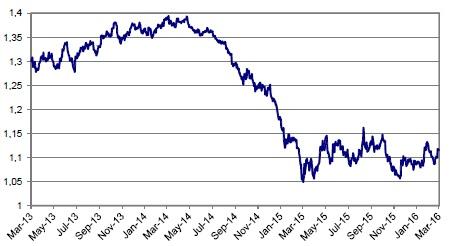

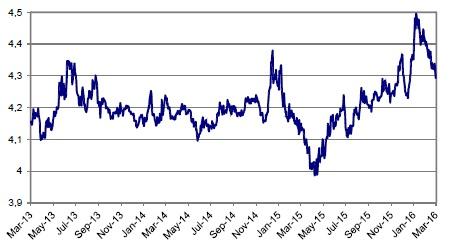

EUR/USD

EUR/USD returned back lower in the range in February/March as an easing of global tensions supported the dollar. However, the pair rebound as ECB’s Draghi signalled a potential halt to further ECB rate cuts.

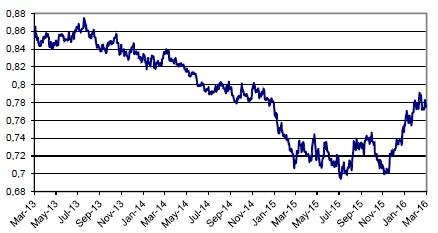

EUR/GBP

EUR/GBP trended higher till late February as uncertainty on Brexit weighed on sterling. In March, sterling showed tentative signs of bottoming out. Is enough Brexit uncertainty discounted?

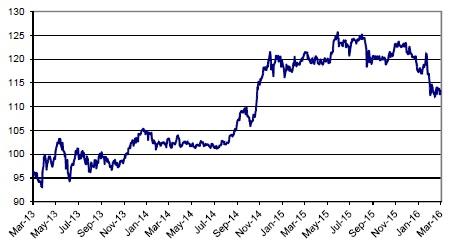

USD/JPY

The January BoJ policy easing didn’t prevent further yen strength. USD/JPY dropped below the key 115.98 support. Since mid‐February, USD/JPY settled in a consolidation pattern between 111 and 115.

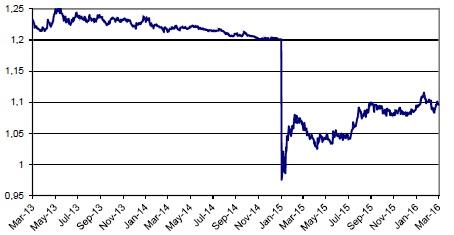

EUR/CHF

The Swiss franc declined early this year even as global sentiment turned outright negative. ‘Selective’ SNB action prevented CHF gains .A decline of the euro was one factor slowing the decline of the CHF in February/March.

EUR/PLN

The decline of the zloty in the wake of the formation of a new government slowed. Markets gradually embrace the idea that a change in monetary policy might be less aggressive than previously assumed.

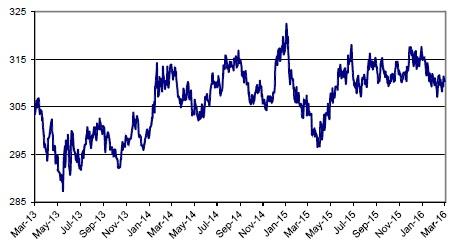

EUR/HUF

The forint holds stable in a sideways range between 306 and 318. Global uncertainty hardly affected the forint. A further improvement in economic fundamentals gives the forint downside protection.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.