So how about a ‘K’ shaped recovery?

Bloomberg had an informative post-mid-week that replaced the idea of the dialogue between a ‘V’ or ‘U’ shaped recovery with the idea of a ‘K’ shaped recovery. The piece was highlighting that there is a two-tier recovery going on at the moment. This ‘two pathway’ road to recovery has a higher rate of recovery for the richer nations than the poorer ones. A Bloomberg study found that the stocks and currencies from wealthier nations are actually outperforming poorer emerging market peers as nations attempt to cope with COVID-19. It is a classic example of the ‘haves’ vs the ‘have nots’ in the global economy.

A Bloomberg study made up of 17 emerging markets found that there was a correlation of 42% between GDP per capita and stock performance since the risk sell-off began in January of this year. The study found that the correlation between GDP per capita and currency returns was 31%. In simple terms, the wealthier nations are recovering at a quicker pace than the less wealthy nations.

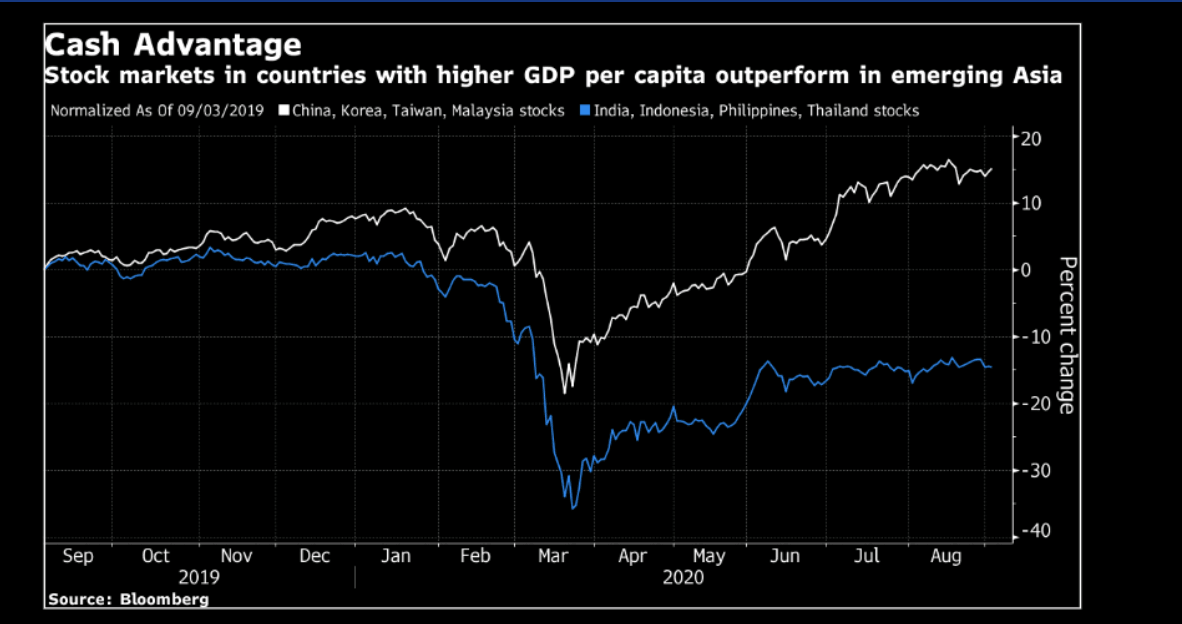

Take a look at this Bloomberg chart below as this illustrates the point visually:

Furthermore, the rich and poor divide was found to be most pronounced in Asia. The stock returns from the four economies per capita GDP above $10000 last year (China, S.Korea, Taiwan, and Malaysia) are 20% above that of other nations that fall below that level including India, Indonesia. The Philippines, and Thailand. Part of the reason for this divergence is also due to the presence of more tech companies in the first list of countries. However, it has also been down to other factors. Such as the fact that more affluent countries have had the benefit of being able to use advanced technologies, have strong governance, and can access a wider range of policy options to cope with the crisis.

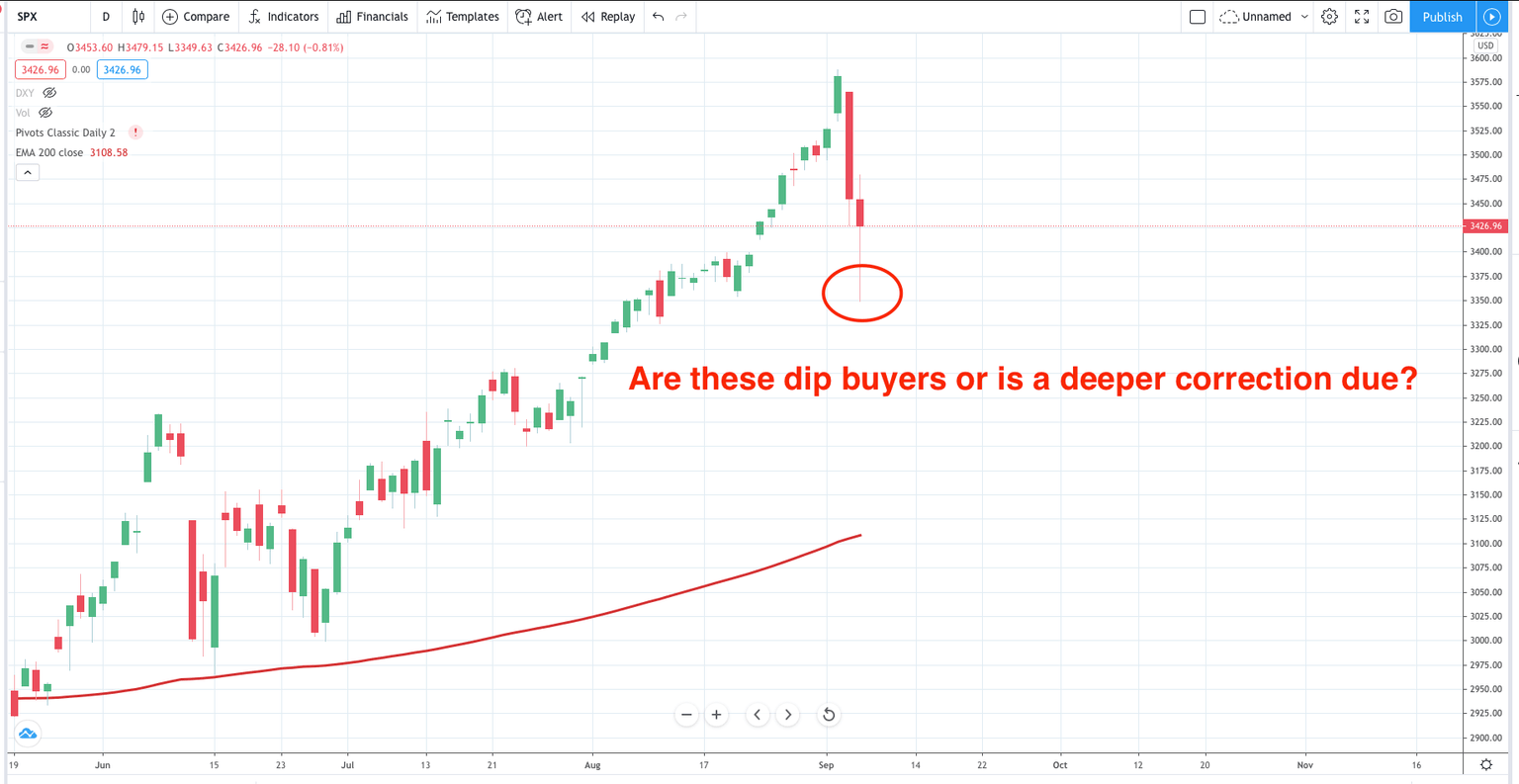

Will this mean that the most developed nations will witness buying on the dips on any stock falls?

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.