Market Brief

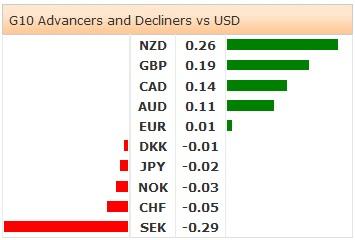

The week starts with soft economic data out of Asia. The Japanese capital spending grew at the pace of 3.0% in 2Q (vs. 4.1% exp. & 7.4% last), China and Japan manufacturing PMIs came in slightly lower in final August reading. Australia’s AiG manufacturing index stepped in the contraction zone (47.3 in Aug vs. 50.7 a month ago). Asian equities made a good start despite soft data and tensions in Ukraine. Nikkei stocks gained 0.34%, Hang Seng ad Shanghai’s Composite added 0.18% and 0.62% (at the time of writing).

JPY crosses opened mixed. USD/JPY advanced to 104.21 early in Tokyo and remained well bid above 104.00. Broad based USD demand and sustained risk appetite keep USD/JPY marginally bullish. Decent option bids trail above 103.00/25, while barriers are presumed at 104.50/105.00. EUR/JPY traded in the tight range of 136.66/83. Trend and momentum indicators are flat, offers are seen at 137.00/55 (including 21 and 50-dma). The BoJ gives policy verdict on Thursday and no changes are expected.

In Australia, soft data had little impact on FX trading. We are heading into an event-full week for AUD-complex. The RBA meeting (Tue), 2Q GDP (Wed), retail sales and trade data (Thu) should shape the short-term direction this week. The pair is currently stuck within 0.9240/0.9375 range, a breakout in either way is required to confirm short-run direction. In New Zealand, the better-than-expected trade terms gave support to NZD/USD above 0.8348. The trade terms remain at 40-year highs despite 5.3% drop in export volumes (and 2.0% in export prices). NZD/USD advanced to 0.8379 overnight, offers are eyed at 0.8400/28 (optionality / 21-dma). A daily close above 0.8342 (MACD pivot) will keep the tone marginally bullish.

EUR/USD extended weakness to 1.3119 at the week opening. The EUR sentiment remains comfortably bearish. The next key support stands at 1.3105 (6th Sep 2013 low). The option related offers should back up the EUR weakness through this week. Solid barriers abound pre-1.3200. After Friday’s drop, EUR/GBP remains offered. The pair extended losses to 0.78971 (at the time of writing), as bearish momentum strengthens. The key support stands at 0.78743 (July 23th low). The ECB gives verdict on Thursday and we do not expect any surprise.

The BoE will also announce policy on Thursday and is expected to maintain the status quo. After rebounding from 1.6500, GBP/USD remains under selling pressures pre-1.6650. Technically, 21-dma (1.6689) tests 200-dma (1.6695) on the downside, suggesting some more interest in GBP-short positions. Resistance to remain solid below the 200-dma (1.6695).

The US and Canada are closed today, due to Labor Day holiday, so we expect a slow Monday. In Europe, traders are focused on German 2Q(Final) GDP q/q & y/y, German 2Q Private Consumption, Government Spending, Capital and Construction Investment, Domestic Demand, Exports & Imports, August PMI Manufacturing in Sweden, Norway, Switzerland, Spain, Italy, France, Germany, UK and Euro-Zone, UK Net July Consumer Credit and Net Lending Sec. on Dwellings, Mortgage Approvals and M4 Money Supply.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.