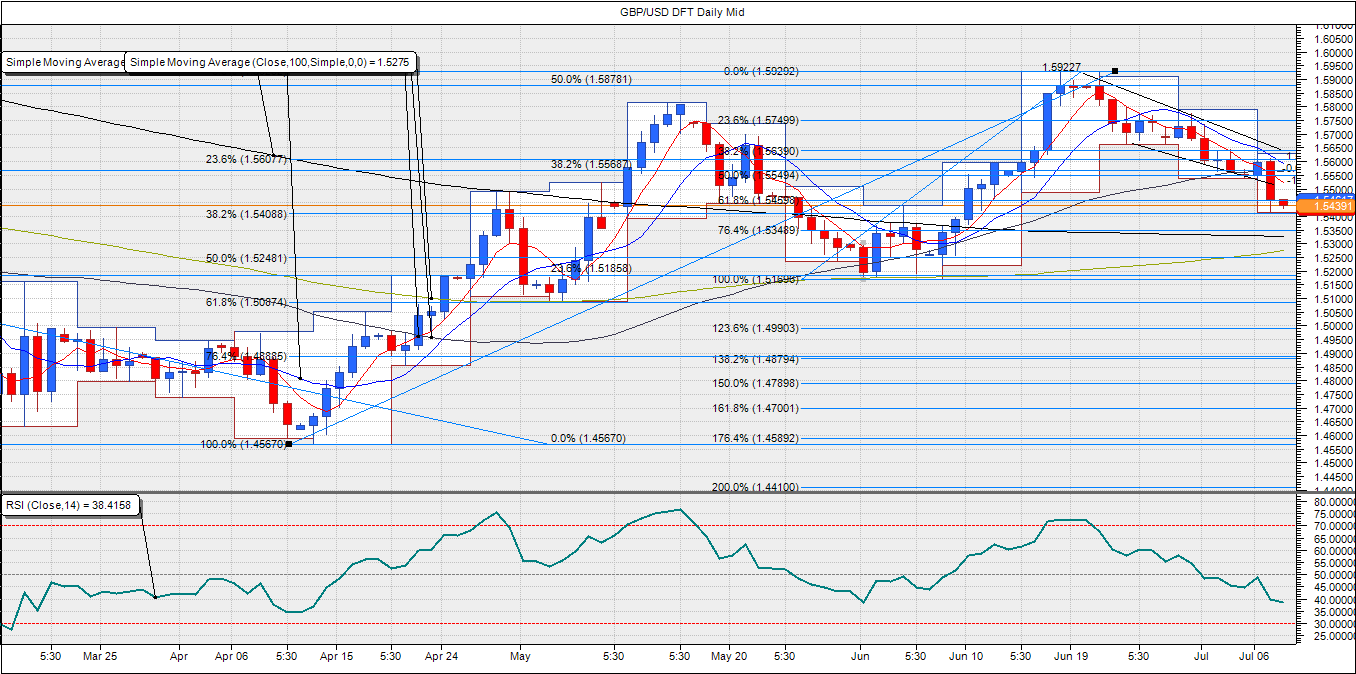

The GBP/USD pair tumbled almost 200 pips to hit an intraday low of 1.5413 on Tuesday as the markets turned risk averse due to the stock market rout in China and increased probability of Grexit. The spot began its downward journey after it was rejected at 1.5606 in the early European session. The better-than-expected Industrial production failed to provide any strength to the GBP bulls. The selling pressure intensified after the EUR/USD pair broke below the 1.10 handle.

With no major UK data due for release today, the cable remains at the mercy of the overall market sentiment. The rout in the Shanghai Composite index continues as sentiment worsened further after 50% of the companies suspended from trading. Meanwhile, Greece has a five-day deadline to submit a detailed package of reforms to international creditors in return for a bailout or risk the "bankruptcy" of both the country and its financial system. The risk aversion is likely to maintain its grip on the markets as we head towards the Fed minutes due for release in the American session. The September rate hike expectations in the US could drop if the Fed policy makers put more emphasis on the turmoil in the global markets, although it could result in a minor correction in the GBP/USD to 1.5520.

On the 4-hour chart, the spot breached the falling channel and extended losses to hit a low of 1.5413, before closing just above 1.5460 (61.8% Fib R of June rally). The pair could drop to 1.5408 (38.2% Fib R of Apr-June rally) in the early European session. However, the RSI on the hourly and 4-hour time frame has hit the oversold regions. Consequently, the pair may sustain above 1.5408-1.54, thereby opening doors for a re-test of 1.5460. A break above 1.5460 would be a double bottom breakout, which could see the pair target 1.5520. On the other hand, a a failure to sustain above 1.548-1.54 would open doors for 1.5348 (76.4% Fib of June rally).

EUR/USD: Another attempt at 1.0955 likely

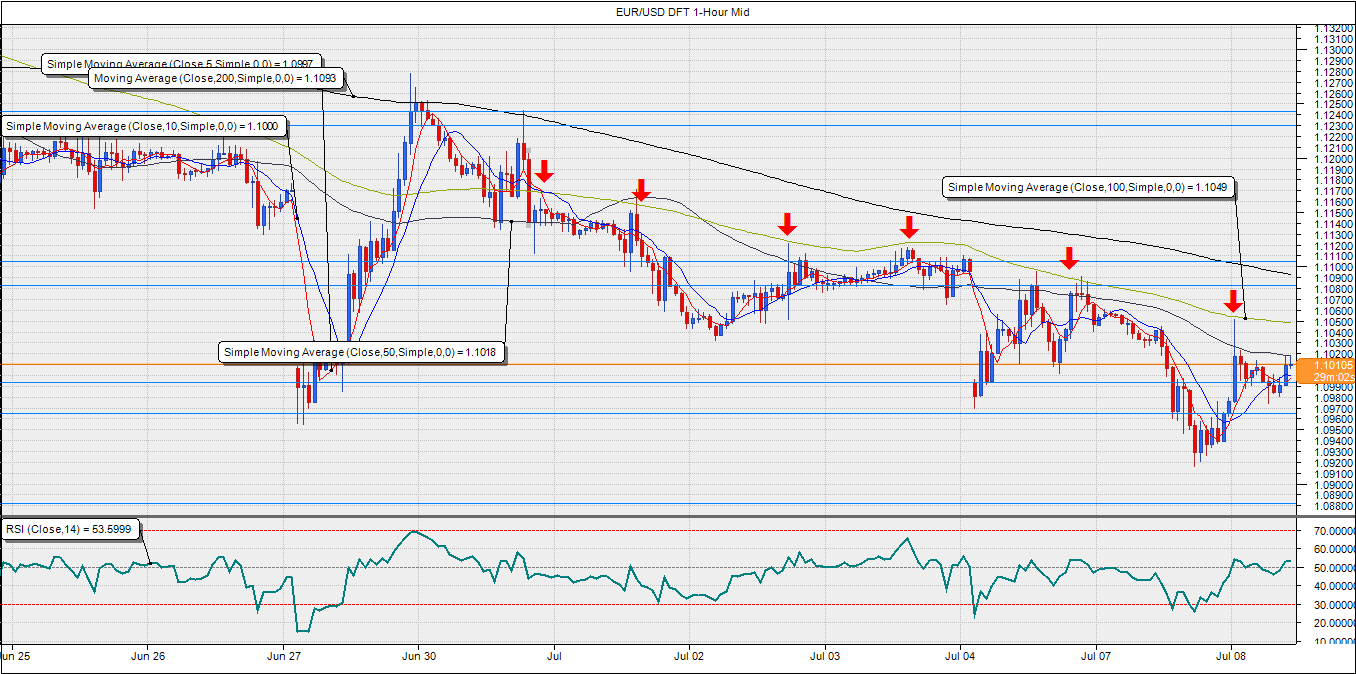

The EUR/USD pair fell to an intraday low of 1.0917 on Tuesday on increased fears of Grexit and rout in the Chinese equity markets, before rebounding strongly to trade above 1.10 handle after Greece received a five day deadline to meet creditor nod. The recovery in the Dow Jones index also helped the EUR/USD pair sustain above 1.10 levels.

With no major data due out of the Eurozone, the Greek issue is likely to remain at the center stage ahead of the Fed minutes release. As per the Greek government official PM Tsipras will address the European parliament today. Meanwhile, European Council President Donald Tusk and Commission President Jean-Claude Juncker warned Tuesday that “Failure to find an agreement will lead to the bankruptcy of Greece and the insolvency of its banking system." Consequently, a hard stance from Greeks/PM Tispras is likely to put the EUR under pressure.

On the hourly charts, the spot is struggling to rise above the hourly 50-MA located at 1.1018. The recovery witnessed in the previous session was halted at the hourly 100-MA. Since then, the hourly 50-MA has acted as a strong resistance. Consequently, a failure to take out 1.1018 could push the pair back to 1.0994 (50% Fib of Apr-May rally). A break below the same could push the pair back to 1.0955. On the other hand, a break above 1.1018 could open doors for 1.1050 (hourly 100-MA). The outlook stays bearish so long as the pair trades below hourly 100-MA, which has acted as a strong resistance since June 30.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.