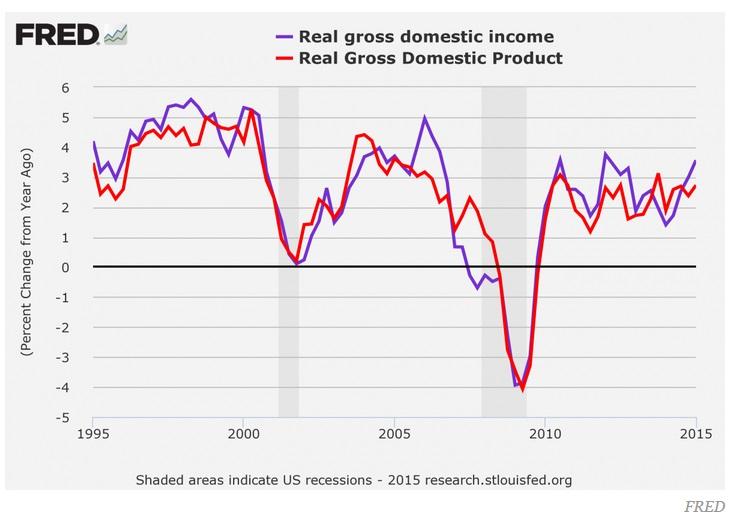

In the US, today we get the Chicago activity index and existing home sales. We also get personal in-come and spending for April, income forecast up a measly 0.3% and spending, 0.2%. The Institute for Supply Management reports the manufacturing PMI for May, expected at 51.8 from 51.5 in April. These are important numbers, to be sure, but we see two other issues: GDP and payrolls on Friday. Is the GDP revision behind us now? On Friday the Commerce Dept reported a Q1 contraction of 0.7% annualized, from the initial +0.2%. One way to get rid of troublesome data is to change the basis on which data is reported. This is exactly what the Commerce Dept intends to do. Starting in July, it will calculate GDP as an average of the old GDP, which measures spending, and Gross Domestic Income, or GDI, which includes wages, profits, etc. Theoretically, spending should equal income in the first place, but it doesn’t. GDI in Q4 was up 1.4% and 3.6% y/y, following a lovely 1.7% in Q4. On the year-over-year basis, Q1 would have been 3.1% if the new methodology had been in place. It looks like economists are embracing the new averaging process. See the chart from the Federal Reserve. The process is not as rad-ical as it sounds at first glance.

As for payrolls, we could just copy&paste the same sentences as last time and the time before. The fore-cast is now on the order of 220,000—ahead of the ADP private sector component forecast on Wednes-day—and the dollar will respond according to how close or far away from forecast the actual turns out to be. Remember that the dollar usually rises on the Wednesday ahead of payrolls, but not always (and not last month, either).

Traders are grinding their teeth over Greece, trying not to react much and not to over-react, either. This is not some new kind of self-control, just a realistic assessment of the situation. Greece keeps promising a deal, and officials on the other side keep saying the Greeks are blowing smoke. Poor Mr. Thomsen, the IMF’s European desk guy, who has to have a bodyguard. A payment of €300 million is due to the IMF on Friday, and funny, there is no talk today about combining the three IMF payments into one bundle that would be due on June 19, as LaGarde offered. Greece appears to be courting default with the inten-tion of blaming the institutions for being unfair, unreasonable and not respectful of democracy. In other words, there has been no progress at all since Syriza took power in January. Tspiras’ remarks in Le Monde are incendiary. Unless something new comes along, default is all but certain. Why this is not more euro-negative is a mystery. The absence of contagion to other countries, notably Spain and Italy, is well-accepted by now but default is still a very big deal. Perhaps the actual Event itself—outright default—will get a rise out of traders. It can’t be euro-favorable, at least not initially.

So, bottom line, it’s ours to lose—i.e., the market doesn’t cut the dollar any slack when it comes to data. It has to be good, or at least not too bad.

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.