Polish Zloty (EUR/PLN) – no reaction despite strong impulses

We had high hopes for this week and they did materialize. Mario Draghi moved markets during his press conference despite the fact that no new easing measures were proposed by the ECB. The NFP report, as usual, increased volatility on the currencies markets. Still, emerging market currencies remained stable and we have to wait for major moves. In Poland the week started with a strong Manufacturing PMI report. “Strong” means the index is back at over 50 points, currently being 51.2, which was higher than expectations. No reaction on the Zloty market was understandable as on Wednesday the MPC was expected to cut interest rates by 25bp from the current 2.00%. It did not! Now, that was a shocker, especially, taking into account the fact that the central bank expects GDP growth and inflation to remain low for all 2015. I believe leaving interest rates unchanged is a mistake. Sure, if the Polish MPC could ease monetary policy in some other way, then the cost of money would not matter so much. The problem is the central bank is known to be very conservative so we cannot expect it will introduce any kind of local LTRO or bonds buyback program. Would interest rates be cut in December as a Christmas present? Now it is hard to predict though it seems the MPC will not do any sudden moves just before year-end. Surprising was the reaction of Zloty – no sudden appreciation happened although the forecasted 25bp cut has already been discounted by the market. This can only be explained by the falling EUR/USD and the weakness of the common currency.

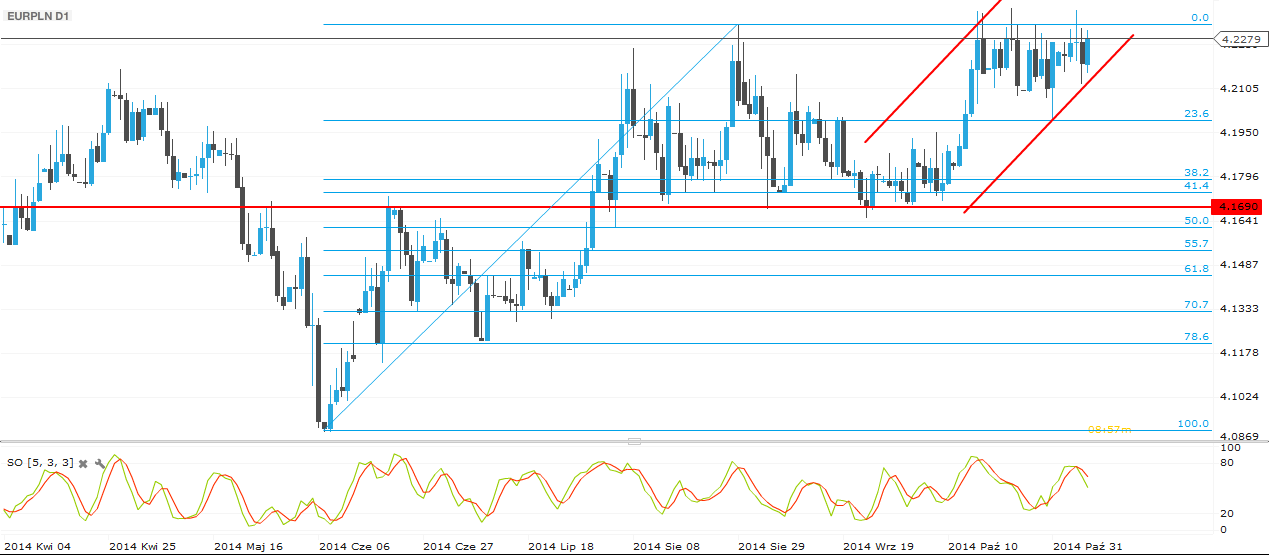

On the daily chart we see the same picture we have been observing for the last couple of weeks. The EUR/PLN is unable to break from the 4.20 – 4.23 range it has been trading. Nothing has changed since the last analysis meaning the crucial resistance remains 4.23 while the support is at 4.20. Breaking any of those should trigger a move towards 4.25 or 4.17.

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – Attracted by weekly trendlines

The ECB press conference was distressing for the euro, but it gave a chance for the HUF to get stronger – decline even under 309 against the Euro. Next week will be calmer for the Euro, only the GDP and inflation numbers can cause some action. This means that those traders who are long the HUF could be in trouble. The debate in connection with the internet tax is getting quieter, but there are many problems and objections with the 2015 budget of Hungary. The Prime Minister, Viktor Orban, said that he would like to abolish the trend, in which the state spends more than it earns. It is a harbinger of a strong limitation. More about politics: news revealed about high ranked Hungarian officers, that their presence in the U.S is undesirable. This does not the international risk assessment of Hungary.

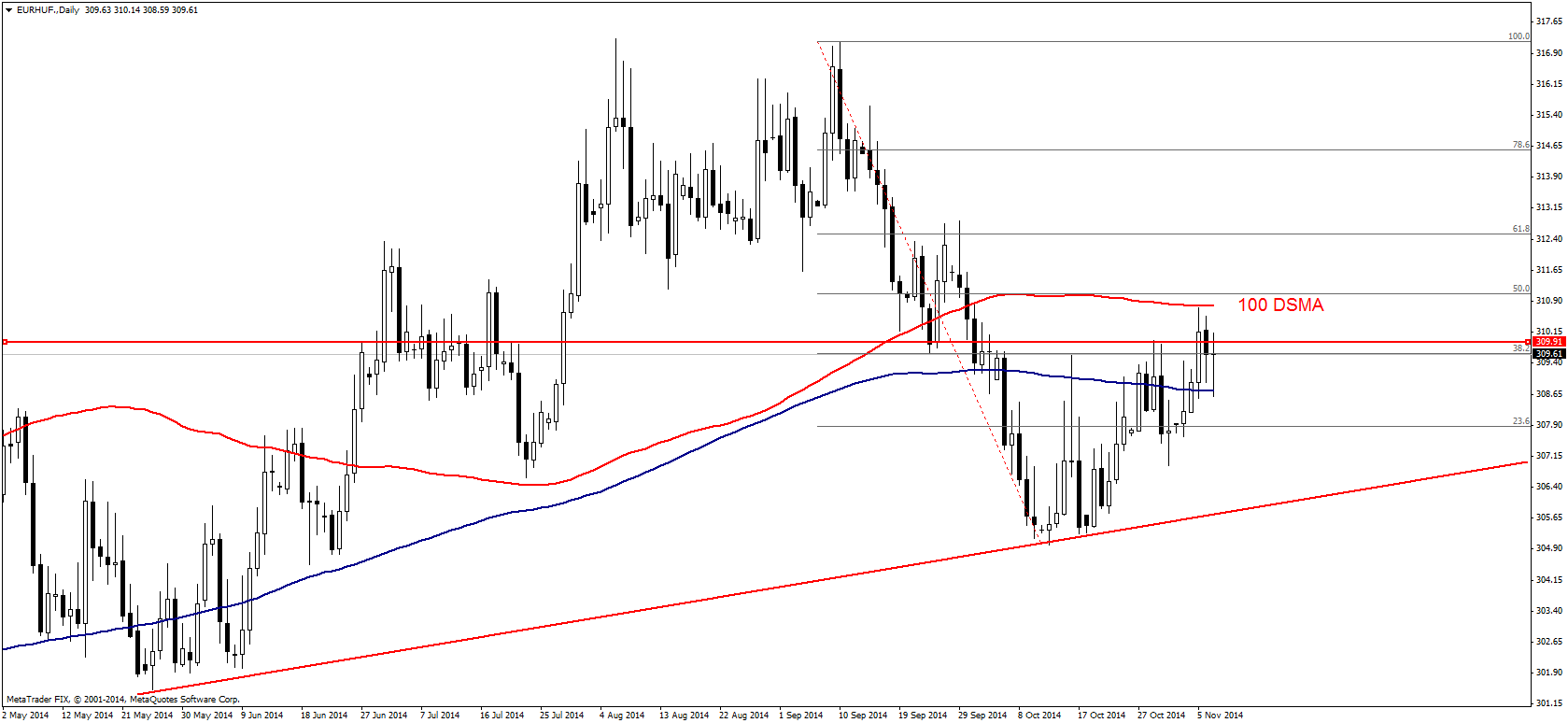

The CPI, GDP and industrial output numbers can ruffle the standing water next week, but as we can see, the HUF might not appreciate much. The mixed, mostly negative mood of investors also sticked to the Hungarian parquet. From the technical perspective, weekly trendlines are important, where the 100 and 200 daily EMA-lines are. We can see rising tops and bottoms in a linear regression channel, we have this uptrend since 17th Oct. Anyways, on the USD/HUF pair we reached 250, which can indicate an attempt from the short-traders, trying to bring to the fore the HUF again. We should focus on the resistance and support levels- 310 caused a strong indecisive situation, but also it is a strong resistance.

Pic.2 EUR/HUF H4 source: Metatrader

Romanian Lei (EUR/RON) – If so says the Governor...

The National Bank cut the interest rate to 2.75% and also reduced the minimum reserve requirements for foreign currency deposits to 14% from 16%. What is more, the communication indirectly supports a further decline of the currency, as the governor said the currency is around where it should be and he does not think it would be good to see the currency gain. ”In my mind I do not see a stronger Leu (ahead)”. He also added that there is more room for maneuvering, implying rates could go even lower. The new range for EURRON seems to be above 4.42 but below 4.45 for the week ahead. On the macro front, industrial production data posted a 18.3% increase, with a larger than estimated jump in new orders by 34% m/m. There is however a large question mark over the deficit target in 2015, as the EC estimates it would increase de 2.8% of GDP unless fiscal retrenching or tax raises are implemented. The gradual slide of the RON may continue even as the Ukraine tensions regain attention.

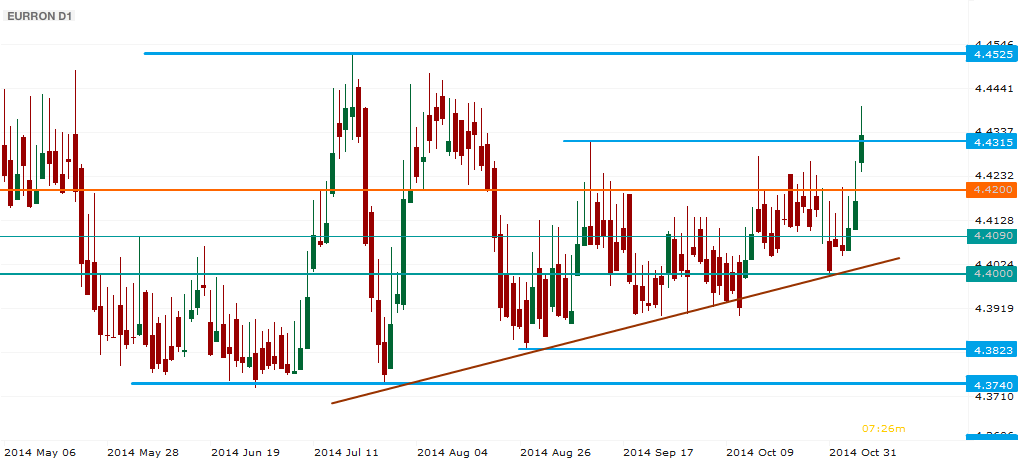

From a technical analysis perspective, the uptrend is gaining momentum. While the 4.4315 area is not yet breached on a closing basis, that may be a matter of days. Further resistance ahead at 4.4525 looks stronger, but this previous high is not invulnerable either. The downtrend line meets the round 4.5000 level to build a stronger barrage, but that may be only tested on a larger timeframe. Support is at 4.4200 and 4.4050, around the rising trendline.

Pic.3 EUR/RON D1 source: Metatrader

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.