Market Brief

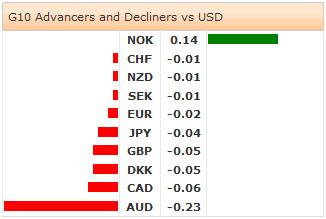

The dollars, Fed minutes inspired rally, has continued today as the release of a soft Chinese manufacturing triggered selling of high-yielding EM FX. HSBC/Markit manufacturing PMI dropped to a 3-month low of 50.3, meaningfully lower than the 51.5 expected result (prior read of 51.7). Softness was broad-based across sub-indices yet new orders was significantly weak falling to 51.3 from 53.7 (although still above 50 expansion threshold) in July. This is concerning as new orders serves as a barometers for domestic and foreign demand. With the Chinese economic recovery seemingly unstable, investors were quick to rotate away from risky EM FX. That’s said, equity markets were balanced as the weaker JPY helped Nikkei rise 0.85%, while the Hang Seng and Shanghai dropped -0.75% and -0.67% respectively (at the time of writing). S&P futures are slightly higher going into the European session. EURUSD spent most of the session on offer following the release of the Fed minutes which suggested intense debate on starting the tightening cycle “sooner rather than later.” For most of Asia, EURUSD was basing around the 1.3250 handle as traders prepare for release of EZ Flash PMI data. The market is currently heavily short EUR, so an upside surprise should trigger decent short covering. USDJPY was already at 103.80, after the hawkish fed minutes, and was unable to gather the buyers to challenge 104.00. However, with the JPY the funding currency of choice and expectations of US yields moving higher it’s just a matter of time before we test near-term resistance. In other Japanese news, data indicates that investors continued to buy foreign assets last week, adding ¥660bn in foreign bonds and ¥263bn in foreign equity. As expected, AUDUSD traded lower to 0.9238 on the weaker Chinese PMI data despite conference board leading index rising 0.4% m/m in June following a gain of 0.2% in May. Commodities remain soft as oil edged down to $102 as ample supply and slowing demand (amplified by Chinese worry data) damaged prices.

Euro-Area PMI

In the European session, traders will be watching euro-area PMI and euro-area consumer confidence. In broad terms, we expect softness in both data sets indicating further deterioration in Europe’s economic condition. This should fuel further speculation of ECB stimulus and raise expectations for ECB President Draghi’s comments from Jackson Hole tomorrow. In the UK, retail sales ex-auto may reverse declines by increasing by 0.4% m/m and 3.5% y/y in July. Given the MPC minutes indicating dissention in the ranks we suspect that the tightening argument will gain pace despite softer economic data and should keep GBP supported. In Norway, investors anticipate mainland Q2 GDP growth to increase by 0.6% q/q.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.