Daily Forecast - 07 March 2016

Eurostoxx March Contract

EuroStoxx below 3030 adds pressure & targets first support at 3000/2995. A break below 2990 targets 2980 & as far as the best support of the day at 2970/65. Although the longer term outlook is more negative a low for the day is likely here. However a break below 2950 is a sell signal & targets 2930/25. If we continue lower look for 3 week bull trend line support at 2910/05. This is the last line of defence for bulls this week.

Important resistance again today at late January high at 3055/60 & strong longer term trend line resistance at 3065/70 in severely overbought conditions. **TO REPEAT: There is a very high risk this area sees an end to the bear trend recovery.** Shorts need stops above 3090. Bulls really need a close above 3100 to feel more confident longer term.

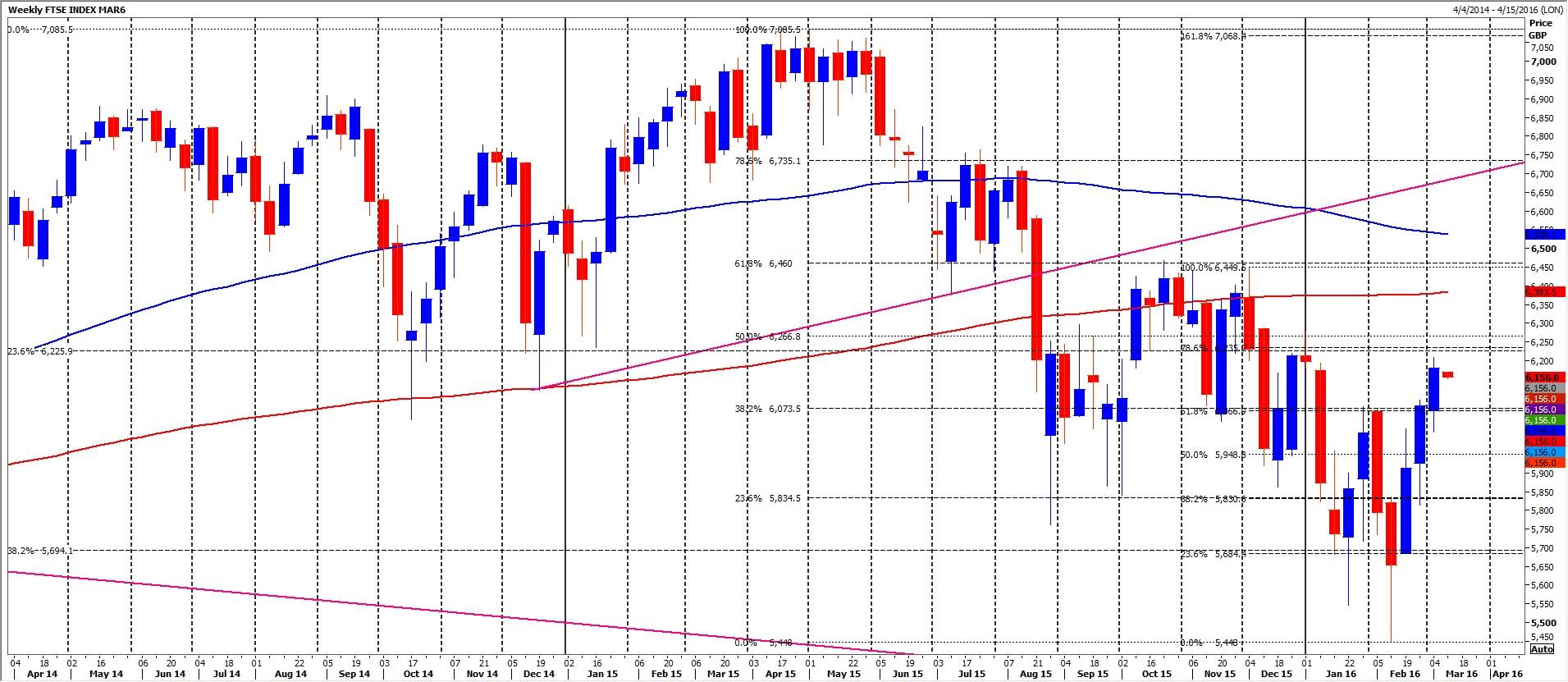

Ftse March Contract

FTSE outlook turning more negative & holding below 6160 targets first trend line support at 6145/40 but 6120/15 is the most important support of the day. A bounce from here is possible on the first test perhaps but be careful. Longs need stops below 6095. A break lower is a sell signal & targets 6080/75 then support at 6060/55.

Again strong trend line resistance at 6205/10 with a good chance of a high for the day. We have further strong resistance at 6225/35 so there is a big risk that the bear trend recovery ends here. However if we continue higher look for further strong 200 day moving average resistance at 6270. Many obstacles for bulls in severely overbought conditions.

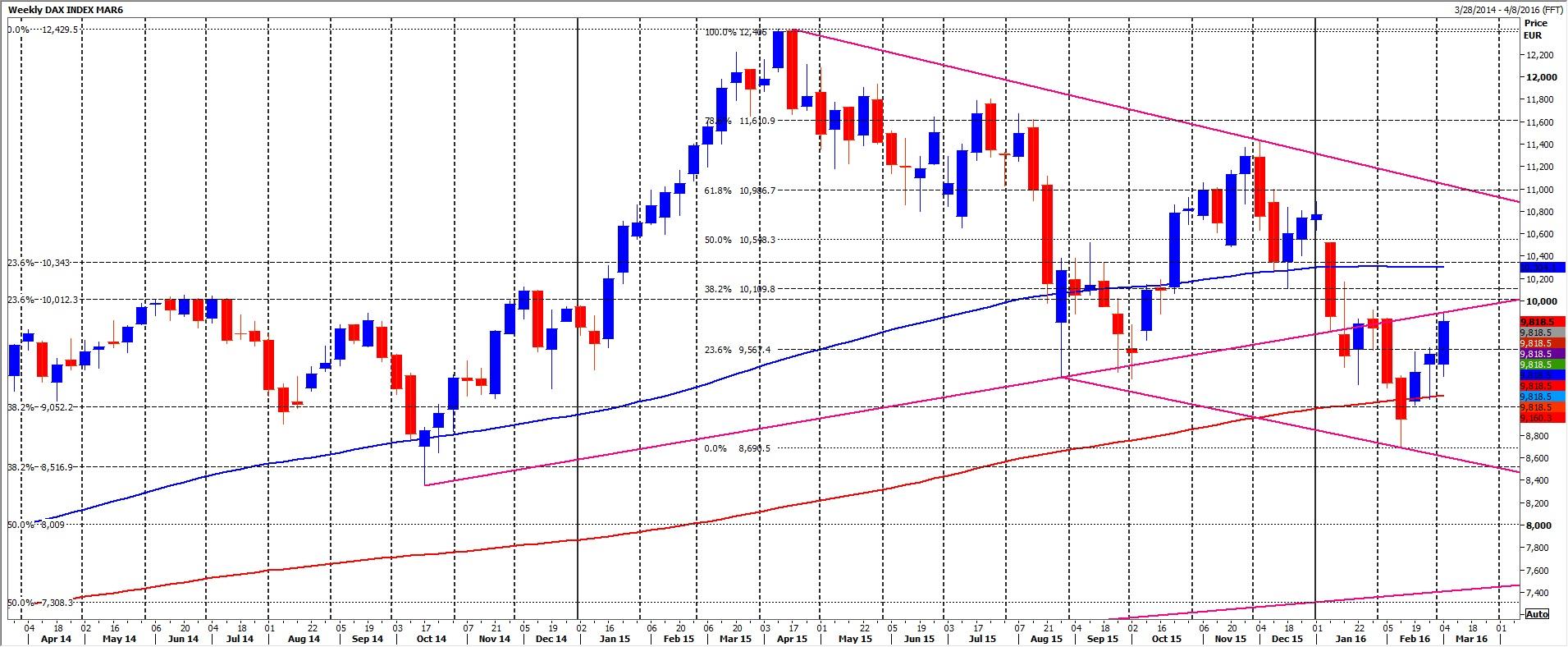

Dax March Contract

Dax hit our target & strong longer term trend line resistance at 9890/9900 & topped exactly here, as predicted. TO REPEAT: **This may signal a high for the bear market recovery.** This trend line resistance moves up a little to late January highs at 9923 but it is only a daily close above 10000 that could put bulls back in short term control. We could then target 10050/60 & but strong resistance at 10100/110 is the next target where the bear market could resume. Even above here we meet the 100 day moving average at 10200, another big obstacle.

Below 9800 adds pressure & targets first support at 9720/10. A break below 9680 signals further losses to best support for today at 9615/05. A low for the day must be seen or bears are likely to feel far more confident again. A break below 9580 triggers stops & targets minor support at 9510/05 then 9450/40.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.