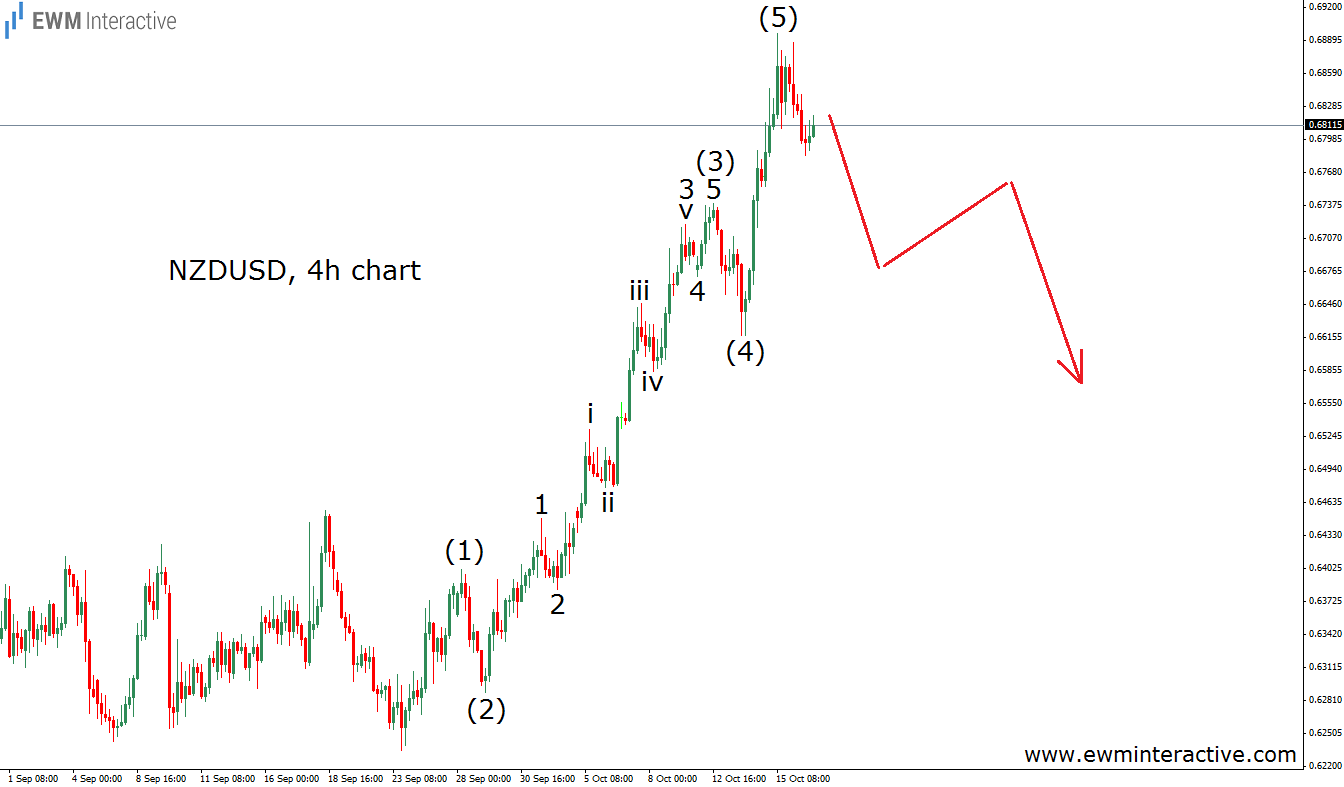

In our previous analysis on NZDUSD, titled “A Disappointing Week Ahead For NZDUSD?”, we shared our bearish view of the pair, saying that “buying NZDUSD now is the exact opposite to the right decision”. We thought so, because there was a clear five-wave impulse on the 4-hour chart. And, according to the Elliott Wave Principle, every impulse is followed by a three-wave correction in the opposite direction. See the chart below, if you need a reminder.

As visible, while NZDUSD was trading near 0.6810, we were preparing for a decline of around 200 pips. The next chart shows how the situation developed.

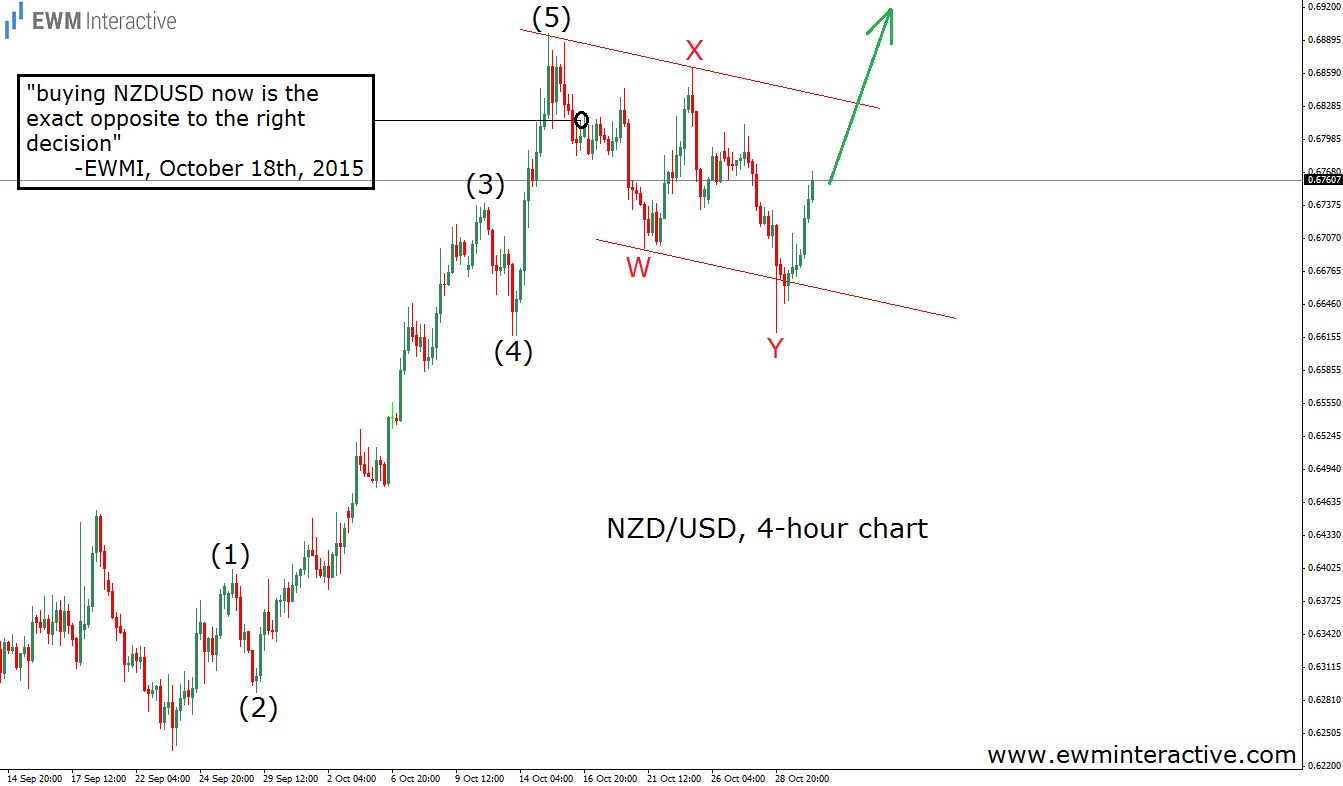

The correction we have been expecting, turned out to be a W-X-Y double zig-zag. Wave Y fell as low as 0.6620. NZDUSD gave us another example of the accuracy the Elliott Wave Principle often provides. But now what?

Now, when the anticipated correction seems to be over, the 5-3 wave cycle looks complete as well. This means the larger uptrend might be ready to resume. If this is the correct count, levels above 0.6900 should not be surprising. The bulls look eager to return to NZDUSD again.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD looks depressed ahead of FOMC

EUR/USD followed the sour mood prevailing in the broader risk complex and plummeted to multi-session lows in the vicinity of 1.0670 in response to the data-driven rebound in the US Dollar prior to the Fed’s interest rate decision.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

Bitcoin price tests $60K range as Coinbase advances toward instant, low-cost BTC transfers

BTC bulls need to hold here on the daily time frame, lest we see $52K range tested. Bitcoin (BTC) price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.