MCX gold: Bullish momentum may continue

The yellow metal is extending upward as US Treasury bond yields pull back further. The massive stimulus packages rolled out by Biden and an additional infrastructure proposal of $2.25 trillion is supposed to appreciate the gold prices, keeping dollar lower. Also, Biden government has hinted at raising corporate taxes to fund the massive stimulus package, which will give some ease to inflation concerns, and could hurt the global equity market supporting the uptrend in gold.

The US yields have dropped after US Senate parliamentarian late Tuesday decided to allow the Democrats to advance multiple pieces of legislation through the so-called 'reconciliation' process this year. This means Biden won't have to face Republicans to pass his expansionary fiscal program. But this may stoke the recent swell in inflation expectations, which is negative for gold prices.

So, the focus is on tonight's FOMC March 16-17 meeting minutes. Any uplift of economic projections and a noticeable shift in baseline rate path expectations to a less-dovish setting will weigh on gold prices. The recent surge in US inflation on hopes of an early Fed rate hike kept the gold prices lower. But going ahead, if the US yields continue to remain subdued then we can see a rise in gold prices.

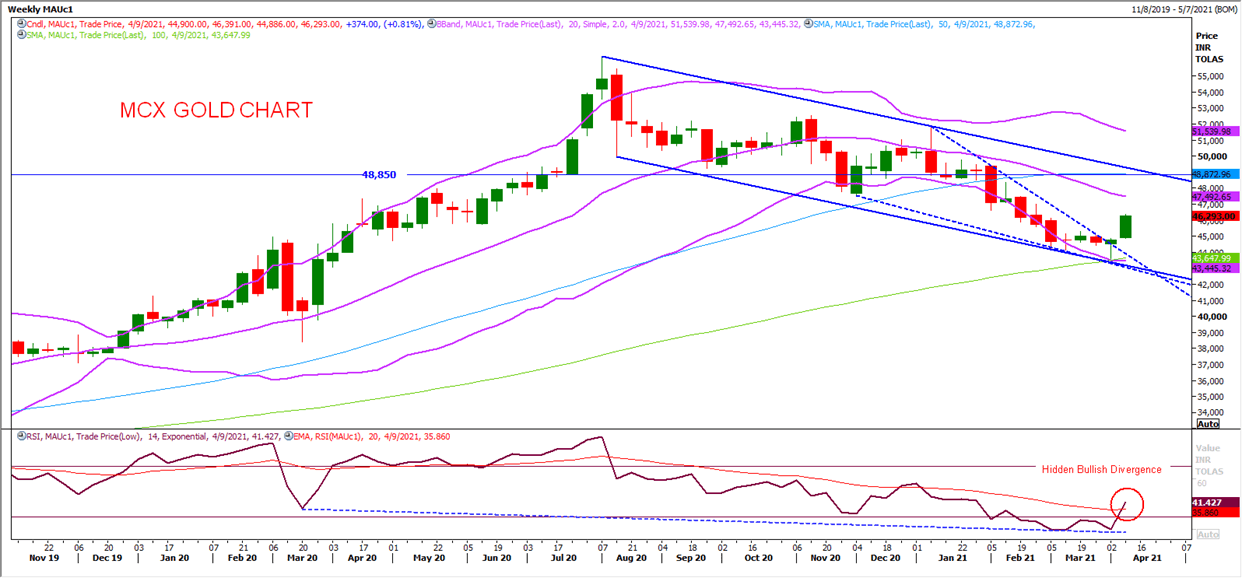

As seen in the weekly chart, MCX Gold have witnessed a Falling Wedge Breakout whose pattern target is 48850 (which is also near 50 days moving average level). The chart have also experienced a Hidden Bullish Divergence with prices giving higher lows while RSI indicator giving lower lows, which will support upside movement in yellow metal. Currently, it is trading at 46200 and next resistance is seen at 47500 (Bollinger band's medium) and then at 48850. If prices cross and sustains above 48850 then doors will be open for 49500-51550. However, on downside support is located at 45000 below which next support is at 43350-42700.

Author

Rahul Gupta

Emkay Global Financial Services Limited

Rahul Gupta is a derivatives expert with an MBA from Mumbai Educational Trust, having more than a decade year of experience in trading derivatives strategies across asset classes.