Morning View:

As expected from an April FOMC meeting, really nothing new to report other than a few subtle changes.

A really good comparison piece from RyanLittle stone over at ForexLive which I highly recommend having a look at. Shows the exact wording changes side to side and talks a little bit about what that means going forward.

The USD was trading off it’s lows after the FOMC statement was released but was unable to offset the relentless USD weakness we’ve seen over the last week.

This weakness was last night compounded by a dismal US GDP reading over the first quarter, with the -0.2% print a huge miss on the +1.0% that the market expected. It was actually this that did all the damage to the USD as markets expected another string of poor data to force the Fed to hold off any rate rises.

The Fed didn’t really comply and failed to provide any new clues about the timing of the first rate hike except confirming that it will be later rather than sooner. The major line to take out of the statement being that the central bank acknowledged that economic growth slowed during the winter months as job growth moderated and spending eased.

How about that weather huh!

We take a further look at the USDX in the Chart of the Day section below.

On the Calendar Today:

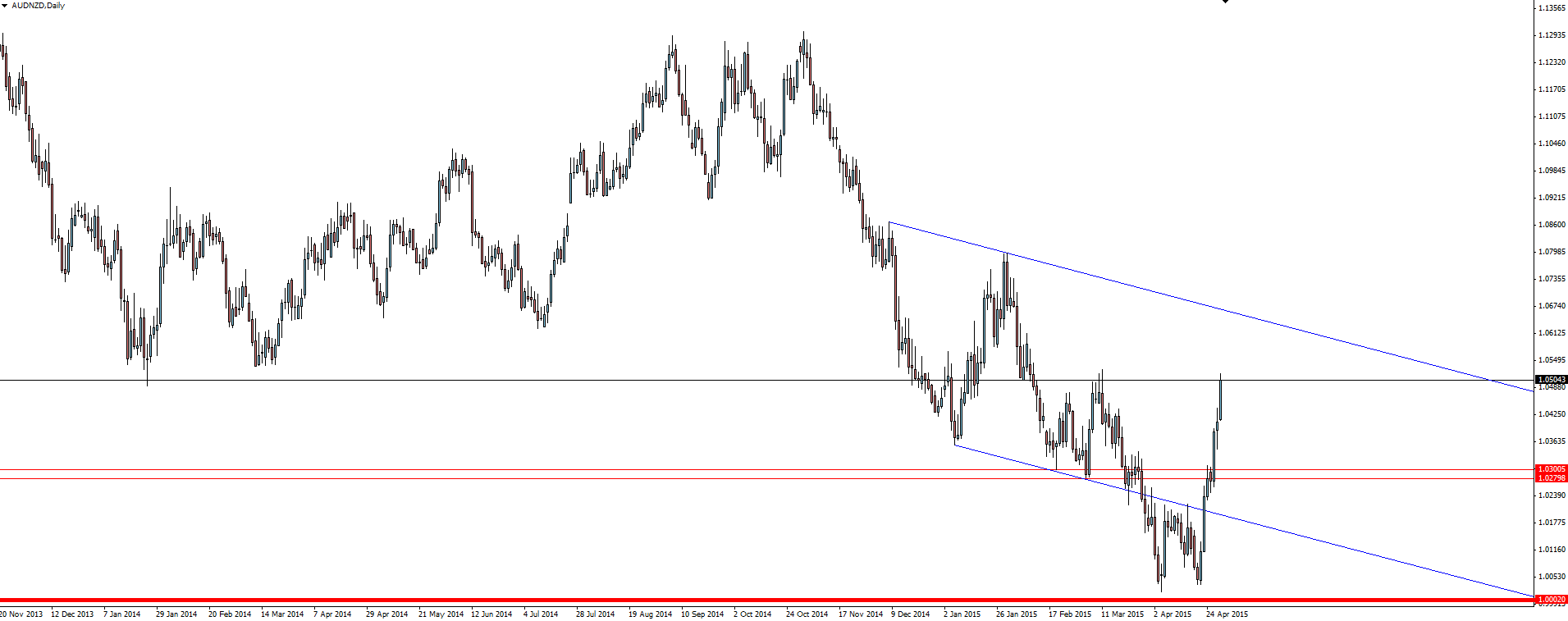

This morning we’ve already seen New Zealand’s RBNZ keep rates on hold at 3.5% as expected. Wheeler did however add that “weaker demand may warrant easing down the line”. Something that the Kiwi hasn’t taken very well as you can see from this AUD/NZD chart. Remember when we were talking about a drop through parity?

AUD/NZD Daily:

Our eyes now turn to Japan with a BoJ monetary policy statement and press conference.

Thursday:

JPY Monetary Policy Statement

JPY BOJ Press Conference

CAD GDP

USD Unemployment Claims

CAD BOC Gov Poloz Speaks

Chart of the Day:

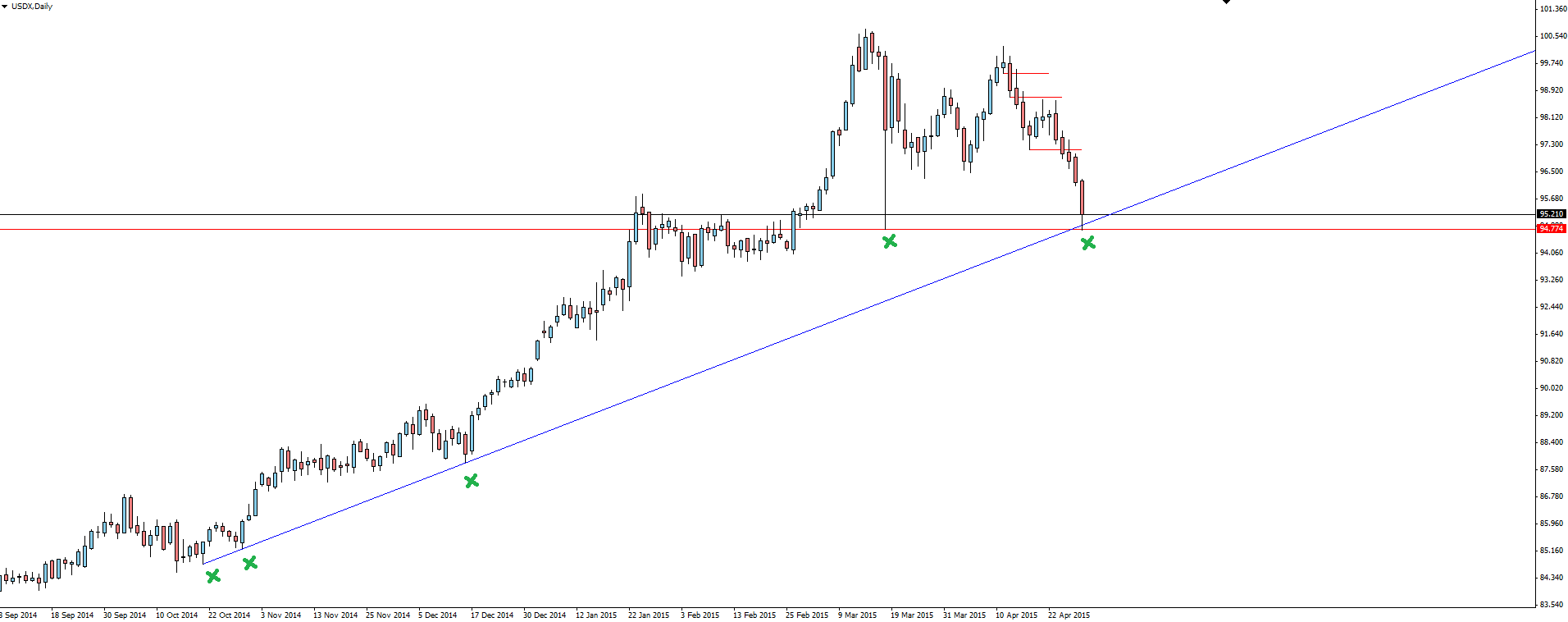

We continue on yesterday’s look at the US Dollar Index with a look at overnight developments and where the correction now sits on the chart.

USDX Daily:

The correction is now sitting at a very important zone. Price is sitting both on trend line support, as well as last month’s spike low. The fact that the major pairs such as EUR/USD and GBP/USD are all breaking major resistance levels shows that this USD correction definitely has some merit to it but this level is key.

If it holds, then normal service will resume and we’ll be looking for the majors to resume their down trends, but if it goes we could get some major corrections flowing through the forex market.

Mark it and watch it.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD looks depressed ahead of FOMC

EUR/USD followed the sour mood prevailing in the broader risk complex and plummeted to multi-session lows in the vicinity of 1.0670 in response to the data-driven rebound in the US Dollar prior to the Fed’s interest rate decision.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

Bitcoin price tests $60K range as Coinbase advances toward instant, low-cost BTC transfers

BTC bulls need to hold here on the daily time frame, lest we see $52K range tested. Bitcoin (BTC) price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.