The GBP/USD pair fell to a low of 1.5028 in holiday-thinned trade. Sterling repeatedly sought support around 1.5055-1.5060 last week, but also struggled equally to sustain above 1.51 handle. Finally, the support at 1.5055 was taken out on Friday following which the pair dropped to 1.5028 and extended losses further in Asia to a low of 1.5015 levels.

Bearish monthly closing ahead of key data

The UK economic calendar offers PMI releases this week, which shall be accompanied by US ISM figures, ADP report, and monthly non-farm payrolls report. Apart from the headline figure, the investors would also keep an eye on the following details –

UK PMI (Nov): growth in new work – manufacturing, services PMI, new export orders in manufacturing sector and employment subindices.

US ISM: The main focus ahead of Friday’s payrolls would be on the ISM non-manufacturing employment index. A strong reading would increase the probability of a better-than-expected non-farm payrolls.

US non-farm payrolls and US ADP report could only add to USD strength ahead of the Dec 16 Fed decision.

ECB rate decision on Thursday: Could trigger sharp moves in the EUR/GBP pair and thus affect the GBP/USD pair.

Technicals - bearish monthly closing likely

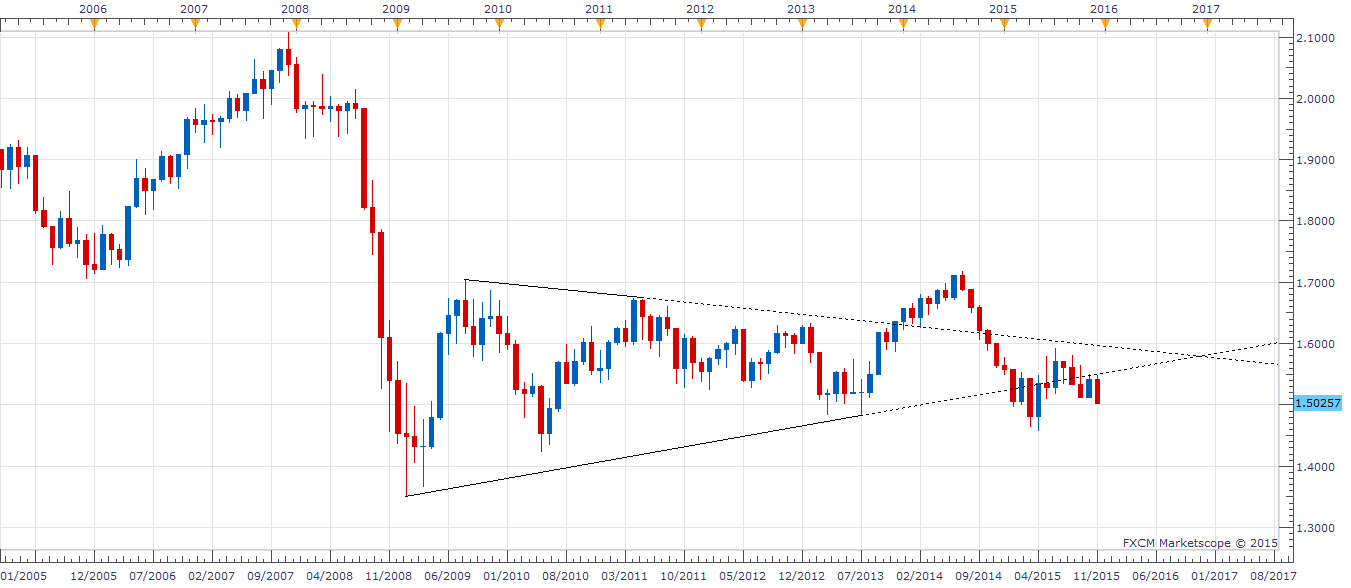

Sterling’s bearish break from the symmetrical triangle in August, followed by two consecutive failures (Sep and Oct) to sustain above the triangle resistance and a rejection at the same this month with a high possibility of a monthly close below 1.5107 indicates the currency may break below 1.4980 (falling channel support on the daily chart) in December.

Given the bullish RSI divergence on the hourly chart, the pair could re-test last week’s strong support/now resistance at 1.5055-1.5060. A close above 1.5107 may open doors for 1.5185 (23.6% of July 2014-Apr 2015 plunge). However, the traders may utilise the upticks to initiate fresh shorts so long as the near-term top at 1.5335 remains intact. On the downside, a break below 1.4980 would expose 1.4951 (Jan 23 low).

EUR/USD Analysis: Focus on German CPI

The EUR/USD pair ended below 1.06 levels on Friday as the correlation between the German bund yields and the shared currency strengthened ahead of the ECB rate decision scheduled this Thursday. The yields could continue to guide the shared currency today as well, but markets would also look towards the German preliminary CPI report.

Uptick in German CPI could strengthen EUR

The preliminary CPI is seen rising 0.4% y/y and 0.1% m/m from Oct’s 0.3% and 0.0%. The harmonized CPI is also expected at 0.3% y/y and 0.1% m/m from Oct’s 0.2% and 0.0%. An uptick in the German CPI as expected could trigger a minor recovery in the German yields and EUR. However, any uptick is likely to be met with fresh offers as the strong CPI number is unlikely to influence the ECB’s decision to do more easing.

On the other hand, a weaker-than-expected CPI would be enough to drag down German yields and the EUR. Moreover, a weaker-than-expected German CPI could see the pair take out the yearly low at 1.0463. Germany already has yields lower than or at -0.20% (ECB’s deposit rate) on 5-year bunds. A weak inflation number could push 6-yr yield to deposit rate and bring 7-yr yield in the negative territory.

Technicals: Could re-test 4-hour 50-MA resistance

Euro dropped below 1.06 and continues to trade below the same today, but has managed to stay above the last week’s low of 1.0566 levels. The RSI continues to call for a technical correction – lower lows on price and higher lows on RSI. Therefore, the pair could see a minor spike to 1.0639 (4-hour 50-MA). Only a close above the same would open doors for a rise to 1.07. On the other hand, a failure to take out 1.0639 would trigger a sharper sell-off to a yearly low of 1.0463.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.