Sterling Under Pressure as Another Brexit Delay Looms

Global stocks were mixed after a busy 24 hours of earnings, corporate news, and macro-economic news. In the past 24 hours, the market received quarterly earnings from companies like McDonald's, Chipotle, Lockheed Martin, and Snap. These results have generally been good. On corporate news, the market has received the resignation of Nike CEO, who will be replaced by the CEO of ServiceNow. ServiceNow CEO will be replaced by the former CEO of SAP. The market also received news that Softbank was doubling down on its disastrous investment in WeWork. On macro-economics, the market has received news from China, Hong Kong, and the UK. In Europe, Stoxx 50 declined by 5 points while DAX rose by 42 points. In the US, futures pointed to a lower open, with the Dow falling by 15 points.

Sterling remained under pressure after the decision by the UK parliament to slow the Brexit decision. While Boris Johnson got the vote he wanted, members voted to delay his calendar. Johnson wanted to rush the scrutiny of his deal to beat the October 31 deadline. The parliament’s vote means that the process could continue for more months. Meanwhile, data from the Office of National Statistics (ONS) showed that services exports declined as the UK’s trade with the EU declined. International services sales declined to $93 billion in the second quarter. This was a 2.1% decline from a year earlier. These numbers are particularly important to the UK because they represent a significant portion of the economy.

The euro declined slightly against the USD ahead of the important interest rate decision by the European Union. The bank is expected to leave interest rates unchanged even as the economy continues to weaken. Just this week, Germany’s Bundesbank warned that the country’s economy was probably heading towards a recession. The ECB has already pledged that it will restart quantitative easing in November. Still, the question is whether these measures will spur growth. In the past, ultra-low interest rates and QE did not do it. In fact, there is an argument that negative interest rates have hurt the EU economy because banks are afraid of extending loans to individuals. In fact, most European banks like Deutsche Bank and Commerzbank have underperformed their American peers.

EUR/USD

The EUR/USD pair started declining on Monday after reaching a high of 1.1180. Today, the pair continued to decline and is currently trading at 1.1115, which is the lowest level since October 17. On the hourly chart, the pair appears to be forming an inverted cup and handle pattern. The short and longer-term moving averages have already made a bearish crossover. The RSI has been on a downward trend. The pair will likely continue moving lower ahead of the ECB decision.

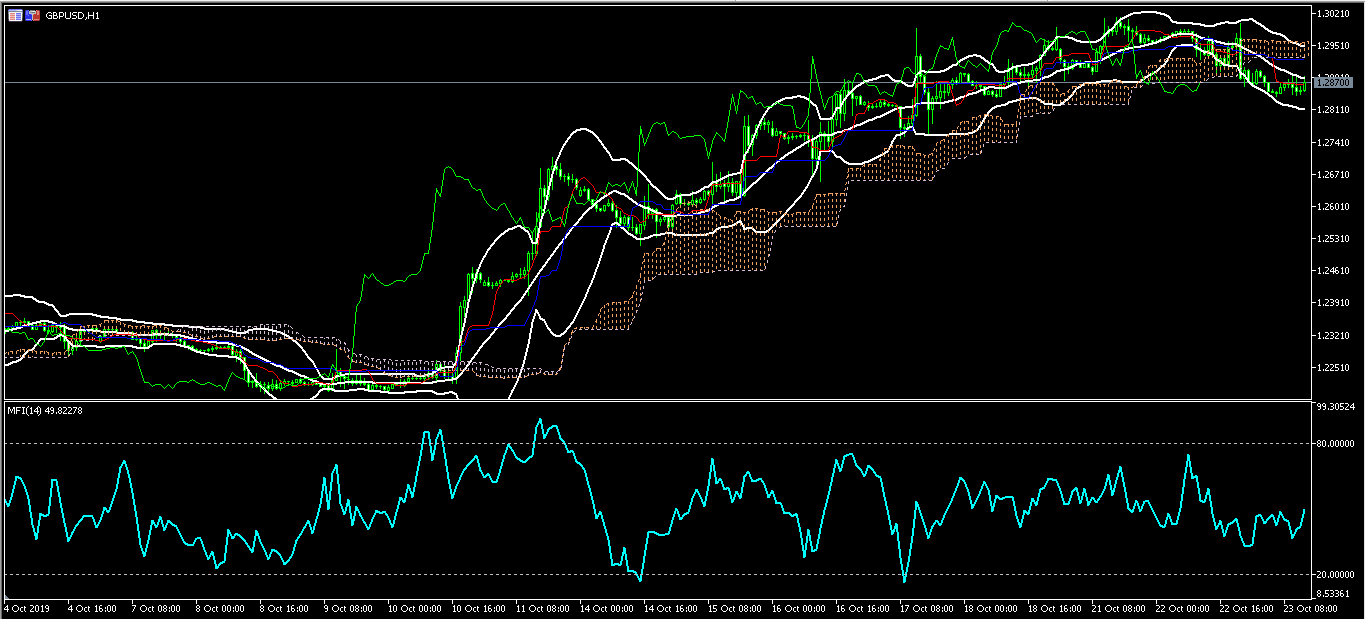

GBP/USD

The GBP/USD pair declined today after another vote implied that a delay on Brexit will be inevitable. As of this writing, the pair is trading at 1.2870, which is lower than the week’s high of 1.3010. On the hourly chart, the pair is trading along the middle line of the Bollinger Bands. The price is slightly below the Ichimoku cloud. The money flow index has continued to move sideways and is currently trading at the neutral level of 50. The pair will likely remain at the current levels in the American session.

US30

US30 futures declined slightly as the earnings season continued. As of writing, the futures are trading at $26720. This is lower than the monthly high of $27135. On the hourly chart, the price is slightly below the 14-day and 28-day moving averages and slightly below the important support of $26757. The price is slightly below the 23.6% Fibonacci Retracement level. There is a likelihood that the current downward trend could continue as the index tries to test the 38.2% Fibonacci level at $26,600.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.