Market Brief

In Australia, private capital expenditure (capex) contracted 5.2%q/q in the first quarter of 2016, missing consensus for a smaller decrease of -3.5% and also below the upwardly revised figure of +1.8% in the last quarter of 2015. On a year-over-year basis capex contracted -15.4% as spending on equipment plant and machinery slid 9.2%y/y (s.a.), while spending on buildings and structures collapsed 18.8%y/y (s.a.). Initially, AUD/USD fell sharply on the news as it hit 0.7162. However, the Aussie bounced back above the 0.72 threshold, supported by rising commodity prices.

Crude oil continued to rally hard as the supply glut issues continue to fade as US stockpiles dropped 4.2k over the last week, missing forecast for a smaller reduction of 2k barrels. In London, futures rose 0.70% to $50.09 a barrel, while US futures stumbled on the $50 threshold as it stabilised at around $49.90 a barrel. We still believe there some upside potential for crude oil prices; however it would be difficult to break the $60 level given the elevated amount of inventories.

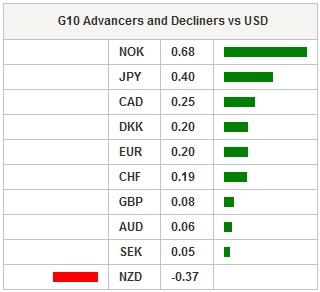

With crude oil prices moving higher, the Norwegian krone followed the trend. USD/NOK slid 0.70% to 8.3070 after hitting 8.4065 amid growing Fed’s expectation for normalising short-term rates. We expect the currency pair to continue moving lower as the NOK will find a strong support from rising oil prices, while the USD should retreat as the market starts to price out a June rate hike.

Precious metals are also taking advantage of the weaker dollar as the yellow metal rose 0.39% in Tokyo. Silver was up 0.72%, while platinum jumped 1.54% and palladium surged 2.05%. Gold has reached the bottom of its medium-term range and should therefore start recovering. A strong support can be found at around the $1,200-$1,220 area, while the top of the range is at $1,300.

In the equity market, Asian regional markets were mostly trading in positive territory. In mainland China, the Shanghai and Shenzhen Composites were up 0.13% and 0.31% respectively. In Japan, the popular Nikkei 225 edged up 0.09% while the Topix index remained unchanged. Offshore, Hong Kong’s Hang Seng edged down 0.04% and Taiwan’s TWSE traded flat (-0.02%). In Europe, equity futures are once again trading in negative territory - just like yesterday - but may turn positive following the Asia lead. US futures are mixed.

Today traders will be watching final reading of Spain’s GDP figures for the 1Q; industrial output from Switzerland; PPI from Sweden; initial jobless claims, durable goods orders and pending home sales from the US; gold and forex reserve from Russia.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 16772.46 | 0.09 |

| Hang Seng Index | 20360.91 | -0.04 |

| Shanghai Index | 2818.68 | 0.13 |

| FTSE futures | 6250 | -0.02 |

| DAX futures | 10195.5 | -0.11 |

| SMI Futures | 8166 | -0.11 |

| S&P future | 2085.7 | -0.08 |

| Global Indexes | Current Level | % Change |

| Gold | 1229.37 | 0.4 |

| Silver | 16.44 | 0.73 |

| VIX | 13.9 | -3.61 |

| Crude wti | 49.88 | 0.65 |

| USD Index | 95.2 | -0.16 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| SW May Consumer Confidence | 98 | 97,1 | SEK/07:00 |

| SW May Manufacturing Confidence s.a. | 108,6 | 107,9 | SEK/07:00 |

| SW May Economic Tendency Survey | 105,5 | 104,6 | SEK/07:00 |

| SP 1Q F GDP QoQ | 0,80% | 0,80% | EUR/07:00 |

| SP 1Q F GDP YoY | 3,40% | 3,40% | EUR/07:00 |

| SZ 1Q Industrial Output WDA YoY | - | -4,50% | CHF/07:15 |

| SZ 1Q Industry & Construction Output WDA YoY | - | -4,50% | CHF/07:15 |

| SW Apr PPI MoM | - | 0,80% | SEK/07:30 |

| SW Apr PPI YoY | - | -3,70% | SEK/07:30 |

| SW Apr Trade Balance | 2.5b | 3.9b | SEK/07:30 |

| TU Bloomberg May Turkey Economic Survey (Table) | - | - | TRY/07:50 |

| NO Norges Bank Releases 2Q Inflation Expectations | - | - | NOK/08:00 |

| NO Norway Releases 2Q Oil Investment Survey | - | - | NOK/08:00 |

| IT Mar Retail Sales MoM | - | 0,30% | EUR/08:00 |

| IT Mar Retail Sales YoY | - | 2,70% | EUR/08:00 |

| UK Apr BBA Loans for House Purchase | 44700 | 45096 | GBP/08:30 |

| UK 1Q P GDP QoQ | 0,40% | 0,40% | GBP/08:30 |

| UK 1Q P GDP YoY | 2,10% | 2,10% | GBP/08:30 |

| UK 1Q P Private Consumption QoQ | 0,50% | 0,60% | GBP/08:30 |

| UK 1Q P Government Spending QoQ | 0,40% | 0,30% | GBP/08:30 |

| UK 1Q P Gross Fixed Capital Formation QoQ | 0,90% | -1,10% | GBP/08:30 |

| UK 1Q P Exports QoQ | 0,10% | 0,10% | GBP/08:30 |

| UK 1Q P Imports QoQ | 1,00% | 0,90% | GBP/08:30 |

| UK Mar Index of Services MoM | 0,20% | 0,10% | GBP/08:30 |

| UK Mar Index of Services 3M/3M | 0,60% | 0,70% | GBP/08:30 |

| UK 1Q P Total Business Investment QoQ | - | -2,00% | GBP/08:30 |

| UK 1Q P Total Business Investment YoY | - | 3,00% | GBP/08:30 |

| IT Apr Hourly Wages MoM | - | 0,00% | EUR/09:00 |

| IT Apr Hourly Wages YoY | - | 0,80% | EUR/09:00 |

| SA Apr PPI MoM | 0,90% | 0,70% | ZAR/09:30 |

| SA Apr PPI YoY | 7,30% | 7,10% | ZAR/09:30 |

| US Fed's James Bullard Speaks at Monetary Forum in Singapore | - | - | USD/10:10 |

| UK BOE Publishes FPC Record, Systemic Risk Buffer Paper | - | - | GBP/11:30 |

| US May 21 Initial Jobless Claims | 275k | 278k | USD/12:30 |

| US May 14 Continuing Claims | 2142k | 2152k | USD/12:30 |

| US Apr P Durable Goods Orders | 0,50% | 0,80% | USD/12:30 |

| US Apr P Durables Ex Transportation | 0,30% | -0,20% | USD/12:30 |

| US Apr P Cap Goods Orders Nondef Ex Air | 0,30% | 0,10% | USD/12:30 |

| US Apr P Cap Goods Ship Nondef Ex Air | 0,10% | 0,50% | USD/12:30 |

| RU May 20 Gold and Forex Reserve | - | 390.9b | RUB/13:00 |

| AU RBA's Debelle, Fed's Potter, BOE's Salmon on FX Code Launch | - | - | AUD/13:00 |

| US May 22 Bloomberg Consumer Comfort | - | 42,6 | USD/13:45 |

| US Apr Pending Home Sales MoM | 0,70% | 1,40% | USD/14:00 |

| US Apr Pending Home Sales NSA YoY | 0,20% | 2,90% | USD/14:00 |

| US May Kansas City Fed Manf. Activity | -3 | -4 | USD/15:00 |

| US Fed's Powell Speaks About Economy at Peterson Insitutute | - | - | USD/16:15 |

| IN Apr Eight Infrastructure Industries | - | 6,40% | INR/22:00 |

| AU SURVEY: Private Capital Expenditure 2016-17 A$86.7B | - | - | AUD/22:00 |

Currency Tech

EURUSD

R 2: 1.1479

R 1: 1.1349

CURRENT: 1.1171

S 1: 1.1058

S 2: 1.0822

GBPUSD

R 2: 1.4969

R 1: 1.4770

CURRENT: 1.4732

S 1: 1.4404

S 2: 1.4300

USDJPY

R 2: 111.91

R 1: 110.59

CURRENT: 109.88

S 1: 108.23

S 2: 106.25

USDCHF

R 2: 1.0257

R 1: 1.0093

CURRENT: 0.9900

S 1: 0.9751

S 2: 0.9652

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades at around 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range above $2,300

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.