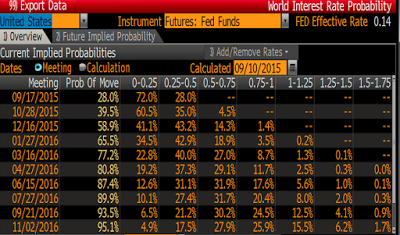

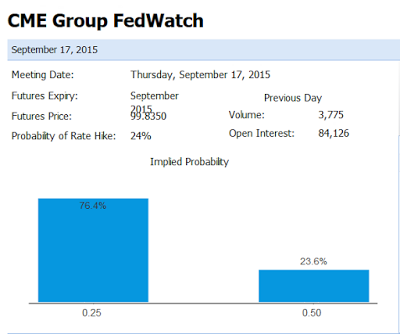

As of September 10, the CME has the of a September hike by the Fed at 24%. Bloomberg says the probability of a move is 28%.

Bloomberg Rate Hike Odds

CME Fedwatch Odds

Both Models Wrong

What's wrong with both models is they still presume a quarter point hike.

Neither Bloomberg nor the CME allows for the possibility of a Fed hike to precisely 0.25% or to a smaller tighter range.

Given the effective Fed Funds Rate is 0.14% (see upper right of Bloomberg chart), a setting the rate to a flat 0.25% from the current range of 0.00-0.25% (now at 0.14%), would be both a "move" and a "hike".

Tighter Range

The Fed could also use ranges as Bloomberg and CME imply, but target ranges in 1/8 of a point increments rather than 1/4 point increments.

For example the Fed could target a range of 0.25% to 0.375%.

I suspect the odds of a move to a flat 0.25 or a range (0.25% to 0.375%), are far greater than Bloomberg's "probability of a move" set at a mere 28%.

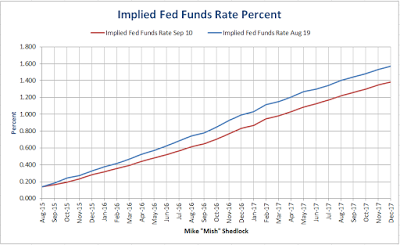

I went over this before, on August 19, in Plotting the Fed's Baby Step 1/8 Point Hikes; Yellen vs. Greenspan "Measured Pace".

I updated my charts today.

Flattening of Rate Hike Expectations

Using Fed fund futures from CME, I calculated implied interest rates through December 2017. The line in Blue shows what futures implied on August 19. The line in red is from September 10.

Note the flattening of the curve. This has been happening pretty much all year.

The market initially penned in hikes for January. The hikes then shifted to March, then June, then September, and now December by both the Bloomberg and CME models.

Range Watch

Curve Watchers Anonymous is closely watching the implied baby steps in the the Fed fund futures. Incrementally, the hikes appear as follows.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.