- S&P 500 index printing fresh highs day after day on 2021 recovery hopes.

- Eyes for the week ahead will be on the US Senate, the FDA and Europe.

In last week's forecast, Investors getting set for the Santa Clause rally built on a house of cards, it was discussed whether the so-called “Santa Claus rally” will show-up this year.

Well, we have seen fresh highs from one day to the next since, and despite a dismal US jobs report on Friday, Wall Street's main indexes rose to all-time highs again.

Despite the house of cards that the stock market has been built upon, markets are staying optimistic about the global economic outlook in 2021.

Nevermind data showing the slowest US jobs growth in six months, investors' expectations for a new fiscal relief bill to help revive the coronavirus-hit economy seemed to trigger the positive response.

The Labor Department's closely watched Nonfarm Payrolls report showed nonfarm payrolls increased by 245,000 jobs in November, below economists' expectations of 469,000 jobs and the smallest gain since the labour recovery started in May.

So-called "cyclical" stocks seen as particularly sensitive to the economy shined as most S&P 500 sectors rose.

While, there is undeniably a lot of slack in the system, when it comes to core inflation and the underlying drivers, to wage costs etc, it could take several years really to come back.

However, in an environment whereby growth returns due to a vaccine and inflation stays relatively muted, investors are banking on central banks continuing to support the recovery.

The expectations that growth will be returning and inflation rising but staying below central bank targets has been founded on a recent slew of positive vaccine results with efficacy rates exceeding expectations.

These point to a significant boost for growth in the second quarter of 2021.

The S&P 500 entered December up 12.1% for the year, a feat that’s especially remarkable given the benchmark’s 34% plunge into a bear market on February and March.

Stock prices have rebounded even while the pandemic has worsened more recently because investors know that tightening is still far out. That means that the S&P 500 could well surpass the 4,000-point mark.

December historically is one of the strongest months for the stock market, with the S&P 500 posting average gains of 1.3% since 1928.

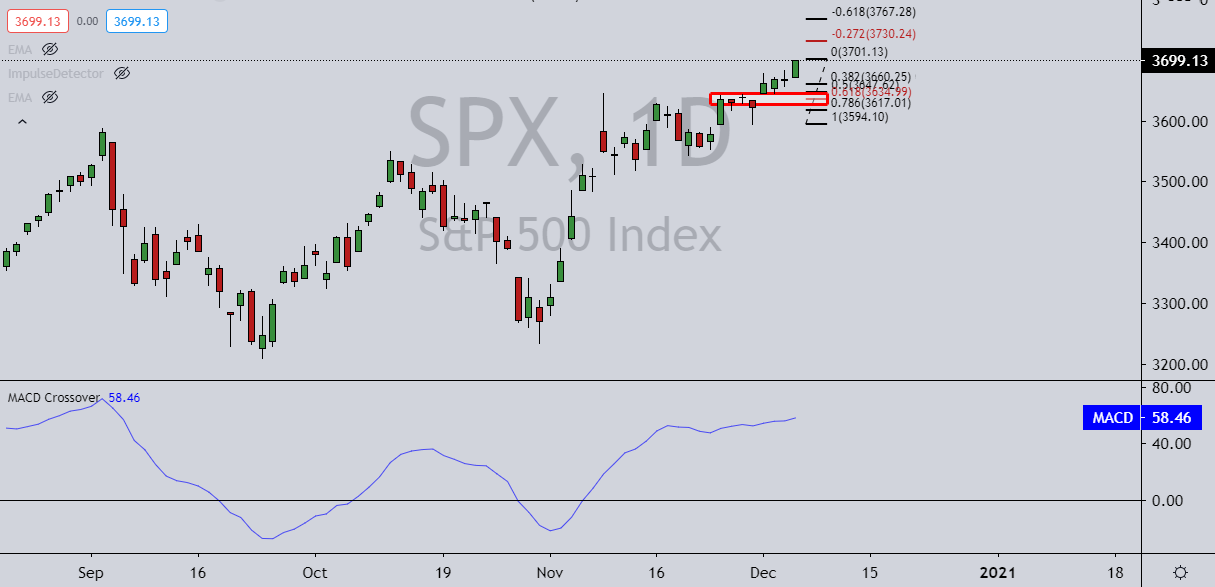

We have already seen a 1.5% rise for the start of the month. A healthy correction could be on the cards though. See the chart below.

Covid cases on the rise

Following the Thanksgiving weekend, expectations for increased numbers of covid cases have risen.

Dr Anthony Fauci, the nation’s top infectious disease expert, had already warned of “a surge upon a surge,” especially amid cold weather and the all-important holiday shopping season.

However, Wall Street has seemingly shrugged off the pandemic in recent weeks, focusing instead on promising reports about a vaccine.

So, rather than focussing on the poor economic numbers, for the week ahead, markets will not only be watching out for progress on the $908 billion bi-partisan stimulus bill in the US Senate, but also whether the Food and Drug Administration, FDA, approves the Pfizer/BioNTech vaccine when it meets on Thursday.

Progress on both of those is good for risk assets and the S&P 500 index.

Bi-partisan stimulus bill in the US Senate

House Democrats are no longer holding out for a $2 trillion+ package.

Analysts at TD Securities explained that Speaker Pelosi has endorsed a bipartisan $0.9 trillion plan. ''Senate Republican leaders are still suggesting around $0.5-0.6 trillion, but a deal looks within reach. Even so, FY21 stimulus will be smaller than FY20 stimulus, implying fiscal drag.''

Meanwhile, Politico argued this weekend that Congress is likely to pass a one-week stopgap spending bill to avert a shutdown at the end of this week.

This would be a relief for markets as it will give negotiators more time to figure out what they are going to do with government funding on a longer-term basis

Super Thursday

Meanwhile, next week is also going to be about Europe.

We have "super Thursday" coming up which includes a European Central Bank meeting (where a QE expansion is widely expected) and an EU summit.

A top-up and extension of the Pandemic Emergency Purchase Programme are widely expected.

''We don't expect agreement on Recovery fund (RF) and Multiannual financial framework (MFF) to be reached at this meeting due to tensions with Hungary and Poland over the 'rule-of-law' clause,'' analysts at TD Securities argued.

The analysts added, ''although Poland softened its stance somewhat, we still think agreement this year is unlikely. If a Brexit deal is done, leaders might sign off at this meeting.''

There are credible threats to write Poland and Hungary out of the EU Recovery Fund, even if it means shifting to emergency budgets in January, which could be enough to secure a compromise here.

Either way, it could be good for US stocks, as to whether we will see the end of negotiations on both of the Recovery Fund and Brexit or not.

On the one hand, a positive outcome on conclusions would be a driver of risk appetite in general.

On the other hand, delays to either front should drive investment into the US.

A light US calendar

The US data calendar will be light after the nonfarm payrolls release.

There will be the focus on November’s small business optimism index (NFIB), November Consumer Price Index and the December University of Michigan data including consumer sentiment and inflation expectations.

On the US Consumer Price Index, the analysts at TD Securities explained that COVID has had positive as well as negative effects on inflation, but they strongly believe the net impact is and will continue to be disinflationary.

''That certainly has been the pattern, and we don't expect any major new signal from the November data. Our forecast implies 1.1%/1.5% YoY for total/core prices, down from 1.2%/1.6% YoY in Oct and 2.3%/2.4% YoY in Feb (pre-COVID).''

SP 500 Index daily chart

The market is blue skies above the structure, 3,644, and bearish below it.

A 61.8% Fibonacci retracement aligns with the structure which is expected to hold initial tests if there is a pullback to it.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.