The US500 (S&P500) and US100 (NASDAQ) futures indexes traded at historical highs on Monday following positive market sentiment. Facebook shares joining the $1 trillion club gave support to the US100 index following a district court decision dismissing the FTC’s antitrust case against Facebook (up 4.18%). Other technology stocks such as Intel (up 2.81%), Microsoft (up 1.4%) and Apple (up 1.26%) also supported the rise of the US100 index.

The US500 index reached a high of 4281.44 points in late trading before declining slightly to 4277 before closing at new all-time highs at 4290.62 it closed with strong bullish momentum and remains above the MA-50 H1 level. It has remained traded in the ascending channel since June 21. The nearest support is at 4264 points.

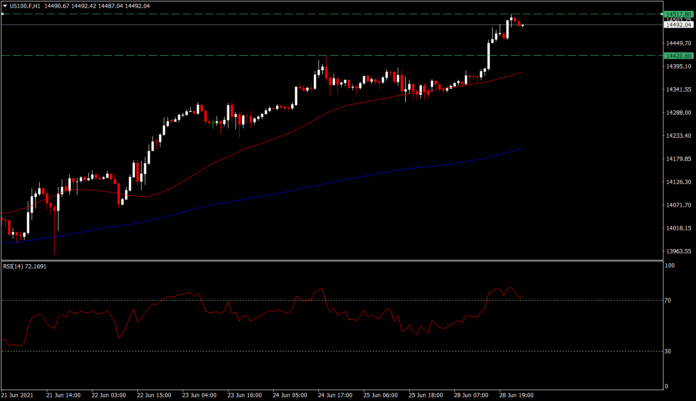

Meanwhile, the US100 also set a record intra-day high when it reached 14,517.80 points before declining back to 14,492 and closing at the key psychological 14,500. The nearest support is well below at 14,420 points.

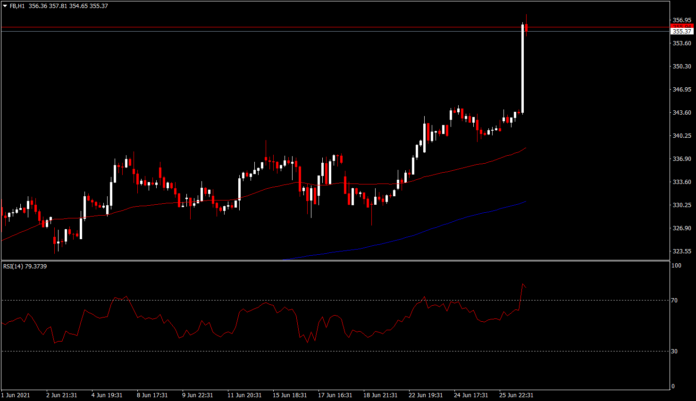

The strengthening of the US100 was supported by a surge in technology shares where Facebook managed to get a court order to set aside 2 complaints filed by prosecutors with respect to antitrust policies. The surge in Facebook shares pushed the company to be worth more than $1 trillion in market capitalization and join other big tech companies in the trillion+ company club. Facebook shares closed at historical highs at $355.37, an increase of more than 30% in 2021. 49 of the 58 analysts tracked by Bloomberg now place Facebook shares in the Buy category, 6 in the holdings category and only 3 place FB shares in the sell category.

Positive sentiment from the US close cooled in the Asian session, where Covid infections and continued lockdowns weighed on markets. The Nikkei JPY225 moved down to 28,689 to a 5-day low before recovering in late trading to close at 28,812 (-0.81%).

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.