In line with Gold analysis, I have a bull and a bear wave count for Silver. Price will tell us which one is correct, but before that happens structure and volume will indicate which is more likely.

Bull Wave Count

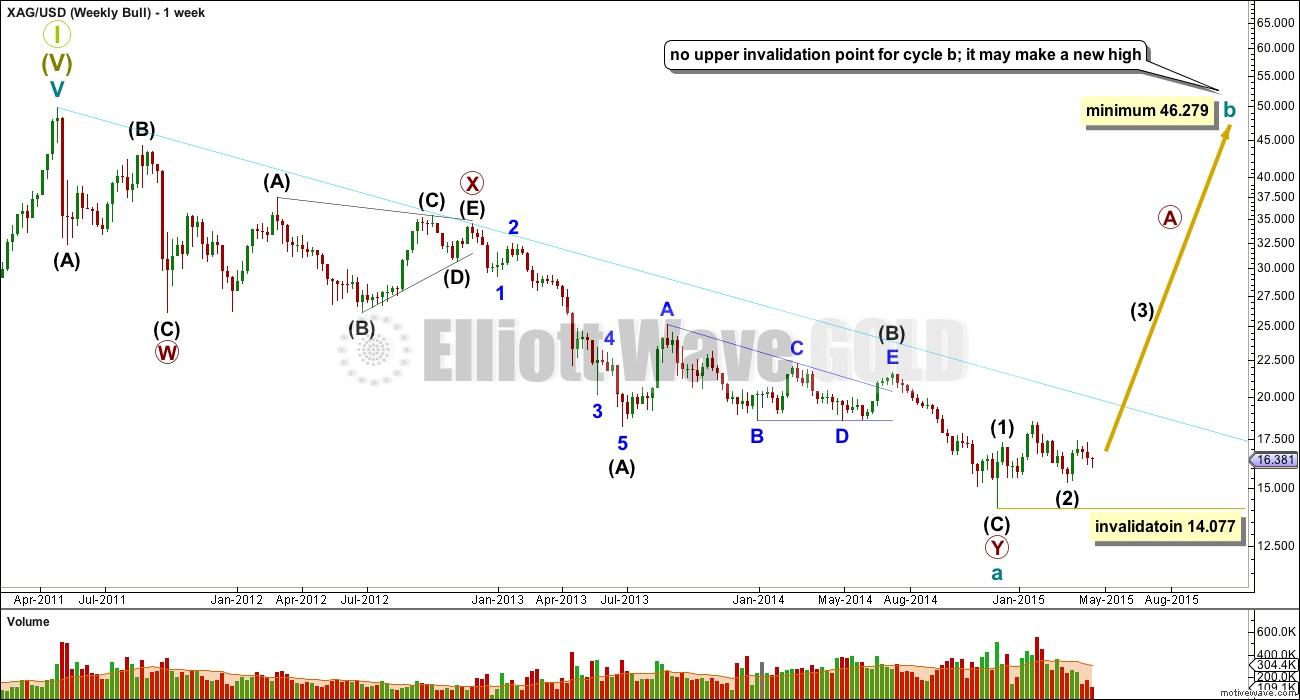

If cycle wave a is over and Silver, Gold and GDX have all recently seen cycle degree trend changes, then importantly for Silver cycle wave a subdivides as a double zigzag.

A double zigzag is a multiple, and the maximum number of corrective structures in a multiple is three. Any wave count which labels W, Y or Z as W-X-Y within them is invalid. W, Y and Z waves may only be simple corrective structures labelled A-B-C (or A-B-C-D-E in the case of a triangle).

Super Cycle II may not be a multiple and must be a flat correction. Within a flat correction the A wave must be a three, and a double zigzag is classified as a three.

Within a flat correction cycle wave b must retrace a minimum 90% the length of cycle wave a at 46.279.

Within a flat correction cycle wave b may make a new all time high above the start of cycle wave a, as in an expanded flat.

The most likely structure for cycle wave b to take price that high is a zigzag.

If cycle wave b is unfolding as a zigzag then within it primary wave A should be a five wave structure, either an impulse or a leading diagonal.

I have adjusted the wave count of intermediate waves (1) and (2) to see intermediate wave (1) as a five and intermediate wave (2) as a double combination.

If intermediate wave (1) is a five then primary wave A may be an impulse. This fits better if cycle wave b is to be a zigzag.

At 22.485 intermediate wave (3) would reach 2.618 the length of intermediate wave (1). Intermediate wave (3) may only subdivide as an impulse. Within it minor wave 1 looks like a five on the daily chart. Minor wave 2 may or may not be over. If it continues lower it may not move below the start of minor wave 1 below 15.296.

A new high above 18.486 would invalidate the bear wave count and provide confidence in this bull wave count.

Bear Wave Count

This bear wave count is identical to the bull wave count up to the end of the triangle for intermediate wave (B) within the second zigzag of primary wave Y.

Thereafter, it looks at the possibility that intermediate wave (C) within the zigzag is not over.

Within intermediate wave (C) minor wave 1 fits as a five better than the bull wave count. Minor wave 2 now though looks to be too large on the weekly and daily chart.

Within minor wave 3 no second wave correction may move beyond the start of its first wave above 18.486.

At 11.52 intermediate wave (C) would reach 0.618 the length of intermediate wave (A). At 5.309 intermediate wave (C) would reach equality in length with intermediate wave (A).

I have drawn a base channel about minor waves 1 and 2. Price continues to find resistance at the upper edge of the base channel.

The biggest problem with this bear wave count today is the base channel. It is difficult to see minute wave ii over at the high labelled minuette wave (a) because this upwards wave looks so much like a five wave impulse on the daily chart. For this wave count minute wave ii should continue, but that means it will breach the base channel drawn about minor waves 1 and 2, one degree higher.

It is also possible that my conclusion that minuette wave (a) is a five wave structure is wrong because this upwards movement may have been a zigzag multiple. A new low below 15.296 would indicate that this is so, and at that stage I would expect minute wave ii was over and minute wave iii within minor wave 3 down may be underway.

Minute wave ii may not move beyond the start of minute wave i above 18.486.

Since the end of minor wave 2 at 18.486 it is down days which have the highest volume. This may indicate that the trend remains down. This slightly favours the bear wave count.

The ADX level is low (below 20) and declining, indicating the market is in a consolidation phase, not trending. This indicates that although price is below the 20 day EMA the trend is not necessarily clearly down, the signal may be false. MACD is close to zero indicating a lack of momentum. This fits a wave count which sees Silver as within a second wave correction at this time.

Our service is educational, we aim to teach you how to learn to perform your own Elliott wave analysis.

Recommended Content

Editors’ Picks

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.