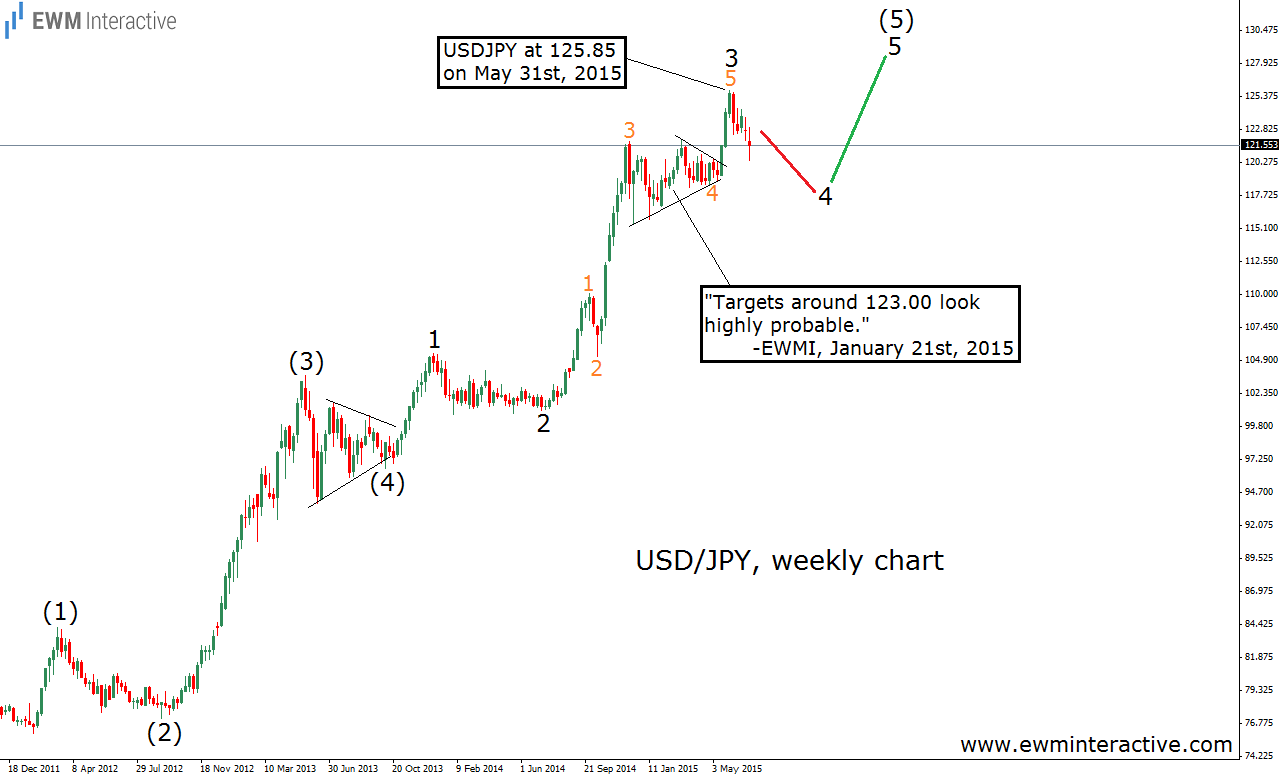

“USDJPY might lose another 400-500 pips in wave 4 of (5), before wave 5 of (5) to the upside begins. You might want to wait a while, before buying this dip.” This is an excerpt from “USDJPY Right On Track In 2015″, which we published on July 9th, 2015, when USDJPY was trading near 121.50. In other words, we were expecting the pair to visit the area between 117.50 and 116.50. The chart below shows how the forecast looked like back then.

Soon as the article was published, the pair rose to 125.28. However, the top 125.85 was never touched. Instead, USDJPY started falling as expected. On August 24th, the “Black Monday”, the dollar plunged to as low as 116.15 against the Japanese yen. This is 35 pips beyond our second target. Not bad at all. The Elliott Wave Principle proved its value once again. An updated chart is given below.

By the way, note where the recent sell-off in wave 4 of (5) ended – precisely at the 38.2% Fibonacci retracement level. It turns out the market is mathematically organized, even in the panics, huh?

From now on, USDJPY should continue higher in the face of the anticipated wave 5 of (5). Naturally, the bulls are supposed to take the pair above the previous high of 125.85, unless a truncation occurs.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.