Markets edging risk positive in front of Nonfarm Payrolls [Video]

![Markets edging risk positive in front of Nonfarm Payrolls [Video]](https://editorial.fxstreet.com/images/Macroeconomics/EconomicIndicator/Employment/NFP/construction-work-before-new-mall-opening-gm72377572-18070848_XtraLarge.jpg)

Market Overview

Today’s Trump update on the trade dispute is positive. Apparently, the talks are “moving right along” and again sentiment is edging more positive. However, trading the headlines makes for a skittish market, and a lack of conviction is clear across majors. After claiming earlier this week that a deal may not be seen in front of the 2020 presidential election, who knows what Trump may say next week. It is an emotionally exhausting path to try and navigate, but as we move closer to the 15th December deadline for the next round of US tariffs on Chinese goods, we will begin to see the picture a little more clearly (we can only hope). Accordingly, there is a positive edge that is weighing on assets at the safer end of the risk spectrum. Bond yields are higher, and equities are rebounding, whilst on the other hand, the Aussie and Kiwi are performing well in the forex space. It is interesting to see that as US data continues to underwhelm, the dollar is also being pressured. It brings focus to today’s Non-farm Payrolls data, which if also disappoints then could really begin to drag on the dollar into the Fed meeting next week. After Wednesday ADP jobs numbers disappointed, the bar is fairly low for payrolls. Could the volatility come out of a strong report then?

Wall Street closed last night with marginal gains, with the S&P 500 +0.2% at 3117. US futures have continued to tick slightly higher today, currently, +0.2% and this has helped Asian markets to edge higher (Nikkei +0.2%, Shanghai Composite +0.4%). There are also slight early gains in Europe with the FTSE futures +0.2% and DAX futures +0.3%. In forex, there is a slight risk positive tilt to moves, but the main underperformer is USD, whilst NZD continues to outperform. In commodities, the risk positive move is a drag on gold which is -$2 whilst oil is tentatively lower by -0.2% ahead of the OPEC+ meeting today.

The primary focus on the economic calendar will undoubtedly be the US jobs report, however, it would also be best not to miss the Michigan Sentiment either. The US Employment Situation is at 1330GMT with headline Nonfarm Payrolls expected to increase to 180,000 in November (from 128,000 in October). Having seen a sizable revision of jobs last month, this could again play a key role in determining the overall makeup of the report. We also have Average Hourly Earnings which at expected to grow by +0.3% on the month which would keep the year on year again at +3.0% (+3.0% for October). US Unemployment remains on its downward trend but has been settling in recent months and is again expected to be at 3.6% (3.6% in October). The U6 Underemployment ticked slightly higher to 7.0% in October and should also be watched. As should the laborforce Participation Rate which continued its increase in October as it posted 63.3% which was the highest for more than six years. Aside from the payrolls report, the key data is the Michigan Sentiment for December at 1500GMT and is expected to improve across the board. The headline Sentiment gauge is forecast to pick up slightly to 97.0 (from the final reading of 96.8 in November). This comes with improvement in the Michigan Current Conditions component to 112.4 (from a final reading of 111.6 in November) whilst the Michigan Expectations component is expected to improve to 88.0 (from 87.3 in November).

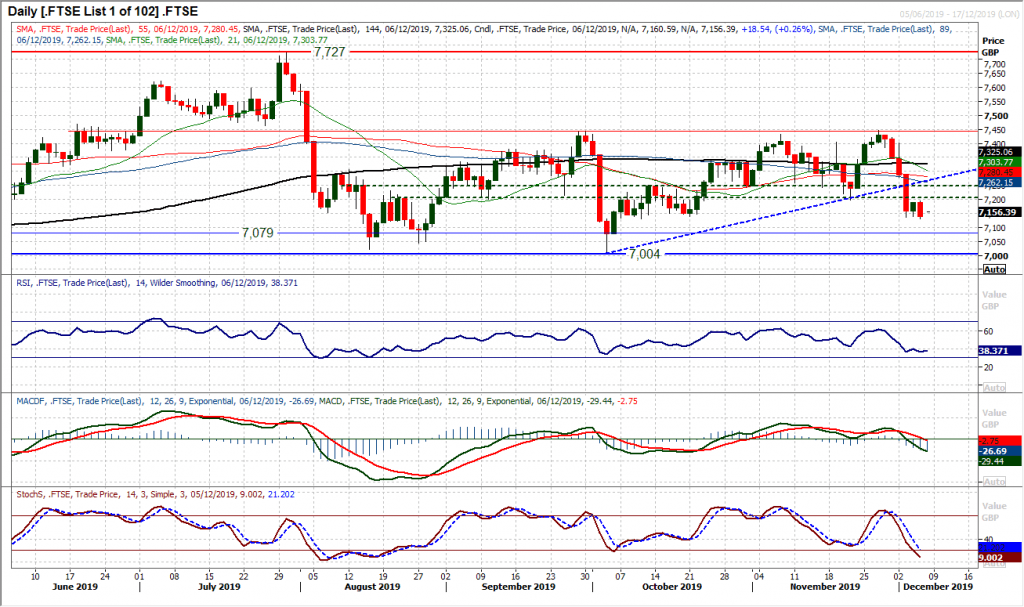

Chart of the Day – FTSE 100

There is still a negative correlation to consider when trading FTSE 100. As GBP rallies (as it has done again recently) this acts as a drag on the performance of FTSE 100. The breakout on GBP has coincided with weakness in equities recently and this has subsequently hit FTSE 100 relatively hard. The result has been a breach of a nine week recovery uptrend, with the formation of a new negative trend. A break below support at 7197 (the old November low) came earlier this week. However, the market has subsequently failed as this has become resistance. This move has come with the RSI falling below 40 in a move, whilst the MACD and Stochastics lines are turning negative. Yesterday’s solid bear candle closing around the low of the day is now eyeing the support around 7130/7140 which is the final real support until the 7004 October low. Yesterday’s price action also shows that rallies are now a chance to sell. There is resistance in the band around 7200/7245. If GBP remains strong and risk appetite mixed, a drop back on FTSE towards 7000 cannot be ruled out.

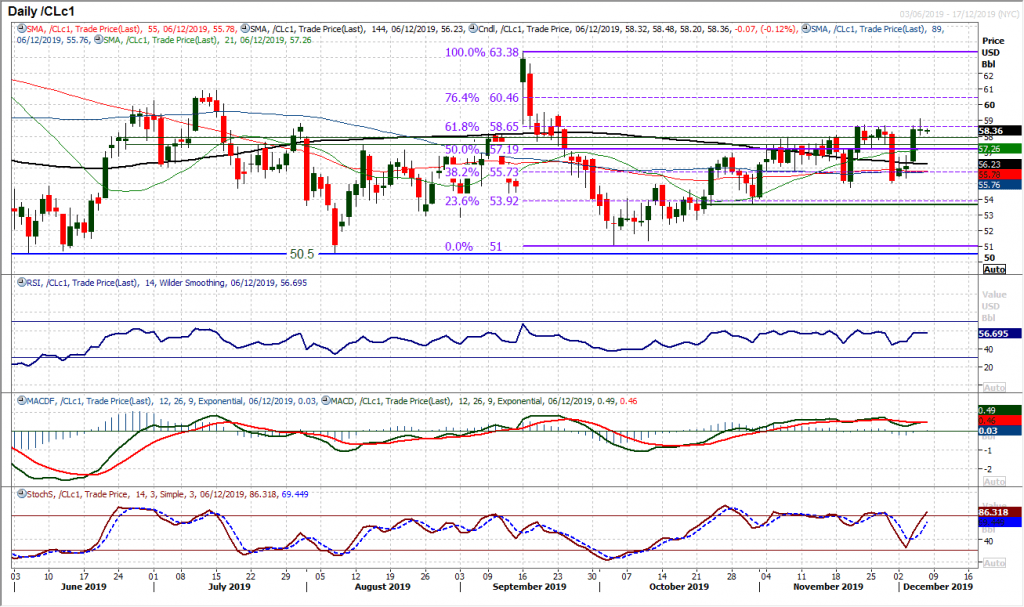

WTI Oil

The oil bulls hardly got the news that they would have been hoping for out of the OPEC meeting yesterday. An increase in production cuts, but no extension to the length of the cuts. Gains have recently come with the expectation of an extension, so we have seen oil hovering in response. Perhaps we will see more from the OPEC+ meeting today (i.e. the meeting that includes Russia), but for now, the outlook for oil is unchanged. Yesterday’s break above resistance around the 38.2% Fib level around $58.65 could not hold and the bulls are back in a holding pattern today. There is a range that has formed in the past five weeks with momentum exhibiting the slightest edge of positive configuration. RSI is between 45/60 whilst MACD lines hold above neutral and Stochastics have swung higher again. There needs to be a closing breakout above $58.65 which would open the 23.6% Fib at $60.45. The continual concern that the bulls have though is that every time they look to have broken the shackles, they get dragged sharply back. It is making for very difficult trading on oil. Until the US/China “phase one” is penned, then this could continue.

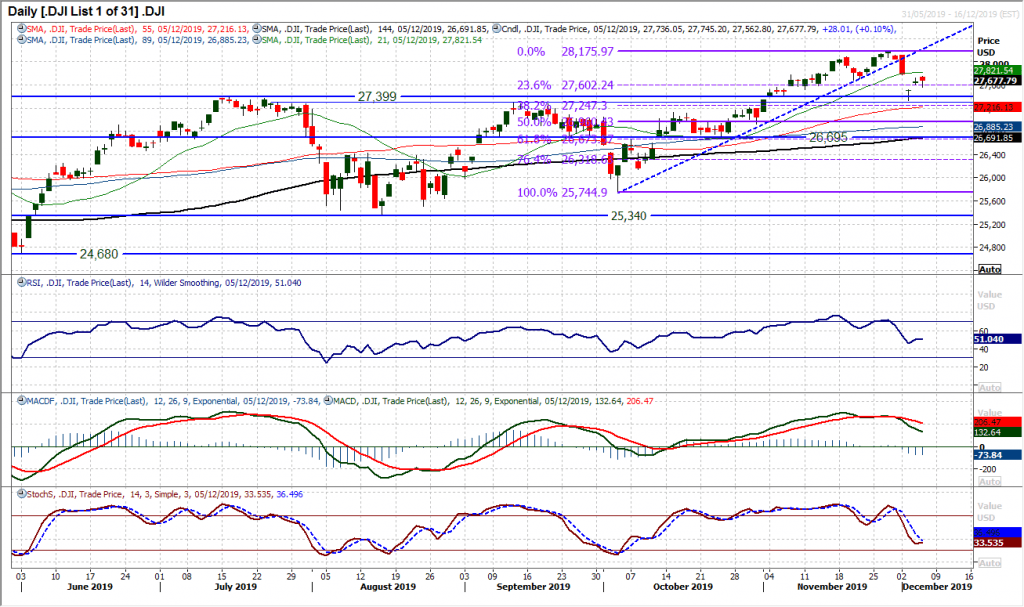

Dow Jones Industrial Average

There is a distinct lack of confidence in the rebound of the past couple of sessions. Once more the Dow closed higher on the day, and once more with a cautious candlestick lacking conviction. We discussed yesterday the two gaps that were open, one at 27,525 and one at 27,782. Both gaps were looked at yesterday, but without being filled and again remain open. Given the market has now closed higher for two consecutive sessions, there is an element of recovery still playing out, but the bulls are not in a strong position. If the gap at 27,782 can be closed (the more likely move) then there will be a more positive look to the chart, however, we still see momentum indicators tentative, as the RSI hovers around 50, MACD lines continue to slip back from a bear cross and Stochastics also hold under neutral. The 23.6% Fibonacci retracement (of 25,745/28,175) around 27,600 is a noteworthy basis of support now and arguably 27,563 (yesterday’s low) could become a near term higher low. We will know more after payrolls today, but the recovery is tentative at best currently.

Author

Richard Perry

Independent Analyst