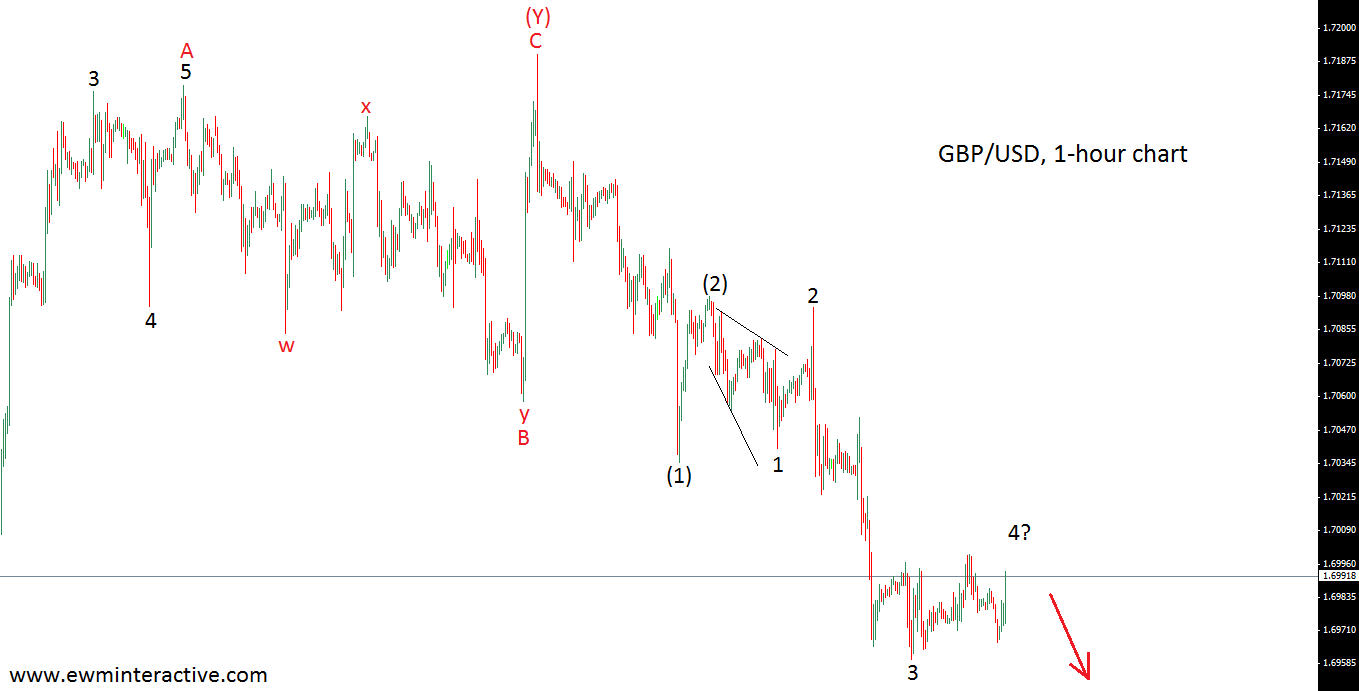

On July 14th we published an intraday analysis of GBPUSD, titled “GBPUSD with one last move to the north”. In that piece of material we were expecting a thrust in wave C to the upside from a presumed wave B triangle. “Once the triangle is finished, we will be expecting GBPUSD to reach 1.7200 in wave C. GBPUSD should not go above 1.7225″ These assumptions were based on the chart below.

Now, 15 days later, we can say that the triangle failed, but the rest of the forecast went quite well. Instead of a triangle, wave B developed as a double zig-zag labeled w-x-y. When it was completed, GBPUSD resumed its uptrend, leading prices as high as 1.7190. Once this level was reached, the pair started declining just as we expected and is now trading below 1.70. The next chart will visualize all these explanations for you.

In conclusion, GBPUSD has been going according to plan so far. Furthermore, prices did not reach 1.7225, which means that our big picture scenario remains valid.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.