Looks like the pound’s glory days are over! After its steady climb since the start of the year, the U.K. currency has been having trouble sustaining its gains and here are three reasons why it could be in for more selling.

1. Weakening economic data

As I’ve discussed in my latest economic data roundup on the United Kingdom, consumer spending and housing reports are no longer as rosy as they used to be. For one, slow wage growth appears to be weighing on consumers’ spending habits as the rise in salaries can’t keep up with rising price levels. Meanwhile, the recovery in the housing sector appears to have hit a few road bumps, with falling mortgage approvals and home prices.

Even the manufacturing sector is reflecting signs of a slowdown, as the latest industry PMI fell from 57.2 to 55.4 instead of holding steady as expected. The construction sector isn’t faring so well either, as the PMI dipped from 62.6 to 62.4 in July.

2. Potential shift in BOE stance

With that, the BOE might decide to switch to a more dovish stance in their upcoming interest rate statement. The minutes of their previous monetary policy meeting already indicated that some policymakers are having doubts that the U.K. economy can sustain its strong pace of growth.

Governor Mark Carney himself acknowledged that the outlook for both the global and local economies has been less upbeat. Policymakers zoomed in on the weakness in wage growth as a potential drag to overall economic activity later on.

3. Technicals suggest a reversal

A quick look at the pound charts also suggests that the rallies are about to turn. As Big Pippin pointed out in today’s Daily Chart Art, GBP/USD has broken below an ascending trend line that has been holding since the start of the year.

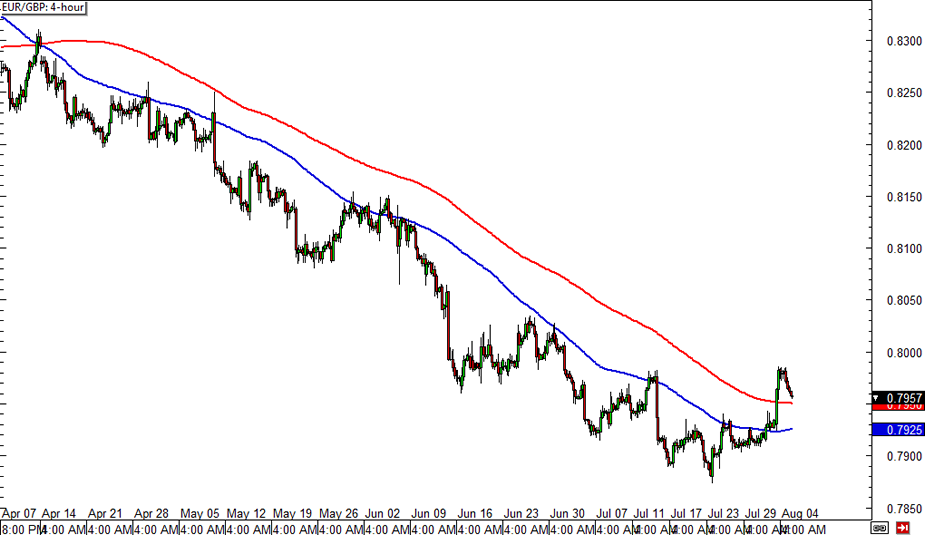

EUR/GBP 4-hour Forex Chart

Even EUR/GBP has made a significant breakout, as price surged past the 100 SMA recently. As you can see from the chart above, this moving average has been holding as a dynamic resistance level for the pair since April.

Recommended Content

Editors’ Picks

EUR/USD stays in tight channel above 1.0750

EUR/USD continues to fluctuate in a narrow band slightly above 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.