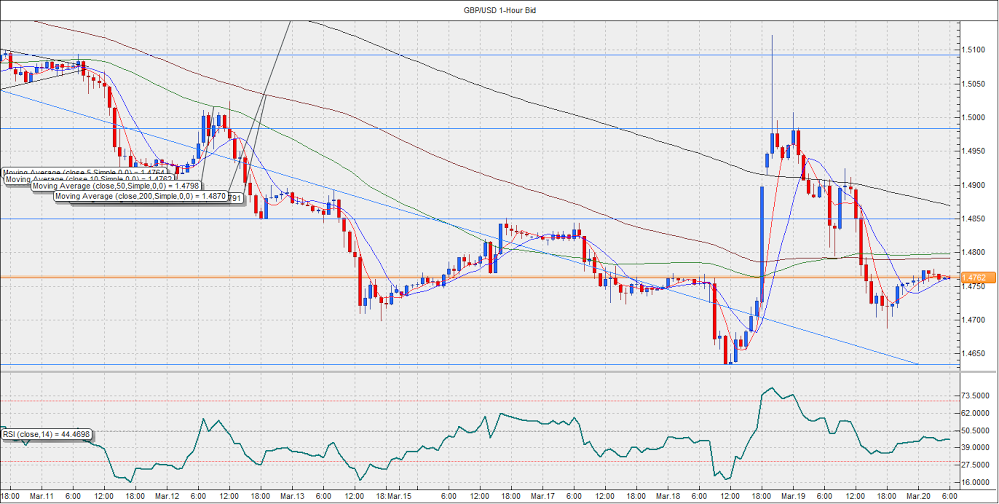

GBP/USD Analysis: Weakness to persist, could drop to 1.4687

The GBP/USD pair almost erased its entire gains witnessed on Wednesday as it finished lower at 1.4758 levels. The USD made a comeback,while Pound was also hit by Bank of England economist Haldane’s rate cut comments. Haldane, in his speech, said that the BOE could be forced to cut rates to zero in order to tackle the deflationary forces. His comments pushed the UK 10-year Gilt yield to 1.516%. With no major data due out of the US or UK today, the pair is likely to focus once again on the divergent monetary policy expectations from the BOE and the US Fed. Consequently, the GBP/USD pair could re-test the previous session low of 1.4687.

On the hourly chart, the pair could be seen struggling to rise above 1.4770-1.4775 since the Asians session. The daily, hourly, and the 4-hour RSI stays bearish, which indicates room for another sell-off in the pair to 1.4687 levels. A fresh demand for Pounds can be anticipated around 1.4687. The immediate upside in the pair appears capped at the 5-DMA currently located at 1.4810 levels.

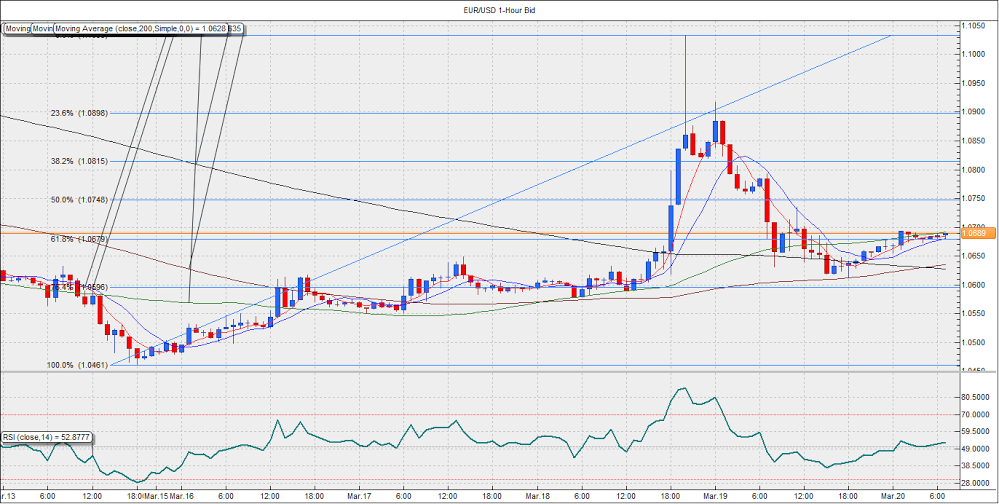

EUR/USD Forecast: Could drop to 1.0617 on Greek concerns

The EUR/USD pair fell to 1.0667 in the previous session, although the pair manages to sustain above the 5-DMA and the 10-DMA. In the absence of a major market moving data out of the EU or US today, the pair is likely to take cues from the Greek concerns. The EU chief said today that the time is running out for Greece to overcome a standoff over aid and that Greece could run out of money as soon as this month as debt payments and monthly salaries and pensions come due. Greece, meanwhile, said it will fulfill debt obligations that are due Friday, and an EU official said the cash-strapped government may have enough money to tide it over until April. The fresh signs of tensions between Greece and its creditors could push the EUR/USD down to 1.0617 levels.

The Hourly chart shows, the pair is currently trading near the 61.8% Fib retracement level of the short uptrend – 1.0461 to 1.1033 – located at 1.0679 levels. Moreover, the pair has struggled to extend gains above 1.0680-1.0690 since the early Asian session today. On the 4-hour charts, the three positive candles have not been able to recover the losses suffered in the previous red candle. Furthermore, the daily RSI still remains bearish. Thus, another failure to rise and sustain gains above the same at the European opening bell, could lead to a fresh sell-off towards 1.0617 levels. On the other hand, a break above 1.0710 levels could push the pair higher to 1.0746 levels.

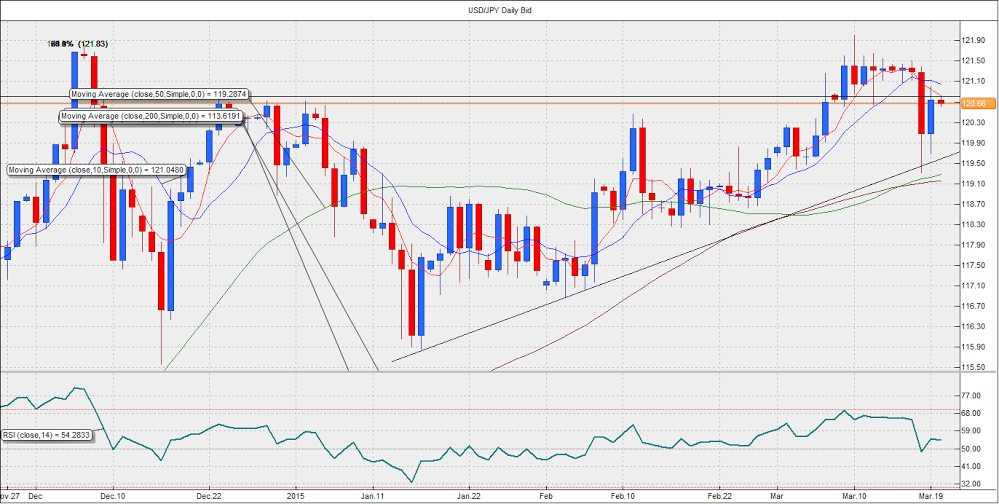

USD/JPY Forecast: Rejected at 5-DMA, could drop to 120.10

The USD/JPY pair rose in the previous session, although gains were capped at the 5-DMA. The Yen came under pressure as the 10-year Treasury yield in the US recovered from 1.899% to 1.989%. The upbeat weekly jobless claims data in the US was countered by the rise in the US current account deficit in the fourth quarter. The Bank of Japan governor Kuroda’s statements failed to have any impact in the pair. Given, the absence of a major market moving data in the US, the pair is likely to take cues from the movement in the Treasury yields.

On the daily charts, the pair was rejected at the 5-DMA located at 120.81, post which it fell to the current level of 120.66. The pair has also dipped below the hourly 50-MA located at 120.69. The hourly as well as the 4-hour RSI is bearish. Thus, the pair could extend the drop to 120.10 levels. Meanwhile, a rise above 121.00 could push the pair higher to 121.55 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD holds gains near 0.7000 amid PBOC's status-quo, Gold price surge

AUD/USD is clinging to mild gains near 0.7000 early Monday. The pair benefits from a risk-on market profile, China's steady policy rates and surging Gold and Copper prices. Focus now remains on Fedspeak for fresh impetus.

Gold price hits an all-time high to near $2,440

Gold price (XAU/USD) climbs to a new record high near $2,441 during the Asian trading hours on Monday. The bullish move of the precious metal is bolstered by the renewed hopes for interest rate cuts from the US Federal Reserve (Fed).

EUR/USD gains ground above 1.0850, focus on Fedspeak

The EUR/USD pair trades on a stronger note around 1.0875 on Monday during the early Asian trading hours. The uptick in the major pair is bolstered by the softer Greenback. The Federal Reserve’s Bostic, Barr, Waller, Jefferson, and Mester are scheduled to speak on Monday.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.