Market Brief

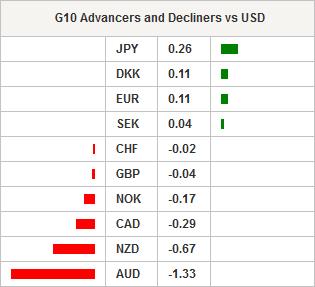

Risk appetite disappeared in the Asian session ahead of the critical US payroll report. Today's read should provide potential indication for the position of the US in its growth cycle. Asian regional equity markets were weaker as the Shanghai composite and Hang Seng index fell -1.94% and -1.31%. ASX was in the green, rising 0.23% as the RBA statement of monetary policy signalled that the bank is likely to ease next month. USD was broadly strong against G10 and commodity linked currencies. EURUSD traded in a choppy tight range between 1.1390 and 1.1410 with no directional indication. As news of the RBA report hit the wires AUDUSD collapsed from 0.7470 to 0.7385. With markets only pricing in a 10% probability of a Fed rate hike in June current downside in USD feels stretched. In Japan, April Services Sector PMI dropped to 48.9, the weakest read in two years from 49.9 in March. Plenty of chatter from Fed members provided entertainment for traders. Fed’s Kaplan suggested that the Fed was still struggling to understand how close the US was to full unemployment. Fed’s Lockhart said it is not realistic to shift from the current 2% inflation target, while Fed’s William commented that he is optimistic about their 2% inflation goal. And finally, Fed’s Bullard steered clear of comment direction regarding monetary policy, instead stating that last year’s “taper tantrum” induced volatility was due to ineffective monetary policy. All solid headlines, but nothing in terms of new insight or market moving.

The RBA’s Statement of Monetary Policy indicates that the bank was prepared to ease policy further. The RBA has revised its inflation forecasts lower by 1pp for the end of 2016. This means that inflation will scrape near the bottom of the RBA 2-3% target band. Our view is that June and August will be both live meetings for the potential of 50bp being removed from the already historically low cash rate 1.75% by summer’s end. We remain bearish on the AUD in light of further downside risk to interest rates and would materialise our view through a short AUDJPY trade (targeting 77.59 reaction low).

In the European session, traders will be watching Spanish industrial production figures, German construction PMI and Poland central bank rate discussions. However the main event will undoubtedly be the US payroll report. FX volatility is likely to remain subdued until the critical release. Payroll growth is expected to decelerate to 200k consensus from 215k prior read, however given the ADP and ISM labor complaint we anticipate noteworthy downside risks. We forecast a number closer to 180k, which should keep the overly short USD position safe. However, an upside surprise in NFP will have an asymmetrical response in USD as traders will quickly need to recalculate the probability of a rate hike in June. Falling participation rates should push the unemployment rate to 4.8%. We expect that the cyclical slowdown seen in incoming economic data, driven by weak international conditions, will begin to play into the strong US labor markets. While USD shorts are heavy we see no sustainable fundamental rationale for holding USD currently. When the smoke clears from today's payroll read we expect EURUSD bullish momentum will reengage heading back towards the 1.1616 resistance.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 16106.72 | -0.25 |

| Hang Seng Index | 20197.41 | -1.23 |

| Shanghai Index | 2927.02 | -2.34 |

| FTSE futures | 6060.5 | -0.14 |

| DAX futures | 9796.5 | -0.33 |

| SMI Futures | 7694 | -0.24 |

| S&P future | 2040 | -0.19 |

| Global Indexes | Current Level | % Change |

| Gold | 1279.79 | 0.16 |

| Silver | 17.32 | -0.16 |

| VIX | 15.91 | -0.87 |

| Crude wti | 43.97 | -0.78 |

| USD Index | 93.69 | -0.1 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| SZ Apr Foreign Currency Reserves | - | 5,76E+11 | CHF/07:00 |

| UK Apr New Car Registrations YoY | - | 5,30% | GBP/08:00 |

| EC Apr Markit Eurozone Retail PMI | - | 49,2 | EUR/08:10 |

| CA Apr Net Change in Employment | 1000 | 40600 | CAD/12:30 |

| US Apr Change in Nonfarm Payrolls | 200000 | 215000 | USD/12:30 |

| CA Apr Unemployment Rate | 7,20% | 7,10% | CAD/12:30 |

| US Apr Two-Month Payroll Net Revision | - | - | USD/12:30 |

| CA Apr Full Time Employment Change | - | 35,3 | CAD/12:30 |

| US Apr Change in Private Payrolls | 195000 | 195000 | USD/12:30 |

| CA Apr Part Time Employment Change | - | 5,3 | CAD/12:30 |

| US Apr Change in Manufact. Payrolls | -5000 | -29000 | USD/12:30 |

| CA Apr Participation Rate | - | 65,9 | CAD/12:30 |

| US Apr Unemployment Rate | 4,90% | 5,00% | USD/12:30 |

| US Apr Average Hourly Earnings MoM | 0,30% | 0,30% | USD/12:30 |

| US Apr Average Hourly Earnings YoY | 2,40% | 2,30% | USD/12:30 |

| US Apr Average Weekly Hours All Employees | 34,5 | 34,4 | USD/12:30 |

| US Apr Change in Household Employment | 170 | 246 | USD/12:30 |

| US Apr Labor Force Participation Rate | 63,00% | 63,00% | USD/12:30 |

| US Apr Underemployment Rate | - | 9,80% | USD/12:30 |

| CA Apr Ivey Purchasing Managers Index SA | 52,3 | 50,1 | CAD/14:00 |

| US Mar Consumer Credit | 1,60E+10 | 1,72E+10 | USD/19:00 |

Currency Tech

EURUSD

R 2: 1.1714

R 1: 1.1465

CURRENT: 1.1396

S 1: 1.1217

S 2: 1.1144

GBPUSD

R 2: 1.4959

R 1: 1.4668

CURRENT: 1.4643

S 1: 1.4300

S 2: 1.4132

USDJPY

R 2: 112.68

R 1: 111.91

CURRENT: 106.94

S 1: 105.23

S 2: 100.78

USDCHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9621

S 1: 0.9476

S 2: 0.9259

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD remains on the defensive near 1.0680 on Dollar strength

The solid performance of the Greenback keeps the price action in the risk-associated universe depressed so far on turnaround Tuesday, sending EUR/USD to multi-day lows in the 1.0680 region.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold maintains its bearish note and challenges $2,300

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.