Currencies

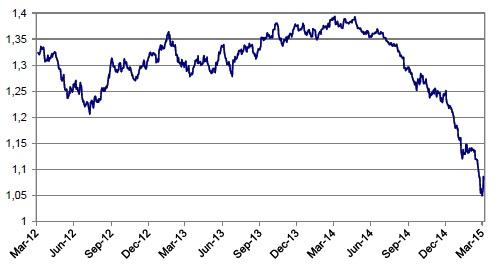

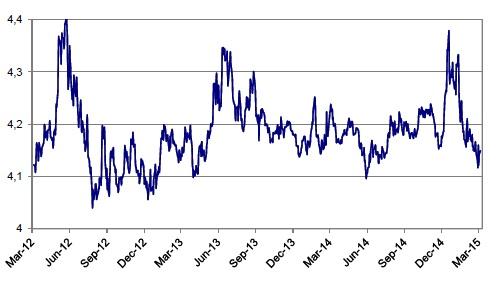

EUR/USD

The EUR/USD decline accelerated as the ECB’s QE purchases pressured European yields to incredibly low levels. A temporary rebound occurred after the FOMC decision.

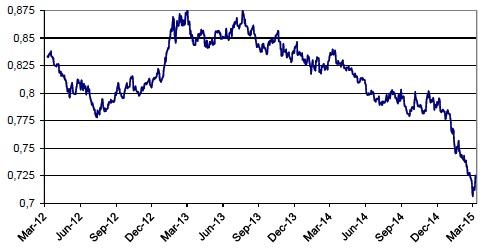

EUR/GBP

EUR/GBP joined the QE decline of the euro. Finally, sterling corrected as the BoE signalled risks from the strong currency on inflation. Markets turn also more defensive on sterling due to the upcoming elections.

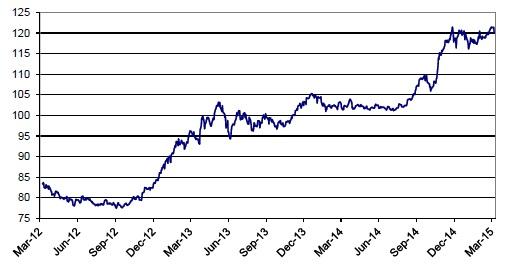

USD/JPY

USD/JPY remains paralysed in the upper part of the 115.57/122.03 trading range. Dollar strength prevails. The BOJ doesn’t signal further policy stimulation in the near future.

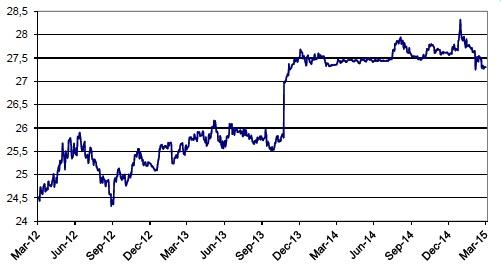

EUR/CZK

The Czech koruna returned closer to the CNB floor of EUR/CZK 27 as markets scale back chances that the CNB will ease policy further.

EUR/PLN

The zloty hardly reacted even as the NBP cut its policy rate to 1.5%. Euro weakness prevails and the NBP rate cut is considered the bottom of the cycle.

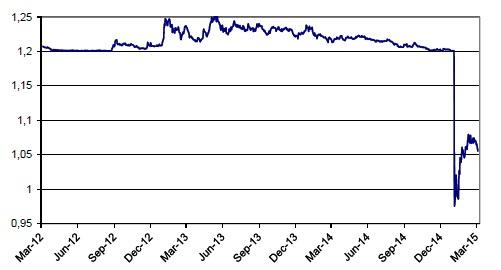

EUR/CHF

The EUR/CHF cross rate found a new equilibrium in the 1.05/1.10 area. However, ‘selective’ SNB interventions are still needed to prevent further CHF strength.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD stays in tight channel above 1.0750

EUR/USD continues to fluctuate in a narrow band slightly above 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.