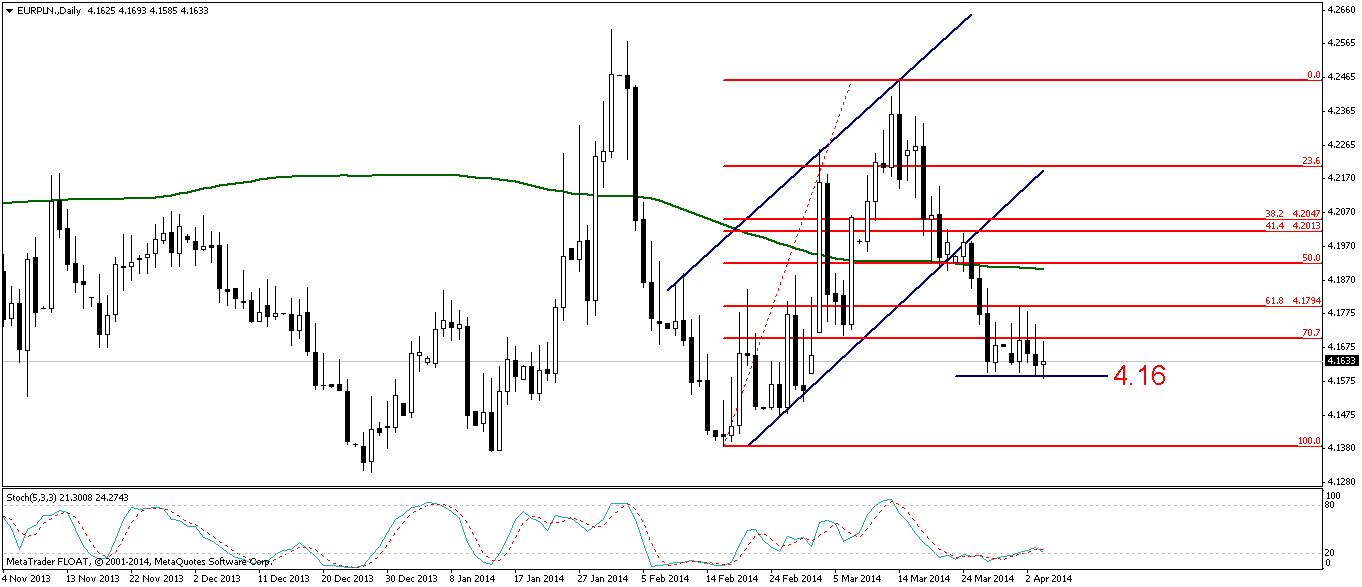

Polish Zloty (EUR/PLN) – consolidation

The markets have calmed down during the last two weeks. Despite the turmoil in Eastern Europe, stock indices keep flying higher. On the improved market sentiment, emerging market currencies remain relatively strong. The Polish Zloty market experienced little volatility throughout the week. The EUR/PLN trader in a very narrow (for this currency pair) 4.16 – 4.18 range. Macro data could have not moved the market as only the PMI report was published (reading of 54 points, which lower than previously). What can affect the Zloty but in the midterm is what decision future retirees will make regarding their pension plans. Starting this week (till July), citizens have to choose between the government and private pension plans. The predictions are that half will decide to stay with the government plan. If more, this can hurt the stock market (private pension funds were big players on the Warsaw Stock Exchange) which in turn can negatively affect the Zloty. Still, this will not affect the market in the upcoming weeks.

As we see on the chart, the EUR/PLN is balancing between 4.16 and 4.18. It seems though that PLN bulls have more power not allowing the Euro higher. Still, the stochastic oscillator shows the market is oversold and that a rebound should be expected. If so, breaking the resistance of 4.18 should trigger a move towards 4.2050. On the other, breaking the 4.16 support will push the market down towards February lows of 4.14

Pic.1 EUR/PLN D1 Chart

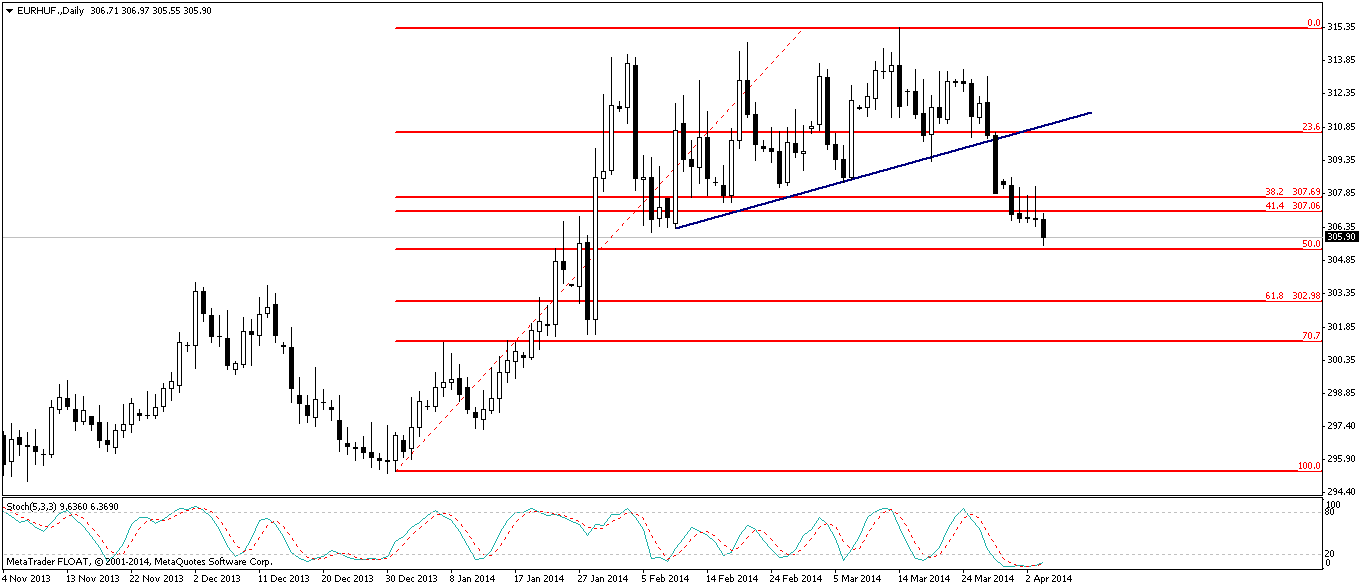

Hungarian Forint (EUR/HUF) – a few days till the parliamentary elections

Inflation data and the Hungarian elections will be the key factors for the upcoming weeks. It is the moment when the Forint just started to appreciate. Now, investors should prepare themselves for a huge event – the elections. If we take a look at the programs of the parties, many opposition parties are promising tax cuts and higher expenditures at the same time. DK and Együtt-PM parties would increase the budget deficit to a greater extent, while LMP, MSZP and Jobbik to an outstandingly great extent. If MSZP's program would be implemented, the budget deficit would grow to 8.4% of GDP by 2015, while Jobbik's program would increase the deficit to 12%. The governing parties did not present any ideas for the next four years so Fidesz-KDNP (the ruling party) could not be analyzed. Nevertheless, more and more local analysts are afraid that any changes in the government could weaken the Forint. The market already got accustomed to the current situation - we all know that a strong Forint is not in the interest of the present government. On the other hand, but other’s party victory would increase the volatility on the EUR/HUF. The victory of Hungary’s ruling Fidesz party seems certain on the April 6th election so the current NBH's monetary policy should also remain unchanged in the next years. Next week’s publication of inflation data can confirm the Monetary Council in further easing.

After reaching the 306 levels, Forint bulls could realize their gains mainly due to the uncertainty about the currency in the next couple of weeks. The EUR/HUF could fly back to upper levels soon and touch the 310 resistance in the near future. For the Hungarian currency it does not matter who wins the elections – it should stay above the 300 levels. Volatility can increase though. If the EUR/HUF rebounds from the 306 support, 310 will be the target. The stochastic oscillator confirms the higher possibility of this scenario showing the market is oversold. If the 306 support is broken though, the next target for Forint bulls will be 303.

Pic.2 EUR/HUF D1 Chart

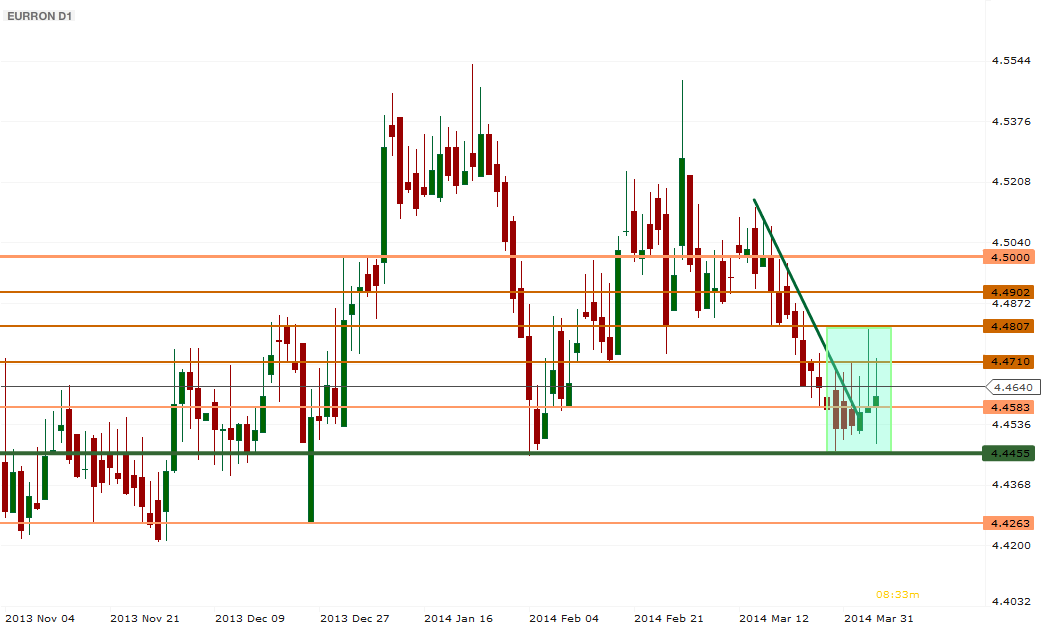

Romanian Leu (EUR/RON) – Finding its pulse above 4.4455

EUR/RON managed to find its pulse this week, but not necessarily its direction. There were beams of energy pointing to 4.48, in the quest for the next larger move. Some of the data was reasonably friendly, as unemployment rate fell toward 7.2%, while GDP rose by 1,6% in Q4 vs. Q3. However not everything is fine, as depicted by the fall in PPI Feb/Jan by 0.2%. While risk is on, the playground can continue to be 4.45 – 4.50, with a real balance to be found on the next episode of global instability by dancing around 4.50.

The technical view confirmed the 4.47 resistance, while also briefly touching but not breaking on a close 4.48, all this before sliding in what may become the next area of lateral boredom. As to what the chart can be trusted to say, the consolidation can be a step in the way to higher ground, as support at 4.4455 appears strong enough to put problems for bears. Levels to watch: 4.4807, 4.49 and 4.50, while support is defined at 4.4260.

Pic. 3 EUR/RON D1 Chart

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.