A negative start to European trade following a similar move in Asia overnight is weighing on US futures ahead of the open on Wednesday, with declines in oil weighing and earnings remaining in focus.

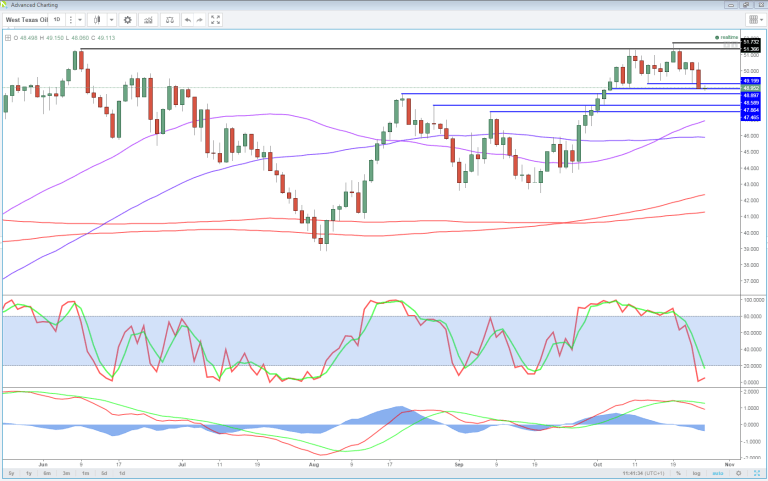

Oil is off more than 1% having gapped lower overnight after API reported a larger build in inventories. This comes as the market had already turned more bearish, leaving it more susceptible to downside moves, after Iraq threw a spanner in the works of the OPEC deal suggesting it should not be involved. The gap lower in WTI took it through $49.70 support and may have opened up a move back towards $47.20, potentially triggered today by EIA confirming or adding to API’s reported build in crude inventories.

Equity indices are lower across the board in Europe this morning, with the decline in commodities taking its toll. Even without the decline in commodity prices, these indices continue to look toppy at the moment, particularly in the US where we’re constantly failing to record new higher highs. While we may be well supported for now, this is not a set up that is indicative of a market that’s about to tear higher. Especially not against the fundamental backdrop of mediocre earnings and a Federal Reserve rate hike.

Once again today we have just under 10 of the S&P 500 companies reporting on the third quarter, while we’ll also get a response to those companies that reporting late on Tuesday, including Apple which is expected to come under pressure following a rare annual revenue decline. While the decline itself may be rare, it was not unexpected with its quarterly revenue declining for a third consecutive quarter.

We’ll also get some economic data during the US session including the services and composite PMIs for October and new home sales for September. The Fed has now entered is blackout period ahead of next week’s meeting so it will now be quiet on that front.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.