Polish Zloty (EUR/PLN) – MPC leaves rates unchanged

The MPC has not surprised the markets and left interest rates unchanged at 2.5%. That was expected. What was interesting was the fact it was the first meeting after the tape recording scandal was revealed. To remind you, MPC’s governor, Marek Belka, is discussing the possibility of the central bank helping the ruling party to fight the budget deficit before the upcoming elections but he wants the then-current Minister of Finance (Jacek Rostowski) out. Of course, during the press conference following the decision, Belka had to answer questions about the scandal. I think he is doing pretty fine, despite the fact the recorded discussion is scandalous. I also believe that the central bank will not be much affected as it will remain independent and the Polish economy is doing fine enough. What will affect the Zloty will be the upcoming macro data. The MPC dropped its forward guidance and its monetary policy will be driven by the published macro data (inflation!). During the press conference, Belka also stated that the MPC will not cut interest rates in September. Of course, till the end of the year it can happen, depending upon how the situation develops. I believe this is the wrong approach because we can experience a déjà vu: the MPC reacting to what has already happened instead of looking at projections.

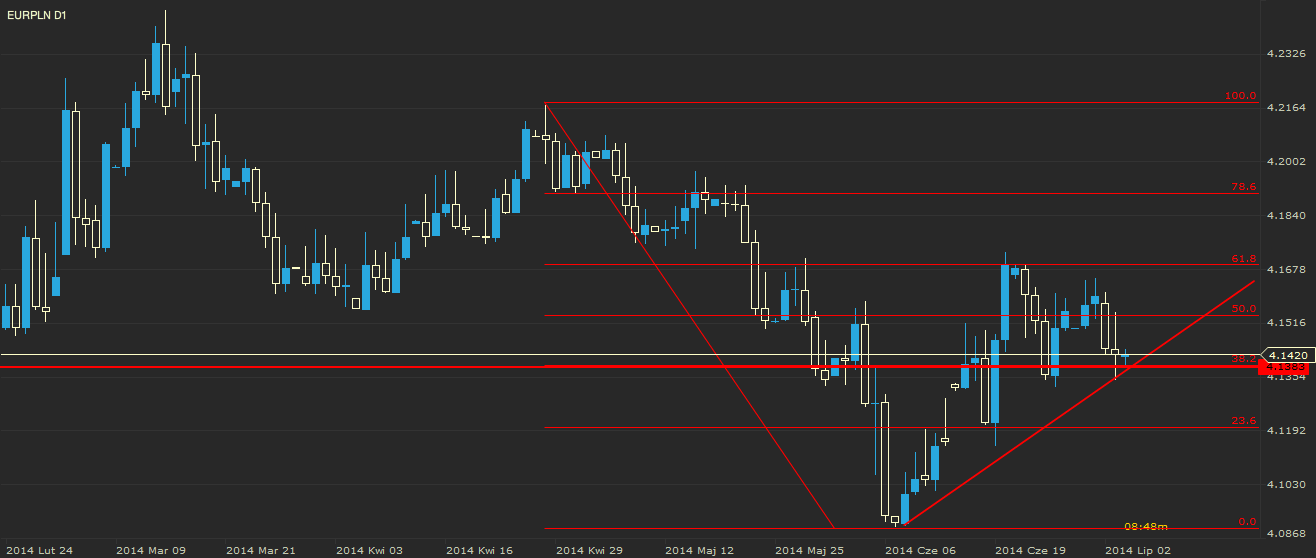

As we see on the daily chart, the EUR/PLN was unable to attack the 4.17 local highs. It collapsed after reaching the weekly high of 4.1650. The corrective movement pulled it down to the 4.1350 support (38.2% retracement of the last downward move). Breaking it would make PLN bulls target 4.12 next week. Although at the beginning of next week I expect a spike towards 4.15. From there we will see if the EUR/PLN has the power to attack the resistance levels.

Pic.1 EUR/PLN D1 Chart

Hungarian Forint (EUR/HUF) – further easing from the NBH

After last week’s interest rate cut, the National Bank of Hungary hinted it might not stop there. Analysts though, see limited scope for further rate cuts. We do not need to say how big impact it has on the Forint market. The Hungarian currency touched its April lows against the Euro and the fundamental background indicates further depreciation. FX loans news and government communication regarding the debt relief package also ”killed” the Forint buyers in the past couple of weeks. The current standing is that foreign currency mortgage debts should be converted below market exchange rates - said Antal Rogán, party whip of Hungary's governing Fidesz party. Rogán also said on public TV - "Banks now have to face the fact that they were not playing it fair with clients." Government would phase out FX loans and share the relief package cost between the clients and the banks by the end of the year. "Banks should calculate how much they have overcharged debtors through, for instance, one-sided modifications to loan contracts", the Economy Minister, Mihaly Varga said. This is a touhg situation for bank and Erste already has issued a lower profit warning. The bank’s management sees more risk costs from EUR 1.7 billion to EUR 2.4 billion due to massive losses in Hungary and Romania and because of FX Bailout of course.

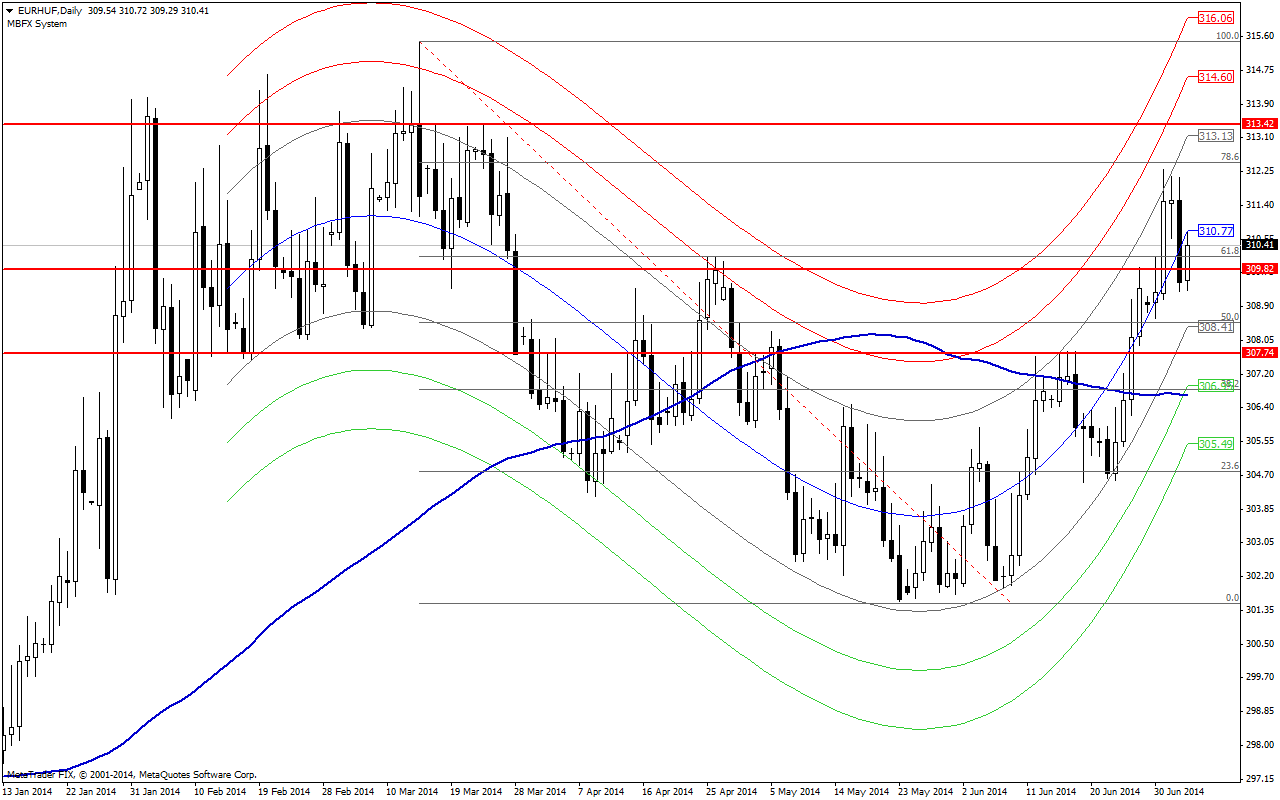

Inflation data is going to be published next week and we all know the values are moving close to 0 in Europe. This publication will be closely followed by traders to see if Hungary follows this trend. Technically, Euro bulls could hit the March highs at 313 but they have to keep in mind the 310 support zone, which exactly a 61.8% fibo level on the daily chart. If 310 is broken, the market will target 307.

Pic.2 EUR/HUF D1 Chart

Romanian Leu (EUR/RON) – Balancing act gets easy, but just for now

GDP in Q1 in Romania was revised higher to 3.9%, retail activity jumped by 1.9% in May, but, unemployment rate increased to 7.3% and producer prices fell by 0,3% m/m. The National Bank chose to keep rates at 3.5%, a juicy level for the yield-desperate Eurozone funds, and surprised mildly by cutting the minimum reserve ratio for foreign currency deposits to 16%. The intention is double: facilitate lending in Euros, an area that has been contracting lately, and move towards the ECB levels (1-2%). One effect that must have been unintentional is the weakening of EUR/RON through repatriation of some of the liberated reserves, though the volume is not significant, amounting to some 0.4 bn EUR. The general investor sentiment would be key in favoring further RON strength ahead, seemingly the natural path for the market.

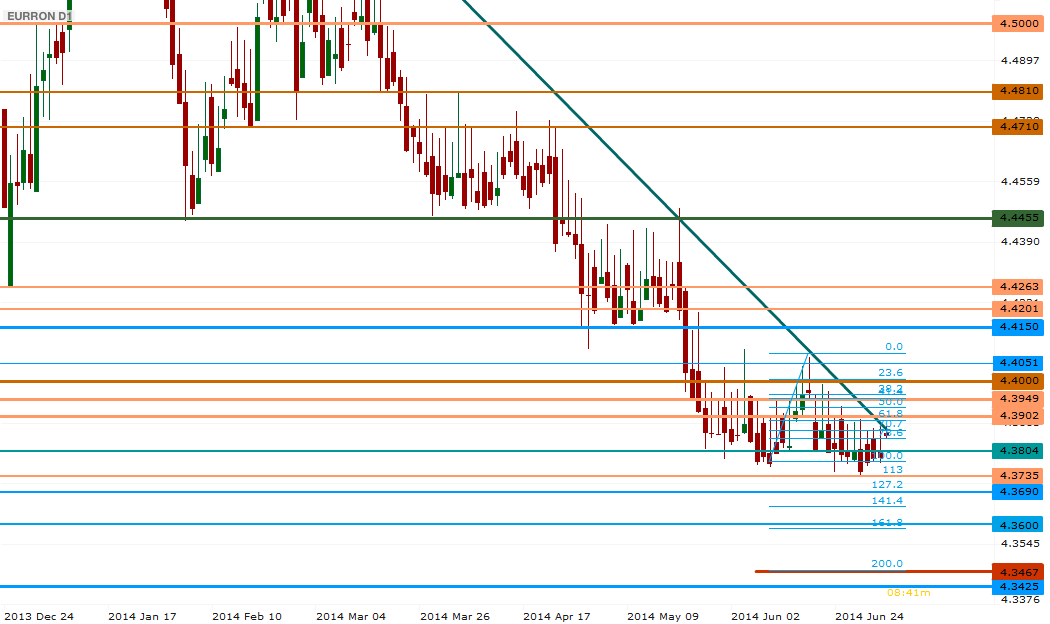

Technical analysis clearly provides a lateral move, with a continuation ”feeling” that may lead to a break below 4.38 possibly next week. Interim levels are 4.3735 and 4.3690, but a decent support comes in around 4.3600. The upside is favored temporarily on a close above 4.3902, but libertion for the bulls arrives only above 4.4000.

Pic. 3 EUR/RON D1 Chart

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD looks depressed ahead of FOMC

EUR/USD followed the sour mood prevailing in the broader risk complex and plummeted to multi-session lows in the vicinity of 1.0670 in response to the data-driven rebound in the US Dollar prior to the Fed’s interest rate decision.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

Bitcoin price tests $60K range as Coinbase advances toward instant, low-cost BTC transfers

BTC bulls need to hold here on the daily time frame, lest we see $52K range tested. Bitcoin (BTC) price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.